INTRODUCTION

Innovation is the lifeblood of the OTC industry. From a business perspective, it drives growth, and from a public health perspective, it better satisfies consumers’ health needs. Because innovation is so important, Kline and IRI have collaborated to examine recent OTC launches and identified their success factors including:

- A point of difference, big or small, real or imagined, to better address patient needs

- Expert awareness-generating, heavy advertising and promotion investment

- Brand equity plays

The nine brands included in this assessment and shown on the timeline graphic in Table 1, have the following characteristics and were chosen for inclusion jointly by Kline and IRI:

- Launched between 2010 to 2014

- A mix of Rx-to-OTC switches, new and line extensions of monograph items, and supplements

- Part of IRI’s New Products Pacesetters tracking and annual review

- Significant media support

- Experienced double-digit growth the year after launch

- Still growing in Year 2

| Table 1: Sales, Market Share, Ad Spending, and SOV for Profiled Brands | |||||||||

| Retail sales, $ million-a | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Brand | Company | Category | Launch date | Year 1 | Year 2 | Growth, % | Market share, % 2014-b | Ad spending, $ million year 1-c | Share of Voice % year 1-c |

| Schiff Mega Red | RB | Omega 3 supplements | 9/10 | 49.7 | 77.3 | 55.5 | 12.3 | 10.6 | 3.2 |

| Trubiotics One-A-Day | Bayer | Probiotics | 8/12 | 19.4 | 25.7 | 32.5 | 25.7 | 27.1 | 29.9 |

| Allegra | Sanofi | Allergy relief | 3/11 | 272.8 | 311.0 | 14.0 | 17.1 | 140.7 | 45.7 |

| Mucinex Fast Max | RB | Cold and sinus | 10/11 | 129.3 | 199.0 | 53.9 | 6.6 | 23.1 | 6.2 |

| DayQuil/NyQuil Severe | P&G | Cold and sinus | 7/13 | 28.7 | 90.9 | 216.7 | 4.0 | 20.4 | 7.2 |

| Nasacort 24HR | Sanofi | Allergy relief | 2/14 | 130.0 | 136.5 | 5.0 | 5.4 | 69.9 | 22.7 |

| ZzzQuil | P&G | Sleeping aids | 8/12 | 63.8 | 123.2 | 93.1 | 35.7 | 38.8 | 44.0 |

| Nexium 24HR | Pfizer | Antacids | 6/14 | 158.2 | $302.1-d | - | 6.4 | 56.6 | 21.2 |

| Flonase Allergy Relief | GSK | Allergy relief | 2/15 | 268.1-e | 294.4-f | - | - | - | - |

| a- IRI MULO retail sales. b- Based on Kline’s Nonprescription Drugs USA study. c- Based on ad spending data from Kantar Media. d- Full year 2015; sales since launch in June 2014 through w/e February 7, 2016 are $500.5 million. e- Reflects IRI MULO retail sales from February 4, 2015 to November 22, 2015. f- Through December 2015. |

|||||||||

WINNING CHARACTERISTICS

Brief profiles follow of the products featured in this paper and are grouped either as Rx-to-OTC switches or monograph/supplement items.

Rx-to-OTC switches

Allegra, Flonase Allergy Relief, and Nexium 24HR have all realized significant OTC sales and market share by building on existing brand equity with both consumers and healthcare professionals from their heritage as prescription drugs. In most of these cases, the prescription drug had been supported heavily by significant direct to consumer (DTC) ad spending, making the OTC brands extremely familiar to consumers. In all cases, each brand successfully communicated a point of difference and unique positioning that resounded with consumers. Despite brand equity built from the prescription heritage, new OTC brands require large-scale advertising and promotional campaigns to have a meaningful impact on the OTC market and make launches successful. While such ad spending can be significant, it helps drive consumer awareness and trial, and there is a particular payoff for marketers of truly innovative OTCs.

Allegra

Allegra

- The Rx-to-OTC switch of Allegra launched in March 2011 and was the third major low- and non-sedating oral antihistamine to switch after Claritin (Bayer) and Zyrtec (Johnson & Johnson).

- Sanofi/Chattem knew a major marketing push would be necessary to gain traction as the third comer to this category, although its Rx heritage was already significant with the allergy-suffering community.

- Launched in sync with the start of the allergy season, the aggressive 360 marketing program hit hard on points of difference versus the competition:

− Faster than Claritin

− Non-drowsy vs. Zyrtec and Benadryl - In 2011, Allegra was the most heavily advertised OTC allergy brand, with expenditures totaling $140.8 million, driving a commanding 45.7% share of voice.

− Sales hit $273 million in year 1 and continued to grow to exceed $300 million in year 2. - Launch sales of Allegra benefited from Johnson & Johnson’s supply disruptions of Zyrtec in 2011 and 2012.

