In 2013, over 100,000,000 hectares of crops are planted in China that can be treated by seed treatment agents. Central China has the largest planted area accounting for over 40% of total planted acreage, followed by Northern China with over 30% and Southern China with over 20%.

An estimated 46.1% of the planted acreage in 2013 are treated with seed treatment agents, either on-farm or off-farm. Corn is the crop with the largest seeds treating acreage, 34,000,000 hectares are treated by agents, representing above 95% of the acreage planted with corn.

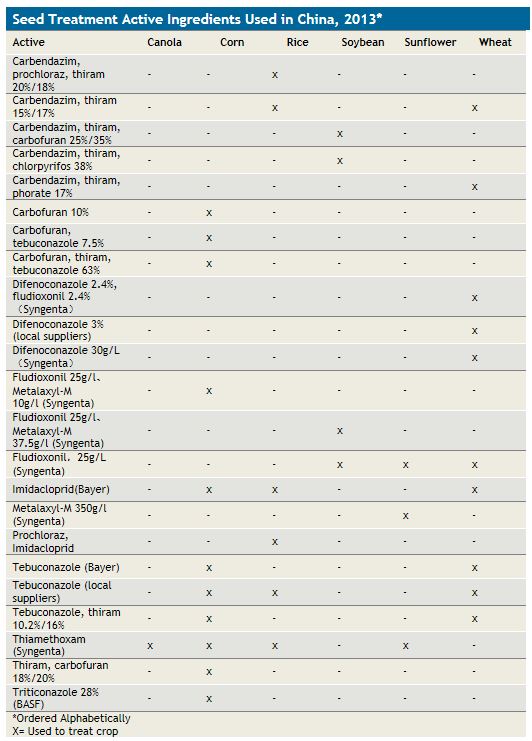

The seed treatment market in China in 2013 is valued at over USD 130 million, covering corn, wheat, rice, soybean, sunflower, and canola. Corn remains the largest value contributor, followed by wheat.

Multinational seed treatment agent suppliers like Bayer, BASF, and Syngenta are offering more single active ingredient product, but promote their fungicides and insecticides as a package to farmers. Seed treatment agents from local suppliers are normally formulated with two to three active ingredients, which combine fungicide with insecticide, thus become effective to both diseases and insects.

In recent years, Syngenta also registered several formulated agents with two to three active ingredients, including its Cruiser Extra (formulated with 0.66% fludioxonil, 0.26% Metalaxyl-M and 28.08% thiamethoxam) to treat head smut and Laodelphax Striatellus on corn registered in early 2013.

Kline’s chapter on China of the global seed treatment market research is a detailed analysis of the Chinese seed treatment market in 2013 covering the following topics:

- Crop background and planted acres

- Crop end use by acres or volume

- Production and crop protection methods

- Key seed suppliers and their product capability with treatment

- Role of seed treatment as crop protection method

- Key diseases, insects, nematodes, and other reasons seeds are treated; regional differences within countries when appropriate

- Chemical treatment methods for target diseases and insects and non-chemical alternatives

- Product sales and market share for seed treatment products

- Active ingredient use for seed treatment products

- Sales by company for seed treatment products

- Seed treatment outlook and assumptions by crop background