In July 2020, the EU announced its hydrogen policy to achieve a carbon-neutral economy. Several countries, including Australia and Japan, have issued such policies in the past. The EU policy is different in that it is more comprehensive and takes an integrated approach to reducing carbon footprints. The policy, issued as part of the EU’s COVID-19 pandemic recovery efforts, is based on a philosophy of “rebuild better” to be better equipped to fight climate change.

In July 2020, the EU announced its hydrogen policy to achieve a carbon-neutral economy. Several countries, including Australia and Japan, have issued such policies in the past. The EU policy is different in that it is more comprehensive and takes an integrated approach to reducing carbon footprints. The policy, issued as part of the EU’s COVID-19 pandemic recovery efforts, is based on a philosophy of “rebuild better” to be better equipped to fight climate change.

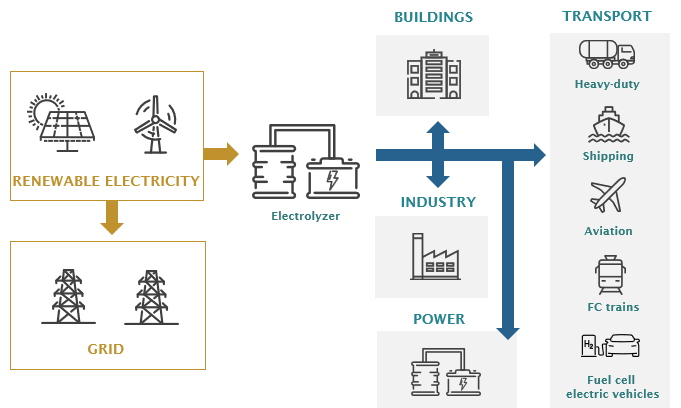

At the heart of the EU plan and other plans before it is the idea of using carbon-neutral hydrogen as essentially the currency of the new energy economy; hydrogen can be used to store carbon-free energy that, in turn, can be traded as a commodity between producers and consumers. Carbon-neutral hydrogen produced from various renewable energy sources and used in any application—residential, commercial, industrial, power generation, or transport—will reduce/eliminate the carbon footprint of that application. There are two key benefits to this approach:

- Carbon neutral hydrogen will be used as an energy source (via fuel cells and synthetic fuels produced from this hydrogen) to decarbonize sectors of the economy which would be difficult to decarbonize by electrification.

- Carbon neutral hydrogen production allows storage of renewable energy, which is produced in an intermittent fashion. This will allow renewable energy to become a mainstream energy source.

A hydrogen strategy for a climate-neutral Europe

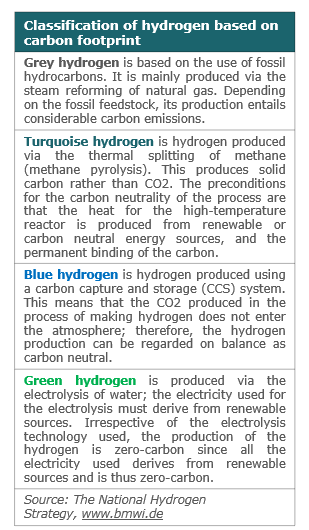

The plan is laid out in three phases: 2020 to 2024; 2025 to 2030; and beyond 2030, during which production capacity of renewable hydrogen is ramped up along with demand and, in the process, carbon intensive fuels are dislodged. Hydrogen can be produced via several routes and is classified on an unofficial color scale based on the carbon footprint associated with its production.

The plan is laid out in three phases: 2020 to 2024; 2025 to 2030; and beyond 2030, during which production capacity of renewable hydrogen is ramped up along with demand and, in the process, carbon intensive fuels are dislodged. Hydrogen can be produced via several routes and is classified on an unofficial color scale based on the carbon footprint associated with its production.

In an electrolyzer, electrolysis is used to split water into hydrogen and oxygen by passing electric current through the water—essentially, the reverse process of a hydrogen fuel cell. When this electrolysis process is powered by a renewable energy source like solar or wind, we get carbon- neutral hydrogen.

In the first phase (2020 to 2024), the plan envisages the installation of 6 GW of renewable hydrogen electrolyzers. Manufacturing of electrolyzers would be ramped up, including large size units up to 100 MW. These electrolyzers would be installed in existing demand centers in refineries, steel plants, and chemical complexes. During this phase, there would be production of 1 million tons of renewable hydrogen, and projects would be initiated to decarbonize existing hydrogen production and facilitate the increase of hydrogen in new end-use applications.

