Kline & Company is recognized as the leading consulting and market research firm serving the lubricants and base stocks industry. As part of our price analysis services for base stocks and the ancillary products of base stock production, Kline offers a custom research tool: the Kline Base Stock Margin Index.

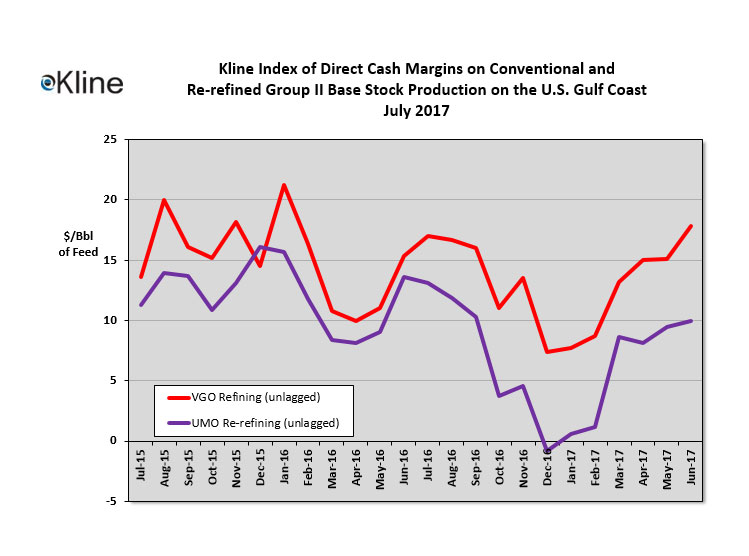

The Index, which is provided on a custom basis, shows the net cash margin for the previous 24 months for a typical VGO-fed Group II base stock refiner, as well as for a characteristic Recovered Fuel Oil (RFO)-based Group II re-refinery, in the U.S. The Kline Index simulates the cash margin to Group II refiners and re-refiners by deducting from the value of the product sales slate estimated feedstock costs and typical cash operating costs at the plant level. In effect, the Index simulates EBITDA before the deduction of corporate SG&A expenses.

Assumptions regarding the yields of base stocks and ancillary products, the pricing basis for each product, as well as VGO and RFO feedstock, and the composition of plant operating costs, are drawn from Kline’s extensive databases, and are not specific to any one plant or producer. While Kline believes the Index is representative of the base stock industry’s margin trends, each player’s yields, costs, and products sales revenues will differ. While the drivers of gross margin (products sales revenues less feedstock costs) are based on public source data, adjustments are made by Kline to those raw price data to simulate typical transactions in the market. These adjustments are particularly relevant in the re-refining industry, as a result of its lack of price transparency and the evolving nature of its pricing structure relative to conventionally-refined products.

The Kline Base Stock Margin Index is available on a subscription basis. The model and data underlying the Index are proprietary to Kline & Company, but are also available by subscription, or as a service to our clients in profitability benchmarking and financial analysis of actual or prospective operations.

For more information on the Kline Index, or to inquire about our pricing and margin analysis services to the base stocks industry, please contact Ian Moncrieff at (973)-615-3680 or at Ian.Moncrieff@klinegroup.com.