Pain Management Devices Market Warms Up for the Sprint Ahead

Over 100 million Americans are affected by chronic pain, according to The American Academy of Pain Medicine. With the aging population, the number of people looking for pain relief solutions is set to grow. Currently, the most commonly used pain remedies are prescription drugs, OTC medications, rubs, and powered devices. According to Kline’s Nonprescription Drugs USA report, manufacturers’ sales of OTC medications are valued at almost USD 3 billion, growing at a slow pace of 1.5%. The topical analgesics account for USD 450 million, showing 12% growth. Powered pain management devices, with a market value of USD 250 million, are growing at over 20% in 2017.

Continue reading→

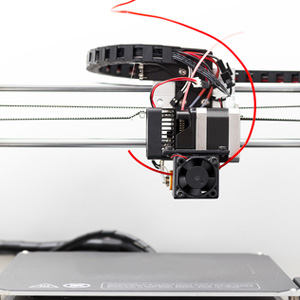

Additive Manufacturing Technology: A Hotbed of Opportunities

The highly disruptive and rapidly growing additive manufacturing technology (AMT) promises a revolutionary change, not only in the large manufacturing industries, but also through average consumers. In addition to an economical alternative to traditional manufacturing, the 3D printing industry also provides the benefits of incorporating high levels of customization and complexity of design, as well as much lower lead times. This phenomenon of 3D printing, which until recently was mainly used for rapid prototyping, is now also increasingly being used in the production of end-parts and finished components in a wide range of applications, such as the automotive, aerospace, machine tools, electronics, medical, pharmaceuticals, and food industries.

3D printing has given rise to a rapidly growing multi-billion-dollar global market, offering highly profitable opportunities to companies along its supply chain. Continue reading→

Middle East Synthetic Latex Polymers Market: A Unique Mix of Trends and Opportunities

The Middle East accounts for approximately 5% of the global consumption of synthetic latex polymers, with a market value of about USD 1.3 billion in 2016. This region represents an interesting mix of diverse economies, displaying a combination of varying market characteristics, ranging from the advanced Turkish market, which closely follows European trends, to the highly price-sensitive Egyptian market.

Like in most regions, except Southeast Asia, paints and coatings and adhesives and sealants are the largest application sectors in the Middle East. However, the region exhibits some striking differences in the application mix.Continue reading→

New Horizons for Professional Beauty Marketers – Asia and the Middle East

Asia, which is important in size, but extremely fragmented with hundreds of local players having some important advantages over international brands, has nevertheless continued to attract foreign companies in terms of both professional hair care and nail care products. The region is the second largest after Europe when it comes to the salon hair care market, accounting for almost 30% of the global sales of professional hair care products. The three giants of Japan, China, and South Korea have experienced sluggish growth recently, and there are many smaller markets where sales show much higher dynamics. Among them, India leads the way with continuous double-digit growth. In fact, India has shown a compound annual growth rate in terms of salon hair care sales of 17% between 2011 and 2016, whereas Asia’s overall growth during that period has averaged to only 2.5%. Because the Asian market’s growth is driven by these smaller markets, such as India, our 2017 edition of Salon Hair Care Global Series will take a deeper look at 12 markets in Asia!Continue reading→

The Growing Business of Medical Care Providers

Globally, medical care providers tend to be the channel of choice among consumers seeking help with their skin care problems, ranging from fine lines and wrinkles, to brown spots, acne, and sagging skin. The channel includes dermatologists and plastic surgeons that offer an array of both surgical and non-surgical procedures and skin care treatments that attracts consumers. In 2016, Americans spend $6.4 billion on non-surgical procedures, up 18.5% from $5.4 billion in 2015, according to the American Society for Plastic Surgery.

Medical care providers is the key channel driving growth in the skin care sector across several markets, including China, Europe, and the United States, according to Kline’s upcoming Professional Skin Care Global Series report. The channel records strong growth of 28% in China, 10% in Europe, and continues to record mid single-digit growth in South Korea and the United States.Continue reading→

The Future of Beauty Retailing is a Mix of Internet, Specialty, and Boutique

It is an interesting time to be a brand in today’s beauty retailing environment. While retail is a unique experience for every brand and each brand must assess where their consumers are shopping, Kline’s latest Beauty Retailing: U.S. Channel Analysis and Opportunities study finds that there has been a shift in where consumers are shopping for cosmetics and toiletries. Among these market-moving channels, it is evident that there are sub-channels that will continue to push growth of the industry forward. Kline predicts that the sub-channels that will grow the strongest during the forecast period are the Internet, cosmetics specialty stores, and vertically integrated specialty stores.Continue reading→

Regulations, Innovative Formulations, and New Niches will Drive the Global Bio-lubricants Market

Plenty of space for growth resides within the finished lubricants market, particularly within niche markets, such as bio-lubricants. Currently comprised of roughly 1% of the total finished lubricant market and driven by governmental regulations, it is expected to grow at a CAGR of 5% over the next five years, according to the latest report Opportunities in Bio-lubricants: Global Market Analysis by global market research and management consulting firm Kline.

Beauty’s Big Movers: Indies and Beauty Boxes

We are about to kick off the 43rd edition of Cosmetics & Toiletries USA, our flagship report that takes a close look at the key drivers and trends, relevant product launches, changing competitive playing field, and evolving retail channel landscape that transform the beauty and personal care market, with a forward-looking analysis through 2022. Naira Aslanian, the report’s project manager, answers questions about key topics that will be investigated, including two agents that are helping to transform the industry landscape: indies and beauty boxes.Continue reading→

Understanding Consumer Perceptions of Natural OTCs Important for Driving Traditional OTC Brand Gains

The U.S. market for OTCs has shown a compound annual growth rate of only 2.6% from 2011 through 2016. Most years during that five-year period the market have shown 3.0% or less year-over-year growth, with the exception of 2014 to 2015, when the market was up nearly 5.0%. This was largely driven by the return to market of previously recalled brands. By comparison, natural OTCs (which refers to non-drug, non-monograph, plant- or supplement-based, or homeopathic products that often make claims of support, prevention, maintenance, and/or treatment of minor conditions or ailments) have grown strongly by double digit gains over the same timeframe.Continue reading→

Henkel Displaces Coty and ELC to become the #2 Professional Hair Care Marketer in North America

Last week’s announcement that Henkel will acquire Shiseido’s North American professional hair care business is the latest step in the company’s path to the top of the leaderboard in the global salon hair care industry. According to data from Kline’s Salon Hair Care Global Series, this plus its earlier 2017 acquisition of Pravana will nearly double Henkel’s share in North America from 7.7% to 13.6%, ahead of Coty’s 11.1% and ELC’s 8.1%.Continue reading→