Nasacort Allergy 24HR

The relatively dissatisfied allergy sufferer helped drive the successful launch of the Rx-to-OTC switch of Nasacort Allergy 24HR in 2014.

The relatively dissatisfied allergy sufferer helped drive the successful launch of the Rx-to-OTC switch of Nasacort Allergy 24HR in 2014.- Nasacort Allergy 24HR intransal spray is different in dose form and function, delivering relief from additional allergic reactions in the body and thus improved symptom control versus existing allergy OTCs.

- Nasacort Allergy 24HR had low brand awareness as an Rx as it made the switch.

- Clear communication of the strong functional point of difference helped drive trial.

- An aggressive multimedia campaign totaling nearly $70 million in 2014, including television and radio advertising and interactive in‐store displays, is rumored to cost an additional $2.1 million.(1)

- Surprisingly, with Nasacort, product efficacy trumped form for many allergy sufferers.

Flonase Allergy Relief

- The second inhaled nasal steroid, Flonase Allergy Relief launched by GlaxoSmithKline in February 2015, was approved to treat both nasal and eye symptoms (such as itchy and watery eyes), which is an advantage over Nasacort Allergy 24HR.

- Unlike Nasacort, the Flonase brand had strong brand awareness and equity from its prescription heritage as it entered the OTC market.

- “Consumerizing” its proposition and building on the Rx heritage, advertising touted Flonase treats six causes of allergy symptoms, compared to just one, using the tagline “Six is greater than one.”

- The timely (start of allergy season) and substantially supported launch drove Flonase to top the inhaled nasal steroid segment, with retail sales in its first eleven months accounting for an astounding $294 million.(2)

Nexium 24HR

- Pfizer launched the Rx-to-OTC switch of Nexium 24HR in June 2014 and the brand joined a crowded antacid market cluttered with numerous brands in the PPI, H2 antagonists, and traditional antacid segments.

- Given the intense competitive landscape of antacids and relatively high consumer satisfaction with such medicines, Pfizer brilliantly built on the “purple pill” equity from the product’s Rx heritage by investing heavily, nearly $60 million in media spend in the first six months out.

- Support for Nexium at $60 million dwarfed market leader Prilosec (Procter & Gamble), which invested $56 million for the entire year in 2014. Copy touts “Time for a new routine. Try Nexium 24HR, the latest choice in frequent heartburn protection, and get Nexium Level Protection.”

- Backed by a 360-degree surround sound promotional campaign, sales reached $158.2 million in the first seven months of OTC availability and $302.1 million in full year 2015.

Supplements and monograph innovations

MegaRed: A brand amidst a commodity marketplace

- Reckitt Benckiser, post acquiring Schiff in 2012, took MegaRed, originally launched in 2010, to leadership in the commodity omega 3 market nearly overnight.

- By 2014, sales reached $88 million with a share in excess of 12%, a far cry from the $10 million performance in its first year on the market in 2010.

- Reckitt Benckiser took the product’s original point of difference in 2010 and morphed it into a more consumer-friendly positioning.

− In 2010, the product carried the Marine Stewardship Council eco-label, an exclusive label given to sustainable, well-managed fisheries.

− The label assured that Schiff MegaRed Omega-3 Krill Oil supplement was the first mass market product to be certifiably sustainable, have minimal impact on the environment, and have 100% traceability from sea to shelf.(3) - Currently, Reckitt Benckiser claims that it produces the most powerful soft gel containing oil from 100% pure Antarctic krill, in an optimized combination of omega‐3 fatty acids, phospholipids, and the powerful antioxidant, astaxanthin, to support healthy heart and joint health.(1)

ZzzQuil

- Procter & Gamble’s ZzzQuil is an example of innovation and marketing genius. The brand responds to the intersection of:

− Consumer frustration with sleep deprivation and poor quality sleep

− Tremendous equity and heritage of Nyquil = sleep

− Dose form associated with home/night time use

− Availability of a safe, time-tested monograph ingredient. - ZzzQuil became the first OTC sleeping aid in liquid form and recorded $121.1 million in retail sales during the product’s 12 months post-launch in 2012-2013,2 disrupting the 54% private-label sleep aids category.

- Despite the flip side of monograph ingredient-based products being susceptibility to private-label competition, ZzzQuil continued to grow share in year 2, reaching 35.7% market share in 20141 and posting $118.8 million in retail sales at the end of 2014.(2)

Mucinex Fast-Max

Mucinex’s mega-brand success is founded on its patented novel products, endorsements by physicians and pharmacists, and its ground-breaking and aggressive promotional campaign that features Mr. Mucus and his family.

