Our recent survey of over 1,000 professional decision-makers revealed several dynamics that are impacting the future spending of and demand for floor care products, including:

1. Changes in flooring type

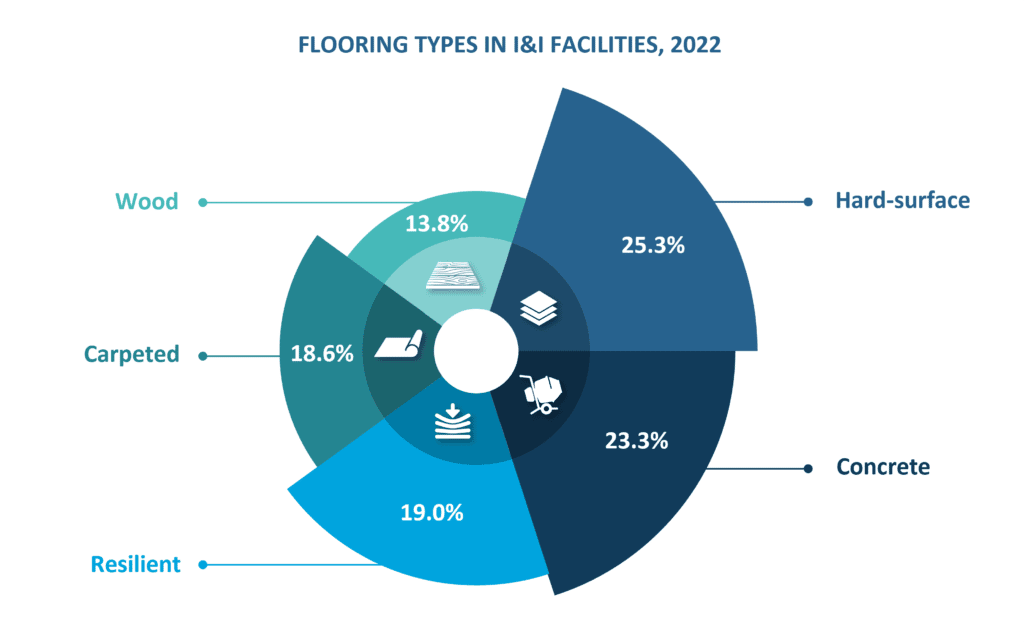

The types of floors installed at industrial and institutional facilities are now increasingly skewed toward low-maintenance substrates, and this is expected to continue.

Source: Kline’s Janitorial and Housekeeping Cleaning Products USA report

In fact, when asked about the future plans for flooring at their facilities, 24% of end users we surveyed indicated that they intend to make such changes over the next three years. Among these, 70% expect to switch to resilient floors, 54% to hard-surface floors, and 41% to concrete floors. Such changes will also have an impact on the chemicals and tools used to care for these floors. “We are seeing more use of general-purpose floor cleaners than that of specialized floor strippers, spray buffs, or waxes and finishes,” says Laura Mahecha, Director of our Professional Cleaning Products, “and increasing need for non-chemical floor care products such as floor pads and tools to maintain floors,” adds Mahecha.

2. Impact of inflation

According to our research, 47% of end users expect to increase their spending on floor care products over the next few years. Of those, 36% attribute the increased spending to inflation and 25% to anticipated price increases. Furthermore, when asked about the impact of inflation, 64% of end users said that they are using the same quantity/volume of floor care chemicals but spending more due to price increases.

3. Elevated cleaning

The stringent standards that increased cleaning frequency during the pandemic are lingering for about one-quarter of end users, who are still anticipating an increase in demand for floor care products. Among these are hospitals, long-term care facilities, education, airports, convention centers, and recreational facilities. However, the demand has slightly declined for building service contractors and office buildings.

For immediate insights on floor care chemicals, including market size estimates for 2020–2022 by end-use segment, product type, suppliers, and a five-year forecast to 2027, refer to our soon-to-be published Janitorial and Housekeeping Cleaning Products USA report. In addition, the second edition of the Floor Care Pads and Tools USA report is coming in 2023 and will be based on updated end user surveys with detailed questions about floor care frequency, flooring types, and the impact of inflation on spending for these products. Product coverage includes floor pads, mop heads, and cleaning tools such as carts, caution signs, and buckets.