Lubricants consumption in ASEAN (the Association of Southeast Asian Nations or ASEAN) is on the upswing after the region found its way to the path of economic recovery last year.

“Before the onset of the COVID-19 health crisis, the region was witnessing sturdy growth in consumption,” says Sushmita Dutta, Project Manager in our Energy division. “This was driven by rapid urbanization, an expanding middle class, and industrialization driven by foreign investments.”

But pandemic-related restrictions proved to be detrimental to the region’s automotive industry and economic growth: All the countries (except Vietnam) reported a contraction of their GDP, as well as a reduction in vehicle sales and production in 2020, thereby impacting finished lubricants demand in the region. Vietnam has been one of the fastest-growing economies in Southeast Asia, witnessing GDP growth in a range of 5.5% to 6.5% per annum until 2019. In 2020, when most countries went into recession, Vietnam’s economy witnessed a slowdown and remained resilient. According to IMF, “strong economic fundamentals, decisive containment measures and well-targeted government support” has helped Vietnam’s GDP to grow by 2.9% in 2020. The COVID-19 crisis was then followed by geopolitical tensions caused by the Russia-Ukraine war in 2022, leading to inflation in many countries.

Still, the regions of ASEAN are recovering ― with the exception of Myanmar. Due to political instability caused by the removal of the democratically elected government by the military at the beginning of 2022, Myanmar witnessed further contraction of its GDP in 2021.

Automotive market review

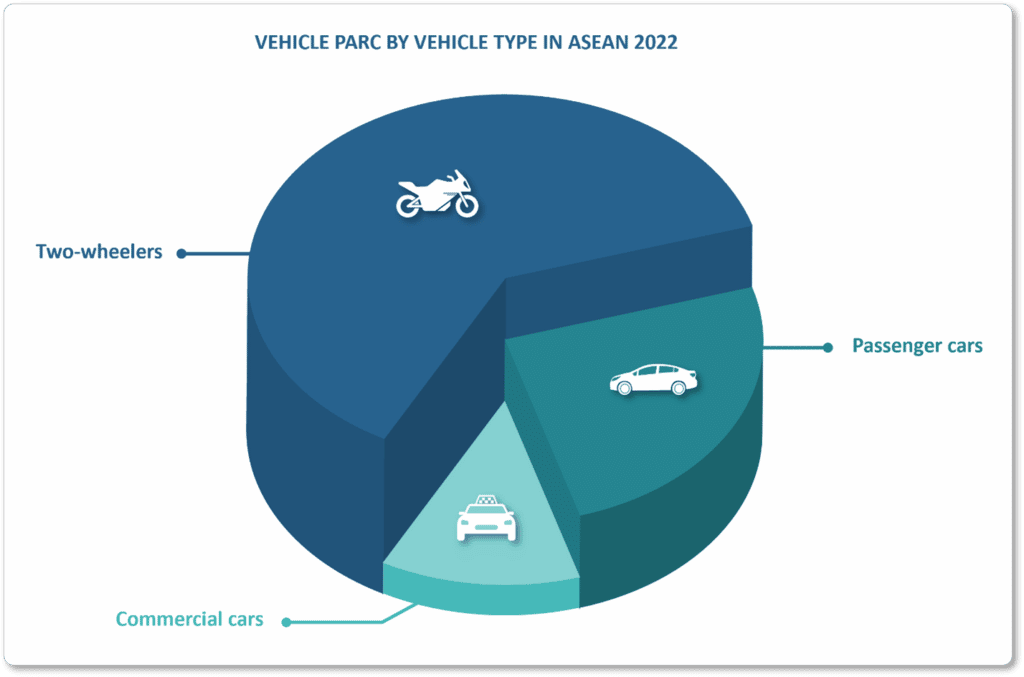

ASEAN’s automotive parc is predominantly a two-wheeler market. According to Dutta, two-wheelers’ popularity can be attributed to their low ownership cost, easy maneuverability in traffic, and the ability to generate secondary/primary income for delivery service and bike taxi riders. These vehicles have the highest share in all the countries except Malaysia and Singapore. And while those two countries have a high share of passenger cars in their vehicle parcs, it is Thailand that has the largest car parc.

