The ease with which esters can be produced and a fragmented supplier base make for a difficult landscape to navigate. This is further complicated by a number of issues impacting the production and supply of esters, including inflation, the real estate crisis in China, Li-ion battery demand, and the ongoing geopolitical issues in Ukraine and the Middle East.

Foresight is key, which is why this article dives into the key trends that are shaping the esters industry, providing valuable insights into the current state and prospects of the esters market.

China Is Currently Dominating, But India Is Also Growing

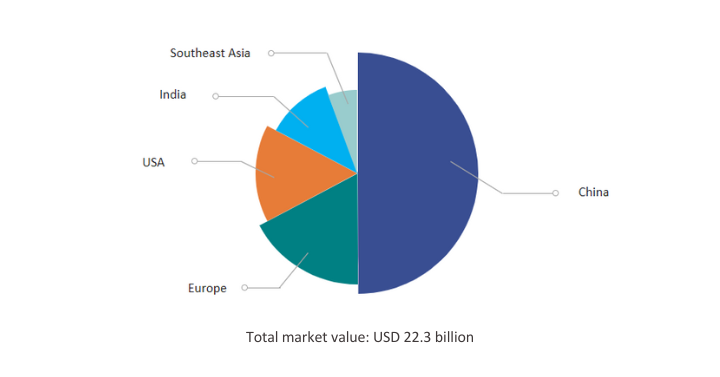

Figure 1. Value Share of Industrial Esters by Region, 2022

Asia, particularly China, has established itself as a dominant force in the esters market. China accounts for nearly 50% of the global demand for esters as it is the largest producer of paints and coatings, adhesives and sealants, and more, which drives the demand for esters in the country.

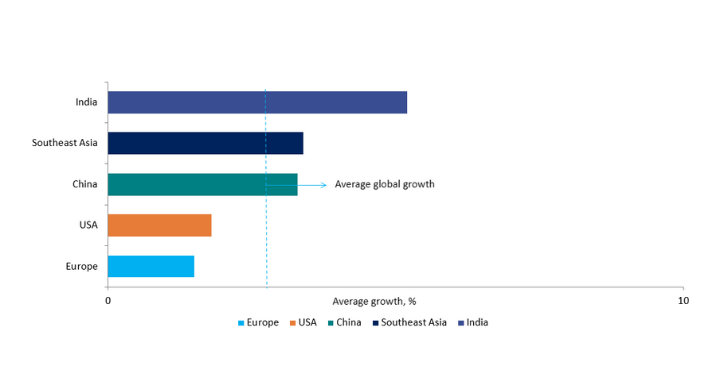

Figure 2. Growth in Consumption of Esters by Region, 2022 to 2027

However, India has emerged as a strong competitor, surpassing China and other Southeast Asian countries in terms of growth rate potential. The Indian economy is expected to be the fastest-growing major economy for the next few years, and this will drive the demand for esters in various industries.

Further, huge infrastructure development is expected to drive the demand for esters in industries such as construction, which will require large quantities of paints and coatings, and adhesives and sealants in India. This growth trajectory offers large opportunities for both domestic and international players in the esters industry.

The Evergrande crisis in China is expected to lead to lower growth in the Chinese construction industry, which, in turn, could adversely affect industries such as paints and coatings, and adhesives and sealants and thus the ester demand in these industries.

Moreover, a downturn in the construction sector could potentially trigger broader negative repercussions on the Chinese economy, subsequently cascading into widespread adverse economic effects on a global scale. Given the scale of esters demand in China, this is a significant concern for ester demand globally.

