Venture Capital (VC) investment has long been a powerful catalyst in fostering innovation in various sectors by nurturing start-ups and high-potential businesses.

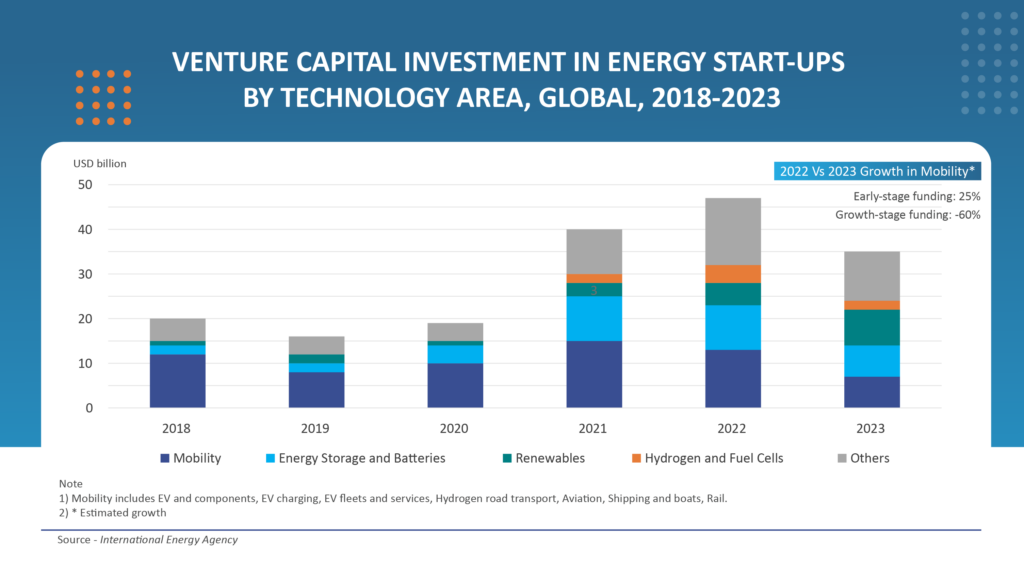

In recent years, the mobility sector has become the apple of the VC eye, with investors betting big on growth. However, 2023 saw a dramatic dip in VC investments across many key sectors. Diminished valuations, higher interest rates, macroeconomic uncertainty and geopolitical risks were the underlying causes, but digging deeper, this trend seems only partially true for the mobility sector. While later stage funding (which usually takes place 3-4 years after operations commence), saw massive declines, a steady influx of investments for initial funding stages was observed, signaling investor confidence. There is no doubt that the innovations in clean energy and sustainability are moving at a rapid speed, but the pace must accelerate even faster for the world to meet its net zero emissions target by 2050. This article highlights the rising interest of venture capitalists and private equity companies in different segments within the mobility domain, such as e-mobility, charging infrastructure, connected vehicles, etc.

The Electric Vehicle Domain is an Attractive Sector for Investors, but the Future of Mobility is much more than Electrification!

The personal mobility market is becoming increasingly complex. It is no longer a traditional marketplace, changing rapidly and racing towards a new world driven by changing consumer preferences and technological advancements, with a strong focus on environmental concerns and sustainability. There is a growing preference for new mobility solutions, such as shared mobility and car subscription models entering the landscape.

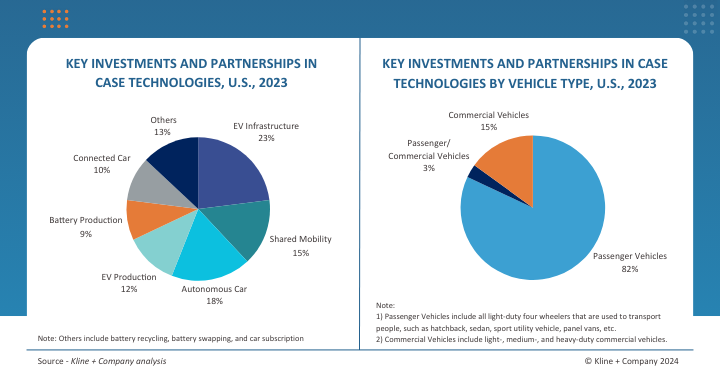

As the world slowly transitions towards a more sustainable future, there has been a surge in interest from venture capital companies and private equity investors in e-mobility and associated technologies including battery technology and charging infrastructure. Although currently electrification is the major trend in the mobility sector and will continue to make significant shifts within the market it is by no means the only trend. The automotive industry is undergoing a major transformation with new trends collectively known as CASE: Connected (C), Autonomous Driving (A), Shared Mobility (S), and Electrification (E). While all these technologies are progressing at different rates, they are having a dramatic impact on the global mobility industry with varying adoption rates and pace. As an example, the visual below shows the investments made for the emerging CASE technologies in the United States in 2023.

Capitalizing on Mobility Trends: A Guide for Investors

As these new trends gain traction in the traditional mobility landscape, the sector has undoubtedly become more complex to navigate. However, the disruptions have also created enormous opportunities for innovators and potential investors. Capital continues to flow into the mobility sector, despite market volatility due to increasing interest rates, indicating the growing focus on the sector from venture capital investors and private equity players globally. Alongside the opportunities it is important to acknowledge the risks associated with investment in this sector. With all the information entering the public domain and with numerous players now joining the field, a cohesive and connected approach to the potential risks offered in the investment opportunities within the mobility sector is crucial.

It becomes critical for venture capitalists and private equity companies to gather comprehensive insights on the questions that can help them plan their effective entry and exit strategies.

- How will the growing focus on sustainable transport solutions impact the demand for personal mobility in the future, and how crucial will those inception points be for my business?

- How will understanding the pace of adoption of alternative powertrains and EV readiness in key countries across different regions help my business plan when determining the right entry and exit timing and strategy?

- How will the evolving landscape of investing in the emerging personal mobility ecosystem assist in identifying key drivers and investment opportunities?

Kline has developed an interactive platform on personal mobility, the Personal Mobility Intelligence Center (PMIC), that tracks this evolving market and offers a clear narrative on the development of the new mobility ecosystem. This includes vehicle ownership statistics, passenger car and two-wheeler parc dynamics and the impact on the finished lubricant market and CASE (Connected, Autonomous, Shared and Electric) framework, which covers new entrants/start-ups in charging networks, EVs, car sharing, ride-hailing, connected and still on the horizon – autonomous vehicles. For further information, please contact us.

Click here to sign up for the Kline newsletter – featuring regular Energy industry updates, expert analysis, insights and webinar invitations directly into your inbox.