The trend of vehicle electrification is catching on in ASEAN, as some developments have been seen in a few countries. Indonesia’s Energy Minister revealed in 2021 that all two-wheelers sold after 2040 and passenger vehicles sold after 2050 would be electric-powered. Thailand’s government, in March 2022, announced its goal to have over one million EVs on roads by 2025 after the approval of 24 new EV projects in December 2021. Thailand further has targets to increase this number to 15 million EVs within the next 10 years. Meanwhile, Singapore has also set ambitious targets for 2040 to phase out internal combustion engine (ICE) vehicles, paving the way for greater adoption of electric vehicles (EVs) in the intervening years.

“Growth in EVs will have a detrimental impact on the overall automotive lubricant demand because, unlike an ICE vehicle, an EV does not require engine oil, a product with the largest share in the automotive lubricants market,” says Dutta. “This negative impact will be more visible in the second half of the forecast period and to a lesser extent in the next five years to 2027.”

The pace of penetration of EVs rests on a vehicle’s range, a broader supply of electric models, the development of a reliable charging infrastructure, and the availability of incentives to make these vehicles affordable. Especially electrification of two-wheelers will be faster than passenger cars in ASEAN, and Vietnam and Indonesia could lead this trend.

“This is because two-wheelers have smaller batteries that can be charged faster than those used in cars,” Dutta explains. “Battery charging downtime is not a major issue for non-business-use two-wheelers, as manufacturers have started offering vehicles that can go up to 100 km per single charge and have double batteries. However, cars that offer high battery range are awfully expensive and hence not affordable by the masses.”

How important is ASEAN’s lubricants market?

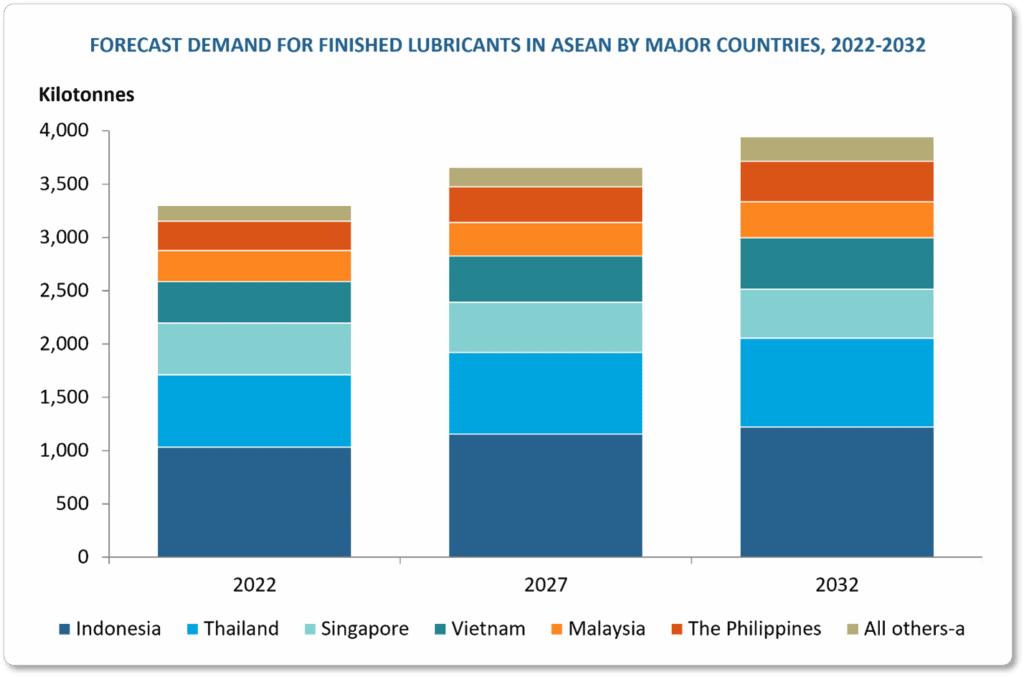

ASEAN, with about 9% of the global finished lubricants market, is a significant contributor to the global market, which ranges between 38 and 40 million tonnes in 2022. Kline’s report, Opportunities in Lubricants: ASEAN Market Analysis, covers lubricants markets of nine major countries in the region: Cambodia, Indonesia, Laos, Malaysia, Myanmar, Singapore, Thailand, the Philippines, and Vietnam.

