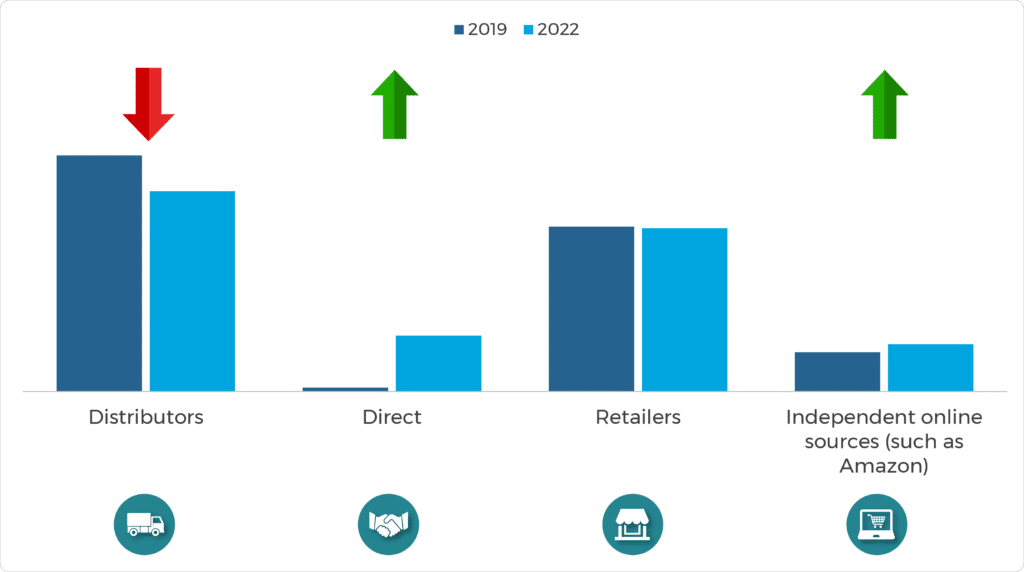

Historically, distributors held the lion’s share of professional cleaning products sales, with retailers, online sites, and direct sales being relatively smaller. However, since the pandemic disrupted the supply chain for cleaning products, some significant shifts have been seen in the purchase channels for end users. In fact, our recently published Janitorial and Housekeeping Cleaning Products USA study revealed some interesting channel moves:

- Retailers have gradually had more impact on sales as small businesses prefer one-stop shopping venues, where they can purchase cleaning products along with other necessities for their businesses. These include office supply stores, warehouse clubs, general supply distributors, and home improvement stores.

- Direct sales became more prevalent as end users that faced low stocks or out-of-stock situations in retail stores or from distributors signed contracts directly with chemical manufacturers to ensure adequate supply. These contracts were sometimes implemented for 2–3 years or more; therefore, the impact is still being felt.

- Online sales accelerated not only via Amazon but also through distributor sites such as HD Supply, Grainger, and Sysco, as well as retail sites such as Walmart, Target, and Staples.

- Leading distributors, such as and BradyIFS, pursued M&A activity to strengthen their positions in the market through product and geographic expansion. Moreover, Dot Foods, one of the largest foodservice redistribution companies in the United States, acquired ShopHero, a leading grocery-focused e-commerce technology company.

Shifts in Purchase Channels: 2019–2022

Source: Kline’s Janitorial and Housekeeping Cleaning Products USA

With the variety of channels where professional cleaning products are sold today, the lines between consumer and professional cleaning brands are blurring. For example, Ecolab, the leader in the jan/san industry according to our research, has recently rolled out a new retail line—Ecolab Scientific Clean—in partnership with The Home Depot. This product line is targeting both professionals and DIY consumers.

To access more key trends that are expected to shape the industry moving forward, download a copy of our latest trend report. In addition, Kline’s Janitorial and Housekeeping Cleaning Products USA provides a wealth of information and insights based on detailed feedback from over 1,000 end users, as well as market estimates and forecasts based on in-depth interviews with suppliers, distributors, trade groups, and experts. This recently published report also features an online interactive database with dollar sales, forecasts, unit sales, sales by supplier, product class and category, and end-use segments, which can be exported to Excel for further analysis.