First published in Petroleum Review April 2013 Licensed for print and electronic distribution to Kline Management Consulting and sites owned by Kline Management Consulting exclusively.

First published in Petroleum Review April 2013 Licensed for print and electronic distribution to Kline Management Consulting and sites owned by Kline Management Consulting exclusively.

© This information is the intellectual property of the Energy Institute. Any unauthorized copying, republication or redistribution of Energy Institute material, either in print or electronically, wholly or in part, is expressly prohibited without the prior written consent of The Energy Institute. The Energy Institute logo together with the EI letters (logo) are registered trade marks of the Energy Institute. For additional information on the Energy Institute, please visit www.energyinst.org

In the global lubricants industry, 2012 can be defined as a year of change as well as a year of continued uncertainty, writes Geeta Agashe, Senior Vice President – Petroleum and Energy, Kline Management Consulting.

In the past year, continuing financial turmoil – notably in the Euro Zone and the US, but not just confined to these regions – has had a significant impact on the performance of several industries (including construction, mining, primary and fabricated metals, transportation equipment and general machinery, on highway and marine transportation). There has also been a significant slowing down in the star economies as China, India, Brazil and Russia all see challenges to what is sometimes seen as inexorable and guaranteed growth rates.

In particular, China witnessed a significant contraction in demand in 2012, including that for finished lubricants, additives and baseoils, as the government tries to re-align the economy from being export- and investment-driven to an economy focused on domestic consumption and services. However, as labor wages grow in the emerging economies, we are also seeing trends such as re-shoring – where companies elect to bring manufacturing closer to the home markets, with increased wages in the emerging markets and increased productivity in the developed markets contributing to this phenomena. The Arab world has also changed considerably after the advent of the Arab Spring; and not enough can be said about the growth opportunities in what could be called the last frontier for the lubricants industry – Africa.

Volatile oil prices, currency fluctuations, product shortages and overages, changes to oil-derived products and petrochemical flows and a continuing emphasis on energy efficiency, the environment and sustainability are all factors that present challenges to the baseoil and lubricants industry. However, there are also many opportunities – and we have an industry infrastructure that is fit to rise to these challenges and continue to provide good earnings for stakeholders.

Shell began blending its new gas-toliquids (GTL) basestocks into its line of branded finished lubricants and the synthetics category as a whole is showing significant growth in many parts of the world given the tightening of original equipment manufacturer (OEM) specs on both the industrial and automotive side, as well as significant barrels of API Group III baseoils gushing into the marketplace. Refinery and Group I base oil plant shut-downs continue in the mature economic areas and investment east of the Suez regions is increasing as refiners seek to reshape their strategic footprints for the new world.

We are seeing national players in the rising economies flexing their wings and demonstrating regional and global ambitions – in our industry and the automotive industry.Mergers and acquisitions (M&A) seems to be the vehicle of choice – eg Gulf Oil purchasing Houghton International and Petromin (this is a joint venture purchase along with the Dabbagh Group), Brazil’s Cosan acquiring the UK’s Comma Oil and Chemicals, and Tidewater India acquiring Castrol’s Veedol brand. National and regional oil companies are expanding, with recent examples including Lukoil’s plans to build a lubricant plant in Kazakhstan and SK exporting its ZIC finished lubricants brand to many countries outside of its home market of South Korea. We are also seeing continuing legislation on fuel efficiency driving new lubricant and hardware solutions, and the beginning of an industry that looks beyond petroleum and gas toward fluid products made from renewable and sustainable raw materials.

Key developments

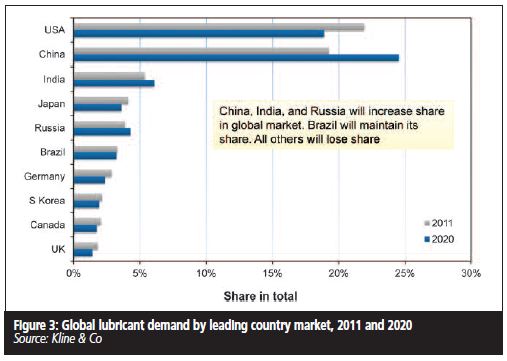

Narrowing down to the specifics of our industry, 2012 was certainly not a strong year for finished lubricants demand growth as originally expected – given the ongoing economic conditions in Europe, lackluster growth in the US economy, a significant six-month demand contraction in China and a slowdown in industrial activity in Brazil. Despite these issues, the global lubricants market remained essentially flat in 2012, as compared to 2011 from a volume standpoint. However, one cannot be complacent given the flat growth as many opportunities and threats are bubbling at the surface.

These key developments can be illustrated under the following broad parameters:

Emerging growth patterns

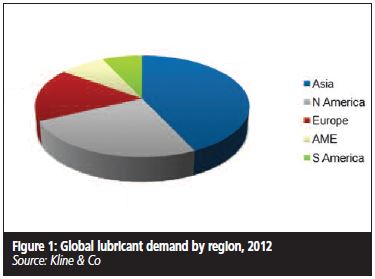

Clearly, from a volume standpoint, the Asia-Pacific region continues to be the growth engine of the finished lubricants industry. Rapid industrialisation, a growing middle class with increased purchasing power and improved infrastructure has led to strong growth in new vehicle production and sales. China, India, Japan, South Korea, Indonesia and Malaysia are the leading consumers of finished lubricants in the region. Similarly, Brazil, Russia and Thailand offer significant growth opportunities from a decent base. However, one cannot be fooled by the sheer size of these markets, and it is very important to understand addressable demand for multinational suppliers. The reason is a certain portion of the market is satisfied by using baseoils with no additive content that are sold as finished lubricants, while another section of the market uses very poor quality products in many instances, such as adulterated and counterfeit oils.

