Kline’s study will show how basestock suppliers perform against customers’ selection criteria

In an overcrowded global basestock market, Kline’s Anuj Kumar explains why producers and merchants need to understand the wide-ranging factors that drive customers' buying decisions to ensure they make the final cut in the supplier selection process.

In an overcrowded global basestock market, Kline’s Anuj Kumar explains why producers and merchants need to understand the wide-ranging factors that drive customers' buying decisions to ensure they make the final cut in the supplier selection process.

Gone are the days when a basestock supplier could manufacture a product meeting a certain API classification and expect to sell it based on its quality alone. The market is changing dramatically—not only in terms of quality expectations but also in the way it expects to be supplied, which is creating a new set of challenges for marketers.

Basestock producers are having a tough time as massive capacity additions, predominantly, of Group II and Group III products come on stream right across the globe in an era of relatively flat lubricant demand. Kline forecasts an average annual finished lubricant demand growth rate of only around 0.5% over the next 10 years, while more than 5 million tonnes of new basestock capacity has been announced and is expected to come on stream by 2028.

Not only does the industry have this overcapacity as a backdrop, but there is also a continued growth of merchant basestock supply at the expense of in-house production, which is intensifying competition. This makes it increasingly important for today’s suppliers to understand customers’ purchasing criteria and the decision-making process they apply to select suppliers and products.

Huge capacity additions

Taking a closer look at the major capacity additions, China had brought around 2.1 million metric tonnes of new basestock capacity on stream by the end of 2018, which was primarily accounted for by independent basestock producers. Around 1.8-1.9 million metric tonnes of Group II/III/III+ capacity is on the way in China over the next few years, all of which will be destined for the merchant market. It looks likely that the nation’s capacity will exceed 8 million metric tonnes/yeara by the end of 2019. This would put it just short of the United States, which is the global leader, producing more than 10.7 million tonnes/yearb of paraffinic basestock capacity.

a: excluding naphthenic basestocks and re-refined oil; b: excluding re-refined oils

In Europe, once a big importer of Group II, the new ~1 million tonnes/year Group II capacity from ExxonMobil’s Rotterdam plant, which came on stream in February 2019, looks set to change market dynamics. The organization has also recently announced the completion of an expansion in Singapore and, although the project’s size is unclear, it will begin to supply customers with Group II products in Q3 2019. In addition, a final investment decision has been made to proceed with a further multi-billion dollar expansion of its refining facilities in Singapore, which will add around 1 million metric tonnes of Group II, with startup anticipated in 2023.

New capacities have also started up in regions— the Middle East, for example—which formerly had a minor share in the global basestock supply.

It’s not that disconnects between basestock capacity and demand are unusual. Each region produces less of some grades and more of others than it needs, which is why the global basestock industry has a healthy inter-regional trade. However, the growing capacity and demand mismatch is resulting in an unfavorable environment for basestock producers who are experiencing lower operating rates, increased price competition and slim margins.

Rise of merchant marketers

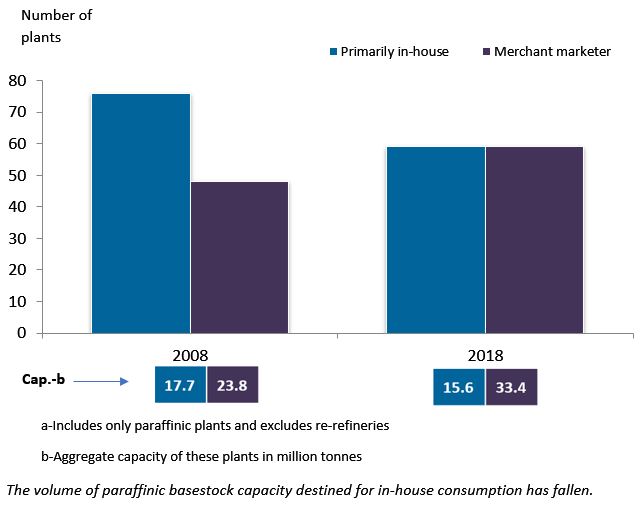

The increase in supply over the past 10 years has forced basestock manufacturing to move from a vertically integrated model, mainly serving in-house requirements, to one that is now led by merchant marketers. And, looking ahead, this is a trend that is expected to continue as the number of independent lubricant blenders and marketers across the world grows.

Split of Basestocks Plants by Nature of Sales, 2008 to 2018-a

Forecasts suggest that of the total 5.0 million tonnes of new basestock capacity expected by 2028, 80%-85% is likely to be destined for the merchant market.

Critical success factors

A few years ago, when the supply of high performance basestocks was relatively limited, product quality was often cited as the key factor used when selecting basestock suppliers. Clearly, product quality and consistency are still high on the list of selection criteria since they allow blenders to optimize production processes and costs. However, as the growth in merchant basestock supply continues, suppliers need a good understanding of all the criteria coming into play in the decision-making process to ensure future success.

Kline researchers are exploring the impacts of the new market scenario, where high-quality basestocks are readily available across the globe. Via the research, the level of importance customers place on specific criteria during supplier selection will be assessed, including:

- Global coverage of plants and supply hubs

- Product approvals

- Range of basestock grades

- Provision and quality of technical support and customer service

- Price consistency and fairness of commercial terms

The relative importance of these criteria may vary with factors including customer size, geography, and type of blender. But in such a challenging market, where finished lube demand is almost flat and capacity additions continue unabated, basestock suppliers that understand the changing decision- making processes of their different customer segments are the most likely to succeed.

Study to reveal top performing basestock suppliers

Kline’s new study Lubricant Basestocks Merchant Supplier Assessment will profile leading suppliers and report on the results of a survey among finished lubricant blenders, assisting both basestock suppliers and lubricant blenders.

The report will assess the relative importance customers attach to various criteria in the basestock supplier selection process and identify the top-performing supplier against each of these parameters. A need-gap analysis will also be included to highlight the changing needs of blenders.