In the second phase (2025 to 2030), at least 40 GW of renewable hydrogen electrolyzers would be installed, allowing annual production of 10 million tons of renewable hydrogen. As the scale of renewable hydrogen is increased, costs are expected to come down. During this phase, policies will be set for demand creation in steel, trucking, rail, maritime, and other applications. Also during this phase, hydrogen clusters (so-called hydrogen valleys) are created. These clusters have local production based on renewable sources. Renewable hydrogen starts to play a role in balancing a renewable source-based electricity system by offering buffering and daily/seasonal storage. Because of all these actions, the need for EU-wide logistical infrastructure will emerge.

In the third phase (beyond 2030) renewable hydrogen matures and is deployed at scale. Renewable energy capacity (wind and solar) is expected to grow so that at least 25% is dedicated to renewable hydrogen production.

Will this plan work?

Only time will tell. The EU is in a better financial position compared to the United States. There also appears to be a genuine desire to “rebuild better”—in other words, to not build the old infrastructure but something new that helps mitigate climate change. As per the EU, the Commission’s economic recovery plan “Next Generation EU” highlights hydrogen as an investment priority to boost economic growth and resilience, create local jobs, and consolidate the EU’s global leadership. The plan calls for electrolyzer capacity increasing and its technology improving so that cost of renewable hydrogen produced from these electrolyzers falls and achieves cost parity with other hydrogen sources. This, of course, is not guaranteed but likely a reasonable assumption. All this works in favor of the plan, but there are two issues with which the plan must deal: water scarcity and hydrogen transportation.

The plan is silent on the impact it will have on the availability of fresh water supply. As per the “Water Scarcity Clock,” many parts of Europe have water scarcity that gets severe in the driest months. Of course, the situation is not as bad as in other parts of the world. For example, this plan cannot be replicated in developing markets like India or even an advanced economy like California. Both have severe water shortages for existing uses and cannot accommodate new demands. Electrolysis of seawater without producing chlorine is possible but still some distance from commercialization[1].

In the EU plan, the issue of hydrogen transportation is an issue left to be dealt with in the future. This is because, while the demand centers are known, the supply centers tied to renewable power generation and water resources will only emerge over time. Hydrogen will not be able to be transported by the existing pipeline infrastructure, which will increase its carbon load[2]. A study conducted by DB Energie finds that it is feasible to transport hydrogen on rails but will require the development of hydrogen transport containers approved for use on railroads. This is the approach that will be used by Germany.

Several companies have signaled their intent to participate in the upcoming hydrogen economy. In its recently publicized strategy, BP said that it would be “seeking early positions in hydrogen.” Shell and its partners are working on an electrolyzer that will produce hydrogen using renewable energy. The REFHYNE project will install and operate the world’s largest hydrogen electrolyzer with a peak capacity of 10 MW and the ability to produce approximately 1,300 tons of hydrogen per year. Even outside the energy industry, companies as diverse as Microsoft[3] and Asda[4] are making forays into this area.

There is certainly a lot of enthusiasm behind this plan. It would be reasonable to assume that some subset of this plan, if not the whole plan, will be realized, provided the current zeal for this technology does not fade away.

Decarbonizing transport

Besides power generation, the biggest impact of the hydrogen economy will be felt in the transport sector: trucking, personal mobility, marine, railways, and aviation. The trucking and marine segment will be the most significantly impacted if the technology lives up to its promise. The impact on aviation and railroad will be limited as reasoned here:

Aviation: Carbon neutral hydrogen can be used to produce various synthetic fuels including synthetic kerosene, which can be used in aviation. Given the long approval processes for the aviation industry, this is very far into the future. The use of synthetic fuels may lead to a change in the formulation of lubricants used but will not eliminate their use.

Railroad: A large portion of the rail network is already electrified. Incorporating carbon-neutral hydrogen in this segment will mean changing the source of electric power used, which will not have any downstream impact. For segments that have still not been electrified, the first option will be to electrify. Only for segments where electrification does not make sense due to size of demand and/or difficult terrain, will there be an opportunity to switch from diesel to hydrogen fuel cells. Thus, the impact on the lubricant consumption in this segment will be limited.

Marine: The marine industry encompasses vessels of all sizes, from small coastal and inland vessels to large container ships, bulk carriers, and oil tankers circling the globe. Deep-sea marine accounts for most of the carbon dioxide produced by this industry. The industry and the deep-sea marine segment, in particular, is difficult to decarbonize. It is a capital-intensive industry operating on very thin margins. Ships have a very long life, so penetration of new technology is slow. Except for the emissions it produces, HFO is the ideal fuel for the marine industry, being a low-cost byproduct of the refining process and having high-energy density. As a result, the industry needs a continuous regulatory push to achieve decarbonization. While many fuels are in contention, carbon-neutral hydrogen and ammonia seem to be viewed most favorably. However, the low-energy density of hydrogen in comparison to HFO is an issue. A great deal of development work will be required before fuel cells are used in the marine industry. There are a many pilot programs being run on hydrogen fuel cell technology focused on small coastal vessels both in North America and Europe[5].