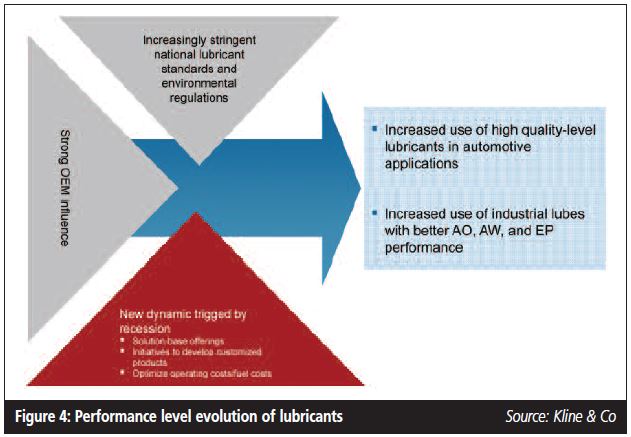

Moreover, the risk potential to the major branded suppliers of counterfeit products can be very high, upwards of 25%of sales volumes. Certain industries, especially government-owned, prefer to steer their business to other state owned or nationalized oil companies. Having said that, the quality of lubricants consumed in these markets is rising rapidly. Mono-grades continue to be phased out of the passenger car engine oil market, replaced by multi-grades as older vehicles are scrapped and new vehicles enter the car PARC. We are seeing a rapid shift from the heavy multi-grades, such as the 20 W and 15 W grades, to the lighter grades, including 5 W. In fact, we see a leap-frogging of viscosity grades, which are jumping from a 20 W grade straight to a 5 W grade due to tightened OEM requirements. The point is that the growth market is expected to continue to be a high volume market, but slowly and surely a high quality market as well.

Quality evolution

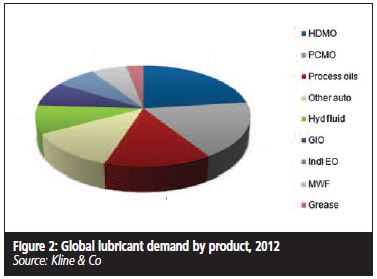

Passenger car motor oils (PCMO) and heavy duty motor oils (HDMO), and industrial lubricants are undergoing reformulation and quality upgrades primarily driven by:

- The need to increase fuel economy.

- The need to increase engine oil durability.

- Compatibility with emission control devices.

- Compatibility with bio fuels (ethanol and biodiesel).

- Industrial equipment shrinking in size while handling the same or increased power – as a result, oils are running hotter for a longer amount of time, and the focus is on increasing thermal stability.

All of these drivers are clearly pointing to increased consumption of API Group II and III base oils in automotive applications. Group II baseoils are also finding a home in industrial applications, such as turbine oil. Having said that, Group I baseoils continue to be the workhorse of the industry today. We also see increased opportunities for Group IV (PAO) baseoils as the full synthetics category is growing, and select marketers are trying to position and differentiate their products from a performance and raw material perspective. Biodegradable grease and vegetable oil-based grease, including soy-based grease and oleic vegetable base stock-based grease, are also enjoying growth, albeit from a small base.

Changing raw material requirements As a result of the above mentioned changes, API Group I baseoils are slowly but surely exiting from automotive applications, and the market space for basestocks is becoming more diffused.

Significant growth in the synthetics category Propelled by OEMs with factory fill and service fill requirements for SAE 0Wand 5 W viscosity grades for mass market vehicles (eg Toyota and Honda), which in the past were only recommended by the luxury auto OEMs, combined with the greater availability of high performance Group III base oils, significant growth has been seen in the synthetics category.

In the past, synthetic products were primarily offered by the global multinational oil companies who had access to high quality base oils and the most advanced additive packages. Today, with the growing availability of Group III base oils marketed by merchant suppliers who promise availability of tested and approved additive packages in their base oils, many lubricant blenders have developed an ability to formulate synthetics. This has led to a growing commodification in this category and new competitors entering the space including retailers, distributors and equipment OEMs offering their own branded product lines. To curb this, some marketers have resorted to a ‘good’, ‘better’, and ‘best’ strategy in their line of synthetics. Will customers be confused? Will the retail stores, mass merchandisers, and do-it-for-me chains give the additional shelf space? These questions are not yet answered. Certainly, synthetics are expected to grow much more strongly than the demand for conventional lubricants.

Competition

The top 10 global lubricant marketers currently account for 50%of the market place. However, as noted earlier, national players in the rising economies are looking to secure larger market share in the lubricants sector, both regionally and globally. Meanwhile, on the automotive side, China, India and others are beginning to take on the lead global vehicle manufacturers.

Looking ahead

In conclusion, we as an industry have done very well – but how do we push the envelope and come up with new ideas? How do we surpass ourselves? Nolan Bushnell, the founder of Atari Games, said: ‘Everyone who’s ever taken a shower has a brilliant idea. It’s the person who gets out of the shower, dries off and does something about it who makes all the difference.’ So, I say, ‘Shower often and dry off often.’ Companies that draw winning strategic plans and, more importantly, execute them to perfection, will be the winners in this race.