Indonesia has the largest lubricants market because of its large vehicle parc and a well-developed industrial sector. The country is the most populated nation in the ASEAN region, which has made it the largest automotive market in the region. Indonesia also represents the second-largest two-wheeler lubricants market in the world and the largest in the ASEAN region.

“Thailand follows Indonesia in the lubricants market,” Dutta says. “Despite recovery in lubricants demand in 2021, these two countries’ markets did not recover to 2019 per-pandemic demand levels. Their markets are expected to cross the 2019 pre-pandemic levels by the end of 2022.”

Singapore is another country generating high volumes of lubricant demand. Its market is highly skewed toward the industrial segment due to high demand for marine lubricants, coming from the international maritime sector.

“Malaysia is one of the most advanced economies among the ASEAN and is an upper middle-income country,” says Dutta. “The rise in inflation and supply chain issues created due to the Russia-Ukraine conflict is significantly affecting the economy. The country’s lubricants demand by the end of 2022 is expected to be close to pre-pandemic demand reported in 2019 (but slightly lower). A similar trend has been witnessed in the Philippines, which is expected to be the fastest-growing economy in ASEAN over the next five years.”

Vietnam, unlike its neighbors, will have a full recovery in its lubricants market, with demand in 2022 expected to exceed the pre-pandemic demand of 2019.

Myanmar’s aforementioned woes mean that lubricants demand remains significantly below pre-pandemic levels, despite some growth in 2022, because the country saw two successive years of demand decline.

“The lubricants market of Cambodia, though a small market, is the fastest-growing in the region,” says Dutta. “Interestingly, its automotive lubricants market is larger than that of Singapore’s.”

What is the market’s outlook?

Overall lubricants demand in the nine major countries in ASEAN is expected to grow at a moderate compound annual growth rate (CAGR) of 1.8% from 2022 to 2032. While this growth rate appears low, upon comparing it with developed economies of Europe, North America, and China, where lubricant demand will either shrink or grow marginally, this rate becomes quite significant.

Cambodia and Laos will have growth rates higher than other countries over the forecast period due to the small base on which the demand will grow. However, Indonesia and Thailand will add the most significant volumes to the overall demand by 2032. Singapore is the only country that will witness its lubricant market contract over the next 10 years.

“The region’s lubricants market growth will be supported by growing industrialization and urbanization in the key ASEAN countries, especially as they continue to recover and try to exceed pre-pandemic levels of lubricant consumption,” says Dutta. “Along with this growth, a shift toward high-quality lubricants, especially in the automotive space, will be seen, and that will function as an opposing force. An increasing quality consciousness among customers, plus OEMs’ recommendations of genuine oils as well as low-viscosity oils, are pushing the use of synthetic lubricants, which is leading to extension oil drain intervals.”

Developments in e-commerce, home delivery of food and other consumer products, and bike taxis are driving two-wheelers sales and causing an increase in demand for their lubricants. However, a slowdown in this demand surge will be witnessed in the countries embracing EVs in the second half of the forecast period.

Commercial automotive lubricants demand growth will be driven by construction activities for infrastructure development, the revival of public transportation, and demand for logistical services (including those for e-commerce). The setting of manufacturing plants, especially automotive; expansion of power generation capacities; and development of transportation infrastructure will power the growth of industrial segment’s lubricants demand.

For more information on this subject, be on the lookout for Kline’s Opportunities in Lubricants: ASEAN Market Analysis. The report provides an in-depth analysis of all key market segments with a special focus on how key market trends, opportunities, and challenges have changed after the outbreak of the pandemic; it is scheduled for publication this month.