Heavy-duty (HD) commercial vehicles: In the HD commercial vehicle segment, hydrogen fuel cells have a distinct advantage over electric batteries due to the higher energy density of the former. The battery pack size for the range needed by commercial vehicles will take away precious cargo space. Fuel cell electric vehicles (FCEVs) have longer range and shorter refueling time compared to battery electric vehicles (BEVs). In addition, fuel cells are said to have a longer life compared to batteries. On the other hand, FCEVs have a much higher price compared to ICE and BEV variants.

Fuel cell buses and other commercial vehicles that return to base (last-mile delivery vans, garbage collection, school buses, forklifts, and emergency service vehicles, among others) are ideal candidates for conversion to hydrogen fuel cells, as they do not require a widespread refilling infrastructure. In fact, hydrogen is well-established in the forklift segment and is being deployed at commercial scale, as shown by the Asda announcement.

There are several factors that suggest hydrogen fuel cells will not grow on their own in passenger cars. Battery electric technology has a lead of several years on hydrogen fuel cell technology, and the gap will be difficult to close and pointless if the aim is just reduction of carbon emissions. Secondly, the hydrogen tank and related hardware increase space and make it unsuitable for small vehicles. Thirdly, deploying hydrogen distribution infrastructure will be complicated and expensive in crowded city centers. In contrast, installing hydrogen refueling stations along highways is likely easier in comparison. There will be instances in which communities have hydrogen refilling networks to cater to commercial vehicles on which passenger cars ride piggyback. This segment is likely to be small.

In the commercial vehicle segment, many automotive OEMs see an opportunity. There have been several announcements of hydrogen fuel cell commercial vehicles in recent times:

- Hyundai recently announced that it had shipped its first batch of Hyundai Xcient hydrogen-powered trucks to Switzerland. The Xcient is powered by a 190kW hydrogen fuel cell system with dual 95kW fuel cell stacks, while seven large hydrogen tanks offer a combined storage capacity of approximately 32.09 kilograms worth of hydrogen, which gives it a range of 400 kilometers.

- In 2019, a trio of companies—Nel Hydrogen Electrolyser AS, renewable energy company Engie, and mining company Anglo American—announced a project to retrofit trucks used at Anglo American’s platinum mines with hydrogen fuel cells.

- In August 2020, Cummins announced that it had received two grants from the U.S. Department of Energy for hydrogen fuel cell powertrain development.

- Nikola, a company operating in fuel cell battery-powered trucks, went public, reaching a market capitalization of USD 26 billion

What does it mean to the lubricants industry?

The European plan may give birth to a new carbon-neutral hydrogen economy. The growth of the hydrogen economy will be a chicken and egg problem. At each stage the plan aims to make small increments in supply and demand so that hydrogen generation projects and end-use applications can grow in synch with each other and sustain themselves. Increasing the scale and technology improvements will allow cost reductions for carbon-neutral hydrogen, which can drive further growth.

Among the various transport sectors, marine (in the long term) and commercial vehicles (in the short- to mid-term) show the greatest potential to conversion to hydrogen fuel technology, provided favorable market conditions are obtained. The total heavy-duty motor oil (HDMO) market in the EU is about 1.3 million tons. Marine engine oils (MEO) account for another 0.3 million tons. It is difficult to state what portion of this demand is at risk of being lost due to conversion to hydrogen fuel technology, but the probability has increased significantly with the announcement of the European plan.

European lubricants demand was in a gentle decline before the COVID-19 crisis. Significant demand contraction has occurred in 2020, some of which will be recovered in 2021. In the mid- to long-term, however, HDMO and MEO demand contraction on account of the growing hydrogen economy should be assumed. Subject to the growth in hydrogen supply and supply infrastructure and continuous hydrogen fuel cell technology development, both product segments face the grave threat of obsolescence. If this seems highly unlikely, remember what the COVID-19 pandemic has taught us: Seemingly impossible change can happen in the blink of an eye.

[1] https://phys.org/news/2018-08-closer-sustainable-energy-seawater.amp

[2] https://www.fool.com/investing/2020/08/05/does-the-hydrogen-economy-have-a-pipeline-problem.aspx

[3] https://news.microsoft.com/innovation-stories/hydrogen-datacenters/

[4] https://www.globenewswire.com/news-release/2020/08/03/2071583/0/en/Plug-Power-Brings-Hydrogen-Fuel-Cells-to-Leading-UK-Supermarket-Retailer-Asda.html