Mucinex’s mega-brand success is founded on its patented novel products, endorsements by physicians and pharmacists, and its ground-breaking and aggressive promotional campaign that features Mr. Mucus and his family.- In time for the 2011-2012 cough and cold season, Reckitt Benckiser launched the new Mucinex Fast‐Max line of items.

- In 2012, Reckitt Benckiser spent $492.4 million in traceable media expenditures (TME) for Mucinex, the most advertising spent on any brand in the cold and sinus medication category that year (and many recent years running).(1)

- Constant advertising of the new brand line, along with the company’s new speed claims about the products, resulted in an 18.4% share of the cough, cold, and sinus market.

- Additionally, Mucinex Fast-Max continues to grow, and retail sales of the brand reached $199.0 million at the end of 2014.(2)

DayQuil/NyQuil Severe

The combo-pack DayQuil/NyQuil Severe, launched in mid-2013, helped add nearly a full share point to Vicks’ share in the cold and sinus market, which reached 19.9% by 2014.

The combo-pack DayQuil/NyQuil Severe, launched in mid-2013, helped add nearly a full share point to Vicks’ share in the cold and sinus market, which reached 19.9% by 2014.- In 2014, Procter & Gamble invested just over $80 million behind inspired copy for DayQuil/NyQuil Severe, portraying parents who apologize to their kids because they might need to take a sick day. For NyQuil, the spot added the “Best Sleep with a Cold” copy to its well‐known “Nighttime, Sniffling, Sneezing, Coughing, Aching, Fever” tagline.

- With the product’s new claims and clever advertising, the DayQuil/NyQuil Severe brand extension experienced $91.9 million in retail sales in its first 12 months on the market.(2)

One-A-Day TruBiotics

Bayer has done a great job of establishing a brand in the relatively new probiotics segment of the supplement category.

Bayer has done a great job of establishing a brand in the relatively new probiotics segment of the supplement category.

− Knowing that the idea of probiotics for health is new to U.S. consumers, Bayer uses the significant brand equity from the One-A-Day trusted and familiar brand name.- Since this is a still developing category, posted sales are modest.

− TruBiotics accounted for just over a 9% share in year one and doubled that to 18.2% by the end of year 2 in 2013.

− True to the Bayer heritage of expert and pervasive marketing and advertising, TruBiotics was advertised in conjunction with One-A-Day vitamins.

− Advertising was comprehensive and included widespread media coverage across television, magazines, and print. - The brand is still growing through 2014, posting the largest market share of the probiotic supplement category at 25.7%1 and $25.7 million in retail sales.(2)

OUTLOOK FOR 2015 TO 2018

Absent innovation, the OTC market inherently grows at a slow and steady pace year over year. Innovation coupled with clear and concise marketing messages combine to better meet consumers’ needs, driving market growth. With this in mind, factors influencing our forecast for the near-term are as follows:

- Consumers will continue to adopt technological advancements in speed of relief, duration of action, and dose form. Claims will play a crucial role in developing innovative and distinctive brands that are efficacious and convenient to use.

- Leading marketers will also continue to launch new products or innovative line extensions of existing brands to stay competitive in the industry, grow their share of the market, and stimulate consumer interest levels in their respective categories.

- Rx-to-OTC switches will continue to play an important role in the evolving industry. While the period from 2014 to 2015 saw an unprecedented surge in Rx-to-OTC switches entering the market, we expect to see fewer drugs making the switch over during the next several years. However, the brands that do switch are expected to deliver significant sales gains for the market.

- Over the next few years, we expect to see more OTCs launched with a natural positioning, as well as alternative products, such as pain management devices that use TENS (transcutaneous electronic nerve stimulation) technology, which will impact the OTC market.

- Over the next five years, marketers are gradually expected to balance their advertising and promotional spending across both traditional media and digital venues. In this way, major OTC brands will build broader consumer awareness across all age groups and be present with messaging at the moment of truth during the ever-evolving and personalized path to purchase.

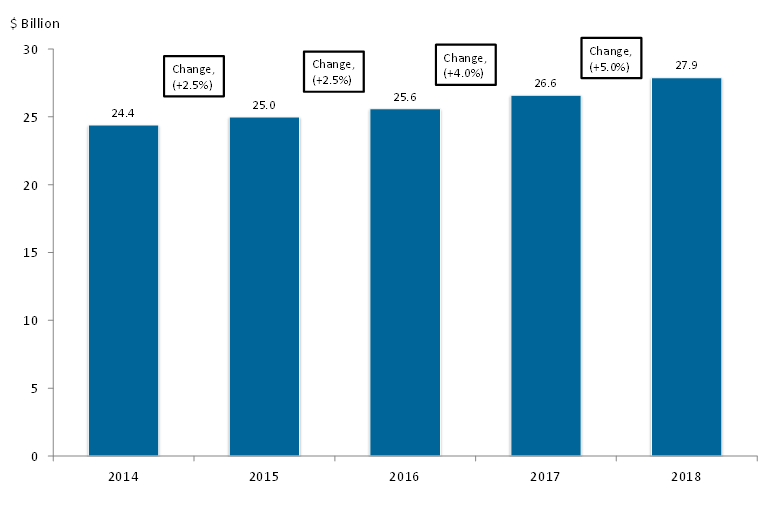

The prospects for the U.S. OTC market look healthy moving forward. We forecast growth for the OTC industry at nearly 4% annually through 2018, as shown below:

