According to a September 2013 International Monetary Fund (IMF) report, the global economy is experiencing transition on an “epic” scale, with turbulence within emerging markets potentially negatively impacting global growth by 0.5% to 1.0%. The report further claimed that all emerging markets - in particular Brazil, India, and Indonesia - have suffered due to the threat of slowing asset purchases by the U.S. Federal Reserve, which has effectively tightened their respective money supplies. By contrast, both the United States and European Union have returned to - albeit sluggish - growth.

According to a September 2013 International Monetary Fund (IMF) report, the global economy is experiencing transition on an “epic” scale, with turbulence within emerging markets potentially negatively impacting global growth by 0.5% to 1.0%. The report further claimed that all emerging markets - in particular Brazil, India, and Indonesia - have suffered due to the threat of slowing asset purchases by the U.S. Federal Reserve, which has effectively tightened their respective money supplies. By contrast, both the United States and European Union have returned to - albeit sluggish - growth.

Anybody reading the report may be forgiven in thinking they are in a different universe. Have the emerging markets, and in particular the BRIC (Brazil, Russia, India, and China) countries, vanished from being the drivers of the global economy to being the drag on global growth? If yes, what does this mean for the lubricants industry? In 2012, BRIC countries consumed an estimated total 12.8 million tons of finished lubricants, with their global lubricant consumption share increasing from an estimated 25% in 2006 to approximately 33% by 2012. Clearly, the economic performance of the BRIC countries is of prime importance to the lubricants industry. This article briefly discusses the outlook for the BRIC countries and the impact on the lubricants industry.

Economic outlook

The BRIC countries have very little in common. The only reason they were clubbed together was because they were the only $1+ trillion economies (on a purchasing power parity basis) outside the OECD and because they made a cool acronym. As the world’s most populous countries, China and India have respective populations exceeding a billion people. By contrast, the populations of Brazil and Russia are less than 200 million. Russia and Brazil are far richer than China and India with a GDP per capita exceeding $10,000, compared to $6,291 in China and $1,508 in India. Russia has near no population growth, while population growth in China, India, and Brazil is 0.6%, 1.2%, and 1.1%, respectively. Additionally, their respective geographies differ greatly. Consequently, the growth drivers and restraints for these four countries are often disparate and diverse.

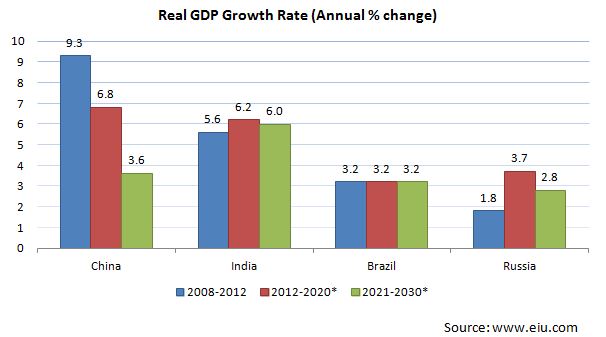

According to The Economist Intelligence Unit (www.eiu.com), growth in China will slow down sharply in the coming years, growth in India and Russia will increase marginally, whereas Brazil will be unchanged.

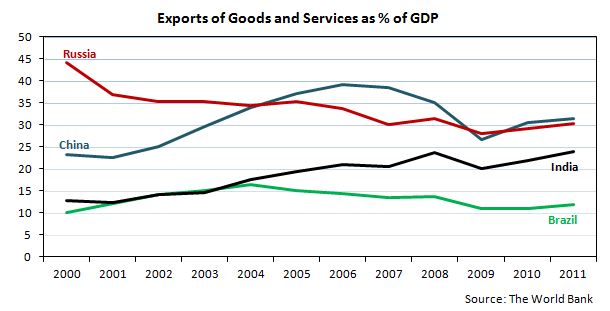

The long-term growth outlook for India and Brazil is relatively stable. India, due to its low dependence on exports, was affected only slightly by the recession in the United States and European Union; however, in recent times, it has suffered from an outflow of foreign capital due to improving conditions in the United States and European Union, as well as the talk of tightening money supply in the United States. Both Brazil and India have seen their currency depreciate significantly in 2013; between January 1 and November 15, 2013, the Indian Rupee and Brazilian Real respectively lost 16% and 13% of their value against the U.S. dollar.

Russian growth has been primarily driven by energy exports, with a strong dependence on Europe. Its growth is consequently affected by growth in Europe; if a shale gas industry takes root in Europe, Russian energy exports will be adversely affected. While consumption has grown during the good times, investments in the country’s manufacturing sector have been few, indeed, a perceived political risk has seen much capital moved out of the country. Given the near obsolete manufacturing sector, Russia is thus unable to grow via manufacturing exports. All this combined with a flat or declining population makes for a dim economic outlook.

The long-term cause for China’s slowdown is its demographic profile, with its population ageing fast and share of the working age population dropping. In the short term though, the primary cause of the slowdown in China concerns the slowing of exports. Europe and North America simply do not have the same appetite for Chinese goods as they had before the recession. China is also losing its cost advantage due to rising labour costs and an appreciating currency. The massive stimulus package announced at the height of the recession helped prevent a too steep drop in growth rate, and the Chinese government is continuing to reorient the economy away from export, to investment- and consumption-led growth.

In reality, as the graph above shows, the re-orientation of the Chinese economy started in 2006. Share of exports as proportion of GDP dropped from close to 40% in 2006 to nearly 25% in 2009 and then recovered to around 30% by 2011.