Focus Is Needed for EU and US Growth Opportunities

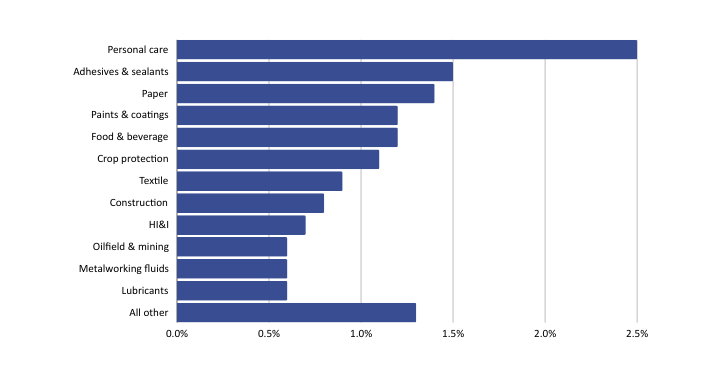

Esters in the personal care industry are expected to record the strongest growth during the forecast period, at a projected 2.5% CAGR through 2027.

Figure 3. Outlook for Esters Demand by Application in Europe, 2022 to 2027

While the Asian markets are experiencing accelerated growth, the mature markets of Europe and the United States present distinct growth opportunities in specific segments. Although the overall growth rate in these regions may be slower compared to the global average, there are pockets of high growth.

Industries such as lubricants and metalworking fluids, personal care, food, and construction are witnessing significant demand for esters in Europe and the United States. These sectors provide avenues for ester manufacturers and suppliers to tap into new markets and expand their presence.

However, esters are largely commodity products and have low profit margins. With high energy costs in Europe and the United States, the supply of esters is likely to shift to Asia. Moreover, lower-priced alternatives may replace esters if the performance benefits do not outweigh the additional costs of using them.

The Push for Environmental Friendliness Is Influencing Shifts in Esters Demand, Both Upward and Downward

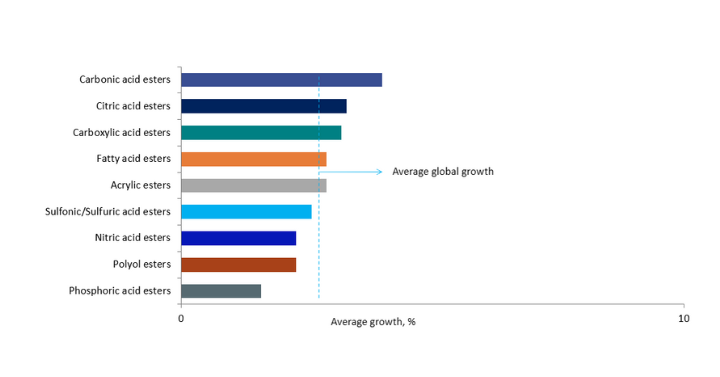

Figure 4. Growth in Consumption of Esters by Ingredient Category, 2022 to 2027

Sustainability has become a critical driver in the esters industry, influencing market dynamics in multiple ways. One of the key advantages of esters is their biodegradability, which makes them an environmentally friendly choice.

As the world becomes increasingly conscious of the environmental impact of various industries, there is a growing demand for esters as a biodegradable chemical. The surge in Li-ion battery manufacturing, primarily driven by the rapid adoption of electric vehicles, has a direct correlation to the increased demand for esters. These batteries utilize esters as an essential component, further fueling the growth of the esters market on a global scale.

The global demand for esters is mainly driven by their environmental-friendliness and biodegradability. For example, in lubricants, ester-based lubricants are more environment-friendly than conventional lubricants. However, the opposite is true for phosphate esters in crop protection. Phosphate fertilizers and pesticides are toxic and are expected to be replaced by less toxic alternatives.

Navigating the Dynamic Esters Market

The esters market is undergoing remarkable growth and transformation, driven by numerous factors. Whilst that growth is overall a net-positive for the industries’ manufacturers and suppliers, informed decisions are needed to take full advantage of the opportunities.

Stay at the forefront of the global esters market with Kline’s Industrial Esters: Market Analysis and Opportunities report. This study provides a comprehensive understanding of these trends and their implications, including data on the consumption of esters by application and region, supplier sales by esters type, application, and region, and more.