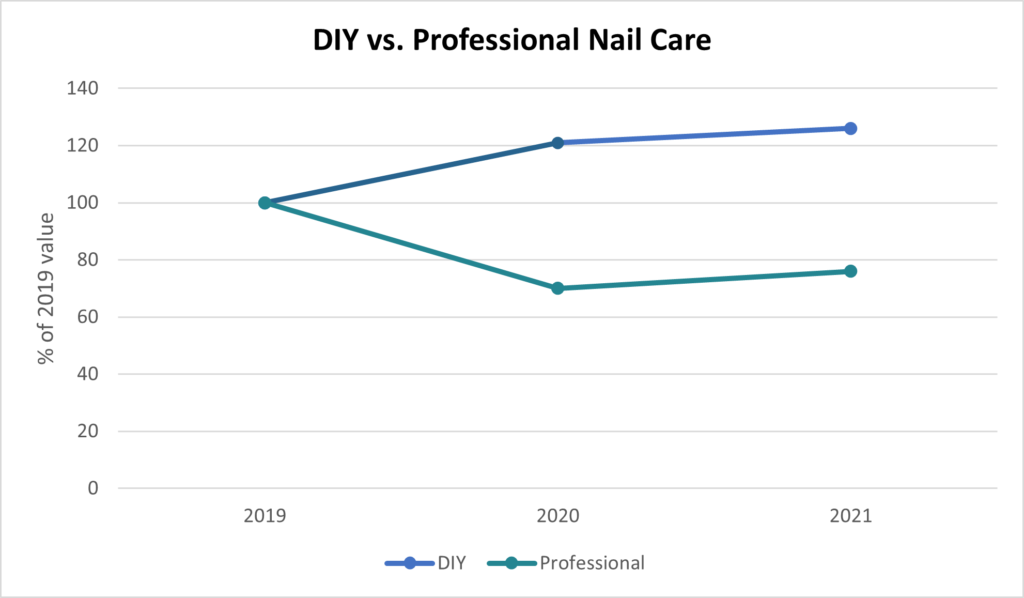

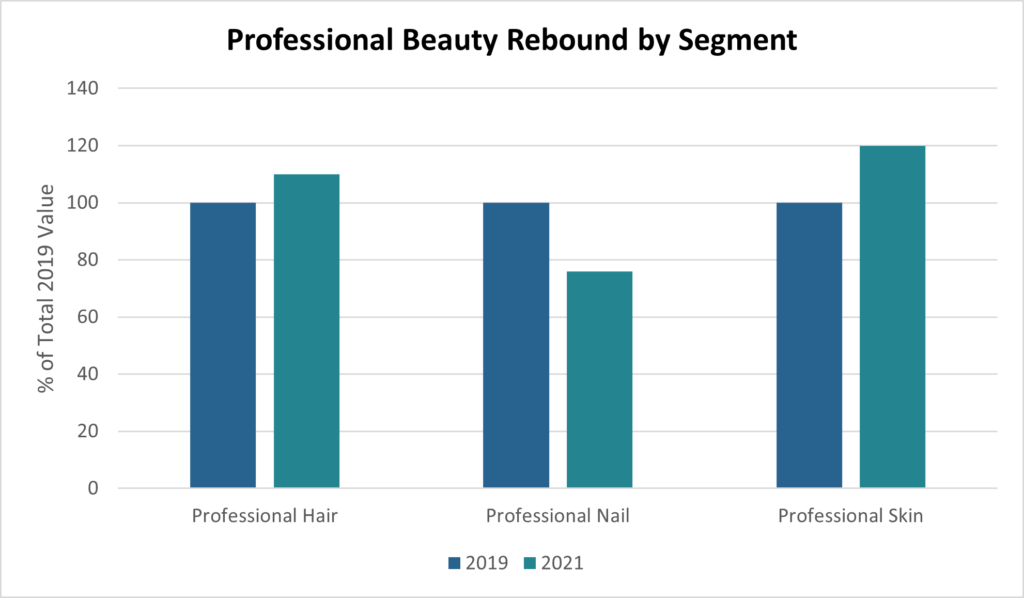

Although the U.S. professional nail care market posted an 8.3% gain in 2021 at almost $700 million, market levels are still only three-quarters of the value in 2019. By contrast, in 2021, the at-home nail polishes category was 26% larger compared to 2019. This is also in divergence from other segments of the professional beauty market; U.S. salon hair care rebounded to 10% above 2019 levels, while U.S. professional skin care surged to more than 20%.

Consumers clearly seem to be content with continuing to do their own nails at home. The at-home nail polishes category grew another 3.3% in 2021 on top of the 21% surge seen in 2020, according to our Cosmetics & Toiletries USA report. Marketers of DIY products have continued to attract consumers with “free from” formulations (e.g., Sally Hansen Good. Kind. Pure), nail art tutorials (e.g., Essie Brushy Ombré), and salon-quality manicure options (e.g., Olive & June).

Meanwhile, the dearth of newness on the professional side of the market has been stark. Apart from the typical seasonal collections and shade rotation, there is little to be found in terms of actual innovation. Marketers seem apprehensive to make major launches during this recovery period. One rarity is market leader OPI’s first natural origin nail lacquer, Nature Strong, which claims to be vegan and devoid of harmful chemicals. The launch helped OPI experience an 18% increase in the traditional nail polishes category.

The only other bit of notable activity was seen in the Care Products category, with Kiara Sky Nails launching Heel-ing Callus Remover Kit, which claims to actively soften the toughest of calluses in minutes. The new product is made with certified organic aloe vera and is free from parabens, sulfates, and fragrances.

Nail enhancements—including dipping powders, which have been trending—are another bright spot for the professional market. This was the fastest growing category in the professional nail care market with a 16% gain, though even this category remains below 2019 levels. This segment is also facing competition from at-home brands with new DIY solutions, such as KISS Nail Dip Powder Kit.

Brands that play only in the professional segment have struggled the most. Not long ago, CND ranked #2 in the entire U.S. professional nail care market and held a dominant position in the gels segment. Currently, the brand ranks #4 overall and has fallen to the #3 spot in gels. Given its parent company’s financial struggles and recent filing of bankruptcy, this comes as no surprise.

However, it is not all doom and gloom for the professional nail care industry. As more people returned to an office environment in 2022 and business travel and special occasions have consistently increased, we are optimistic that a stronger return to nail salons will be seen. We also expect marketers to be less cautious with launch activity and bring more innovation to the category, which should help improve sales. Our forecast indicates that the market should return above pre-pandemic levels by 2026, at a CAGR of 6.9%.

For more in-depth information on the market performance in 2021 and the outlook spanning to 2026, stay tuned for our soon-to-be-published Professional Nail Care: Global Market Brief report. This study will size the market by care products, gels, long-wear nail polishes, nail enhancements, and traditional nail polishes, highlighting key trends and dynamics across eight country markets—Brazil, the United States, France, Germany, Italy, the United Kingdom, China, and Japan.