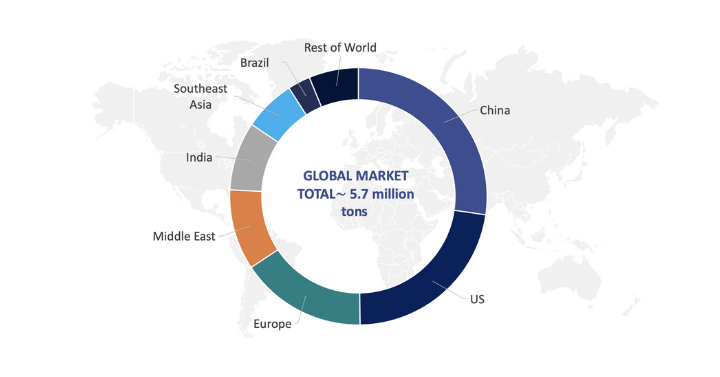

Industrial applications represent over one-third of the total global market volume of surfactants. They encompass a wide range of industries such as construction, paints and coatings, textiles, lubricants, food and beverages, crop protection, oilfield and mining, pulp and paper, and metalworking fluids (MWFs), with each requiring specific surfactant properties tailored to its unique needs. In 2022, the global consumption of surfactants in industrial applications reached 5.7 million tons (100% active basis), according to our just-published Industrial Surfactants: Global Market Analysis and Opportunities.

Regional Share of Industrial Surfactants Consumption

Source: Kline’s Industrial Surfactants: Global Market Analysis and Opportunities report

Regional Variations in Surfactant Usage Within Industrial Applications

In China, construction is the primary application for surfactants, with acrylic copolymer being the most used surfactant. Acrylic copolymers are known for their ability to reduce water consumption in concrete production and are marketed as low-dosage, environment-friendly options. In other regions such as Europe and Southeast Asia, naphthalene sulphonate takes the lead as the primary surfactant used in construction, highlighting a significant difference compared to China.

Moving to the Middle East, fatty alcohol ethoxylate emerges as the dominant surfactant. It plays a crucial role in applications such as textiles, a key industry in Turkey, as well as in paints and coatings, construction, and oilfields.

Crop protection emerges as the primary focus for surfactant usage in Brazil, with fatty amine ethoxylate leading the charge due to its outstanding wetting, spreading, and penetrating capabilities. On the contrary, stringent environmental regulations in regions such as Europe are leading to restrictions on fatty amine ethoxylates in crop protection.

India showcases a diverse range of surfactant applications, including crop protection, textiles, and construction. Fatty alcohol ethoxylates are the most widely used across these applications, followed by naphthalene sulphonates in construction and alkyl benzene sulphonate in lubricants.

Meanwhile, the United States boasts a thriving lubricant market, driving the demand for alkyl benzene sulphonates, which claim the largest share of the surfactant market in the country.

Key Macrotrends Shaping the Demand for Surfactants

The packaging industry is experiencing a strong momentum, driven by the continued use of e-commerce platforms. Segments such as adhesives, inks, and flexible packaging are benefiting from this trend. Additionally, emerging economies such as India and Southeast Asia are transitioning from plastic to board packaging materials, further fueling the growth.

Bio-derived surfactants, including castor oil and natural fatty alcohols, are gaining market share due to their superior biodegradability. Stricter environmental regulations in regions such as Europe and the United States are driving the demand for these surfactants across various industrial sectors. Similarly, demand for surfactants in crop protection is driven by the rise in biopesticides, favoring those surfactants with a better environmental profile, such as alkyl polyglucosides and fatty alcohol ethoxylates.

The transition to electric mobility is changing the MWF and lubricant additives market. Vehicle manufacturers are shifting toward different raw materials, leading to increased demand for low-foaming systems and nonionic emulsifiers. However, the manufacturing process of electric cars requires less oil, which may impact the demand for MWFs and lubricants in the medium-to-long term.

In the construction industry, rapid urbanization and industry diversification in emerging regions such as Southeast Asia, India, and Brazil are driving the demand for industrial surfactants. The Middle East is also seeking to reduce its dependence on the oil industry, creating opportunities for surfactant consumption in sectors such as crop protection, textiles, paints and coatings, and construction.

Eye on Biosurfactants in Industrial Applications

Biosurfactants, derived from microbial fermentation, are given special attention in our latest report as they are making a breakthrough in industrial applications. With their excellent biodegradability and low CO2 footprint, biosurfactants offer superior performance as foaming agents, defoamers, wetting agents, and emulsifiers. However, the adoption of biosurfactants in various industries is still uncertain due to the lack of established regulations.

The personal care and household, industrial, and institutional (HI&I) segments are leading the way in embracing biosurfactants, while industrial applications have lower priority as the environmental requirements can often be met by biobased surfactants.

Key Factors Influencing the Industrial Surfactant Consumption

The global consumption of surfactants in industrial applications faces a complex web of challenges, from destocking and economic uncertainty to geopolitical tensions and energy costs. The lack of a robust recovery in China, influenced by factors such as reduced exports and shifts in consumer behavior, has led to subdued demand in crucial industrial sectors. Similarly, high inflation and slow-paced job growth in Western countries have led to reduced consumer spending, affecting products reliant on surfactants.

These factors not only influence the demand for surfactants but also shape the broader landscape of industries that rely on them. Adaptation and resilience will be key for both surfactant manufacturers and industries as they navigate these challenging conditions.

Our comprehensive Industrial Surfactants: Global Market Analysis and Opportunities report offers valuable insights into the present and future demand across various end-use applications in key geographies, enabling you to pinpoint the areas of substantial growth potential. Additionally, the report includes an interactive database with data on surfactant consumption by end use and region; supplier sales by surfactant, end use, and region; average pricing of surfactant by end use and region; and historical and projected consumption by 2027.