This article originally appeared in the Society of Tribologists and Lubrication Engineer’s September edition of TLT magazine

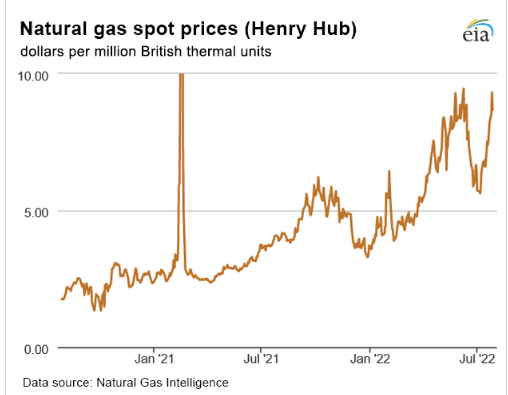

Natural gas and liquified natural gas (LNG) supplies have witnessed global disruptions as the Russian/Ukraine war forces Europe to turn to alternate sources of natural gas and LNG, which will drive shortages in other regions as Europe bids up the prices. This could drive changes in the type of natural gas engine oil (NGEO) consumed as the natural gas supply chain is altered and engines start to see more variable sources of fuel.

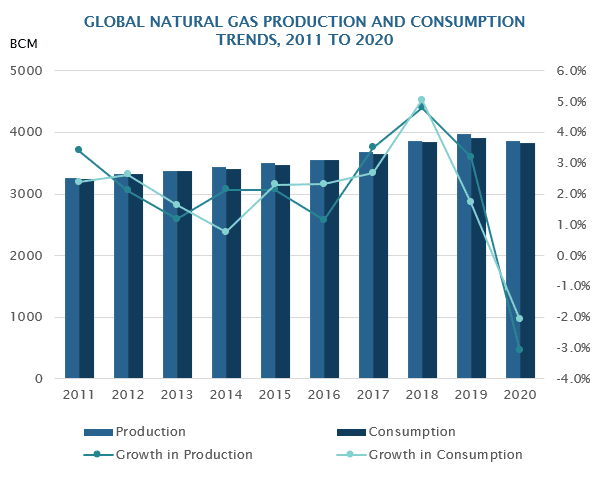

Natural gas is acting as a transitional fuel source as the world shifts toward fully renewable energy. Recently, Europe has confirmed this continued usage of natural gas, with the European Union voting in favor of calling natural gas a “green” or “sustainable” source of energy despite some pushback. However, there is one caveat: a further transition toward biogas or green hydrogen and other renewable gases by 2035. This is a good sign that natural gas power generation units will have a solid future in the energy mix of tomorrow. Kline expects global gas consumption to remain strong as global economies recover from 2020 declines caused by pandemic-related shutdowns.

Production of natural gas has only slowed slightly; however, the supply chain and sourcing for natural gas have seen dramatic shifts that began when Russia invaded Ukraine and the UN began to impose sanctions on Russian natural gas. The EU has also implemented changes in its sourcing for natural gas and halted Russia’s Nord Stream 2 gas pipeline. In response, Russia’s Gazprom is limiting natural gas through the Nord Stream 1 pipeline to 20% — just as European energy consumption hit record levels, with natural gas being burned to meet electricity demand from a historic heatwave which caused temperature spikes of more than 104°F (40°C) in some countries in July 2022. This is hindering Europe’s plans to maximize its gas stores before winter should Russia cut Europe completely off from natural gas.

The rapid strategy shift away from Russian-sourced natural gas, which had supplied 40% of Europe’s demand with more planned as Nord Stream 2 was to come online, has caused Europe to tap into other sources including LNG imports. In 2021, 45% of European LNG imports were sourced from the U.S., and another 20% was sourced from Qatar. This shift has helped drive up prices and will likely cause supply shortages for poorer nations. (For more information on the EU’s emerging power generation scenario, check out Kline’s blog here: https://klinegroup.com/the-eu-s-emerging-power-generation-scenario/).

According to Kline’s recently published Natural Gas Engine Oils: Global Market Analysis and Opportunities study, the change in gas sourcing will help drive growth in new pipelines and liquefication and gasification facilities, as well as expedited investment in renewable gases such as green hydrogen and bio or landfill gas. This, in turn, is likely to drive demand for NGEO more suited to handle various fuel sources that could include a mix of hydrogen and gas or sour gases from landfills.

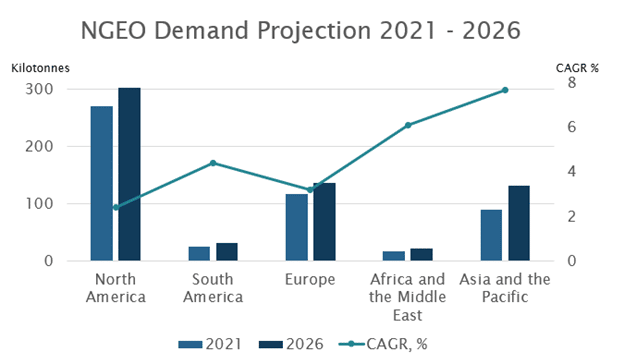

Kline projects growth in low ash and medium ash NGEO, along with products formulated to better handle a more variable Wobbe Index (WI) and greater levels of contaminants or water. NGEO demand, globally, is expected to exceed 500 kilotonnes by 2026 and grow at almost a 4% CAGR, with some regions outpacing others.