Commencing with this article, each month we will shine our spotlight on a confirmed or potential M&A candidate, sharing our point of view – and expertise – on the opportunities that we see. This month, in our inaugural offering, we focus on OQ Chemicals and its potential divestiture by parent company OQ.

Background

OQ, an integrated energy company that is wholly owned by the Government of Oman, is currently considering divesting OQ Chemicals (formerly known as Oxea), a German company that it acquired eight years ago from private-equity owner Advent International for slightly over USD 2 billion. At the time of purchase, Oman sought to tap into increasing demand for oxo-based chemicals.

Rationale

OQ is now looking to use its energy assets to raise money and reduce a budget deficit that skyrocketed during the COVID-19 pandemic, which severely impacted oil prices and tourism within Oman. To help offset the negative effects of the economic downturn, the company initiated a number of OpEx (operating expenditure) and CapEx (capital expenditure) optimization projects. In divesting OQ Chemicals, OQ, like Saudi Aramco and other Gulf oil producers, seeks to capitalize on a rebound in crude prices to attract foreign investors. Discussions about the potential divestiture of OQ Chemicals are ongoing, although there is no certainty that they will result in a sale.

Positioning and Performance

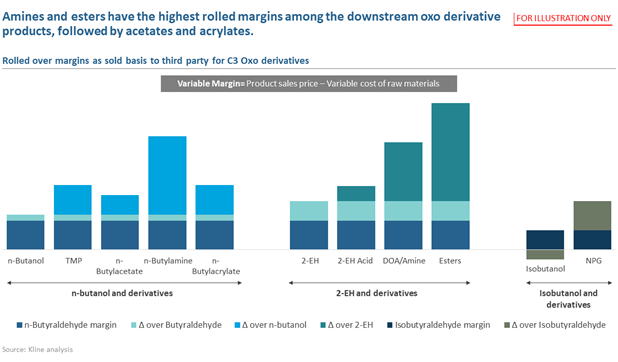

OQ Chemicals, a leading manufacturer of oxo-intermediates and oxo derivatives, is recognized for its integrated production platform of oxo aldehydes and oxo aldehyde derivatives such as oxo-alcohols, polyols, acids, esters, and amines. These products are used in the manufacturing of a wide range of products, including paints, coatings, adhesives, lubricant additives, cosmetics, pharmaceuticals, flavorings and fragrances, printing inks, plastics, and animal-feed products. Among OQ Chemicals’ downstream oxo derivative products, its amines and esters have the highest rolled margin.

OQ Chemicals’ business achieved net revenue of 1.056 billion euros in 2020. Earnings before interest, taxes, depreciation, and amortization (EBITDA) were in excess of 10% in each of the company’s segments, with an overall average of 12%.

Why We Consider OQ Chemicals an Attractive Purchase

“OQ Chemicals has a growing international footprint, with strategically positioned production sites in which it has made significant investments,” says Hardeep Parmar, Vice President of the firm’s global M&A and Corporate Development practice. The company serves attractive growth markets in attractive regions, making it quite nimble.” OQ Chemicals is also very technically astute, observes Parmar.

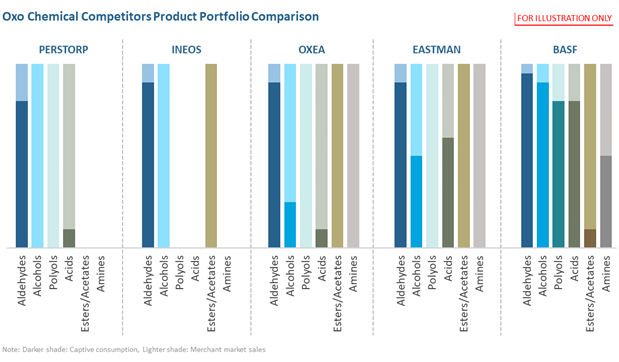

“Another factor very much working to OQ Chemicals’ advantage is that the field in which it competes is not very crowded,” says Dilip Chandwani, Head of Kline Management Consulting’s Process Industries and Manufacturing Competitiveness practices. The company is one of the four leading producers of oxo intermediates and oxo derivatives globally among top players like BASF, Eastman, and Grupa Azoty.

Potential Risks

It’s not yet clear what effect the Ukraine/Russia war will have on the industry. “Germany,” says Parmar, “where OQ Chemicals has two manufacturing plants, is vulnerable to Russia disrupting — or even completely halting — the country’s supply of natural gas due to Germany’s refusal to pay for its supply in rubles.” Germany currently obtains more than 50% of its natural gas from Russia and has stated that it will not achieve full independence from Russian supplies before mid-2024. As such, Parmar believes that oxo-alcohol prices will likely continue to rise, particularly in Europe.

Parmar also sees potential challenges stemming from the cyclical markets OQ Chemicals serves, in addition to the availability of raw materials, price sensitivities, and increasing competition in Asia.

Possible Suitors

Because it already has a presence and strong brand awareness in Asia, OQ Chemicals may appeal to a major feedstock producer looking to go downstream. Private-equity firms may also be interested in supporting OQ Chemicals’ growth into a global stand-alone player.

How We Can Help Potential Acquirers Vet This Opportunity

Kline has a strong appreciation of oxo-aldehyde and derivatives including alcohols, polyols, acids, esters, and amines through end-use application markets. We may be the only specialty chemicals consultancy worldwide that has access to experts across the entire value chain, from raw materials and products to end-consumer markets. Our technical and commercial capabilities across the value chain enable us to support clients in assessing opportunities for growth within this space, identifying risks, and mitigating against risks.

Our analysis capability includes assessing:

- Competitive technical and market landscapes

- End application markets and customers

- Technology and operational benchmarking

- Growth opportunities

- R&D activities

- Business models

About our M&A practice

Kline’s M&A practice provides advisory services for buy- and sell-side mandates, in addition to project finance support. Services are built around integrated competency platforms that include acquisition-led growth strategies, commercial and technical due diligence, manufacturing competitiveness, deal origination, and capital-raising support.

About this article

Kline’s M&A Spotlight: OQ Chemicals contains insights from Hardeep Parmar and Dilip Chandwani.

Parmar, Vice President of the firm’s global M&A and Corporate Development practice, has worked with Kline for approximately seven years and holds specific expertise in commercial engagements across the chemicals value chain. Her experience includes delivering buy- and sell-side due diligence support, in addition to independent market consulting services through to strategic growth assignments. Prior to Kline, Parmar spent more than 15 years in chemicals consulting, working with clients in Europe, the Middle East, and Asia.

Chandwani heads Kline Management Consulting’s Process Industries and Manufacturing Competitiveness practices. He has more than 40 years of experience in a variety of process and manufacturing industries and has assisted numerous clients with market analysis, technology and manufacturing competitiveness, performance improvement, and identifying/evaluating new business opportunities. During his 30 years with Kline, Chandwani has helped clients grow their business and improve profitability.

Press inquiries

Lance Debler

Content Marketing Manager

Kline & Company

+1-973-435-3425