Base growth will hover near 2% annually, while switches and other innovations will spur the industry to a forecast CAGR of 3.7%, as shown in Table 2.

| Table 2: OTC Market Outlook, 2015 to 2018 (1,4,5) | |||||

|---|---|---|---|---|---|

| Manufacturers’ sales, $ billion | |||||

| Line item | 2015 | 2016 | 2017 | 2018 | CAGR, % |

| Base OTC market | 24.4 | 24.9 | 25.4 | 25.9 | 2.0 |

| New Rx-to-OTC switches | 0.2 | 0.3 | 0.4 | 1.1 | 76.5 |

| OTC innovations | 0.4 | 0.4 | 0.8 | 0.9 | 31.0 |

| Total | 25.0 | 25.6 | 26.6 | 27.9 | 3.7 |

Factors impacting our forecast include:

- In early 2016, Rhinocort OTC (Johnson & Johnson) is launched after having received approval from the FDA for the switch in March 2015 (in allergy, waiting for the season makes sense).

- Additional switch activity will drive gains for the OTC industry, but many are not expected to enter the market until 2017 or 2018. Rx-to-OTC switch activity is expected in existing OTC categories, such as:

− Allergy

− Topicals

− Sleeping aids - New OTC categories come 2017-2018 including:

− Erectile dysfunction

− Migraine

− Overactive bladder - Line extensions and other monograph innovations of existing OTC brands will spur incremental gains of about $0.4 billion to $0.9 billion per year over the next three years.

- The joint venture between Glaxo Smith Kline and Novartis, as well as the recent merger between Pfizer and Allergan, should lead to several switch candidates being brought to market.

References

1 Kline & Company: Nonprescription Drugs USA, 2010-2014.

2 IRI New Product PaceSetters, 2008-2014.

3 https://newhope360.com/supply-news-amp-analysis/schiff-megared-first-marine-stewardship-council-certified-krill-mass

4 Kline & Company: Rx-to-OTC Switch USA: New Paradigm for Growth, 2014.

5 Kline & Company: Rx-to-OTC Switch USA Pipelines USA: Competitive Assessment, 2015.

ABOUT THE IRI/KLINE ALLIANCE

Information Resources, Inc. (IRI) the global leader in innovative solutions and services for consumer, retail and over-the-counter healthcare companies, and Kline & Company, a global market research and management consulting firm, have established an exclusive alliance to serve the worldwide, over-the-counter (OTC) drug and overall consumer healthcare industries. This powerful alliance will provide a higher level of data accuracy and an unparalleled, global range of thought leadership on stimulating topics in the consumer healthcare space.

As part of this collaborative relationship, IRI will contribute its granular, widely recognized, point-of-sale (POS) market data, related insights, and thought leadership. Meanwhile, Kline will provide its unmatched historical database, global network, and 360-degree view of the complex OTC drug market, including its comprehensive channel coverage and vast expertise in the area of Rx-to-OTC switches.

The collaborative thought leadership will manifest through white papers like this one on such topics as Rx-to-OTC switch, merger and acquisition activity, new product innovation, as well as trends and issues in international and emerging markets within the OTC drugs industry.

About IRI

IRI is a leader in delivering powerful market and shopper information, predictive analysis and the foresight that leads to action. We go beyond the data to ignite extraordinary growth for clients in the CPG, retail and especially in the over-the-counter healthcare industries, by pinpointing what matters and illuminating how it can impact their businesses. Experience the power of IRI’s mantra “Growth Delivered” at www.IRIworldwide.com.

About Kline & Company

Kline is a worldwide consulting and research firm dedicated to providing the kind of insight and knowledge that helps companies find a clear path to success. The firm has served the management consulting and market research needs of organizations in the agrochemicals, chemicals, materials, energy, life sciences, and consumer products industries for over 50 years. For more information, visit www.KlineGroup.com.

For more information on this white paper or the IRI/Kline alliance, please contact Lisa C. Buono, Client Insights Principal, Health Care Vertical at IRI or Laura A. Mahecha, Industry Manager, Healthcare at Kline & Company.