The reorientation has been quite bumpy. A growing housing bubble prompted the Chinese government to clampdown by slowing both credit flow and construction project approvals. This caused a slowdown not only in China but also on economies dependent on the country.

Impact on the lubricants industry

Against this background, the key question is whether the BRIC countries will continue to prop up global lubricant demand growth. Kline’s analysis foresees continued growth, but at a much slower pace. Between 2006 and 2012, the share of BRIC countries in the global lubricant demand grew by an estimated eight percentage points. Over the next five years, this is expected to slow to between two to three percentage points.

However, the growth potential in China and India remains strong despite the current situation.

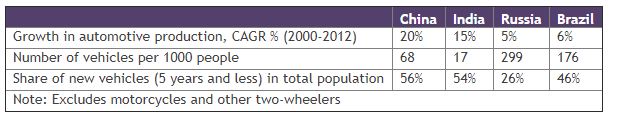

Automotive production in China and India has grown strongly over the last 12 years. Despite this, automotive penetration in China and India remains low even by Russian and Brazilian standards, let alone more advanced economies. Despite rising disposable income, it is unlikely that emerging economies will ever achieve the level of motorization observed in advanced economies, given the constraints of crowded cities and poor road infrastructure. However in the short term, automotive populations will show strong growth with this in turn driving lubricant consumption. On the industrial side, infrastructure development – comprising power generation and transmission, roads, ports, airports and the like - will drive lubricants directly and peripherally through related industries like mining, cement production, and construction equipment manufacture.

While the underlying drivers for lubricant growth remain unchanged, what has changed is the greater focus on higher quality lubricants. The primary drivers for this change include environmental factors, cost advantages and basestock supplies.

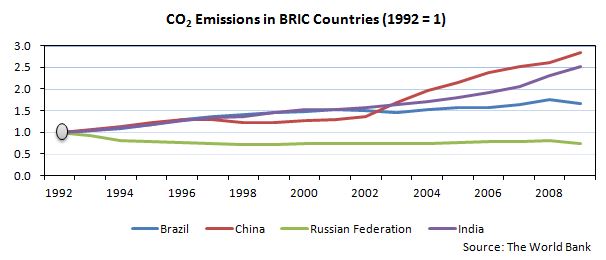

Environmental factors: China and India’s economic development has been accompanied by severe environmental deterioration with, as shown in the figure below, carbon dioxide emissions having grown rapidly in both countries. The smog experienced by Beijing in January 2013 was a wakeup call for the Chinese government regarding the need to tackle environmental issues. The Chinese government is reported to have allocated USD 275 billion for environmental remediation. This spend could spur the creation of various low cost technologies which could be applied in other emerging markets. Besides environmental remediation, the government also plans to produce 20% of its energy requirements from renewable sources.

Aside air-pollution, water scarcity and water pollution are equally important issues being tackled in China. Of the largest three water consuming segments, household, agriculture, and industry, the latter has usually enjoyed the greatest leeway due to political reasons. However, applications for new industrial projects must now respect increasingly stringent water consumption and disposal norms. This has spurred greater focus on water conservation and recycling, and is also creating greater interest in neat oils as opposed to water miscible fluids.

Manufacturing refocus: Faced with increasing costs due to growing labor costs and currency appreciation, Chinese manufacturers can no longer focus on low value-added manufacturing. Many western companies have concluded that when logistics costs are factored in along with higher labour costs, higher exchange rates, and greater risk of intellectual property theft, outsourcing of manufacturing in China no longer makes for a compelling business argument. This has put greater pressure on Chinese manufacturers to move up the manufacturing value chain. This is already evident in the construction equipment industry where many of the leading global manufacturers are Chinese – for example, Sany, Zoomlion, and Xugong. Sectors where the Chinese may challenge and overtake counterparts from OECD countries include sectors encompassing auto manufacturing, auto components, ship building, and a variety of fabricated products such as tubes and fittings, ball bearings, heat exchangers, and electrical equipment. As these manufacturers increasingly compete on a global scale, they will have to make their manufacturing process greener, energy efficient, and less polluting.

Basestock supply: The share of high performance basestocks in the overall supply is increasing. By 2020, Group II and Group III share will exceed 50%. The use of these basestocks will be predominantly driven by their availability, with technical requirements taking a secondary role. More interestingly, Asia’s role as the supplier of Group III to the world will change. Asian share in global Group III supply will drop from about 80% at present to about 30% by 2022. This is due to the growing Group III supply in other parts of the world. As a result of this change, most of the Group III manufactured in the region will stay in the region. This will spur movement to higher quality lubricants.

Summary

The BRIC countries have little in common except that they are substantial (being the only $1+ trillion economies, measured on PPP, outside the OECD) and have enjoyed high growth. However the economic growth drivers differ significantly between them. All four BRIC countries face economic challenges with China re-orienting its economy to consumption and investment led growth which will lower its overall growth rate, while both Brazil and India are battling high inflation and currency depreciation. In case of Russia, stagnation is a real possibility.

Each of the BRIC countries has a large lubricant market with strong growth potential. While growth in China may wane, Brazil and India appear likely to continue to grow at present rates. Conversely, growth in Russia is likely to taper.

While the lubricant market in BRIC countries is vast, the quality portion of the market is still limited; however, due to environmental and cost compulsions, lubricant quality may improve rapidly in the near future.