Max Marioni

Project Lead, Energy

Explore how lubricant marketers can navigate Europe’s fragmented landscape, uncovering high-value opportunities amid regulatory shifts, electrification, and industrial transformation.

Europe is a mature lubricant market, shaped by stringent regulations and a sustainability focus.

- Growth potential in volumes is limited, but value growth increasingly outpaces volume as the mix tilts toward synthetics, lower-viscosity grades, and premium specialty fluids.

- Opportunities can be found in sectoral and local niches rather than at the broader level.

- Regulatory frameworks, and particularly EU policy, loom large, with EV mandates, emission standards, and sustainability targets all factors influencing demand. Geopolitical instability and high prices act as brakes but also as shapers.

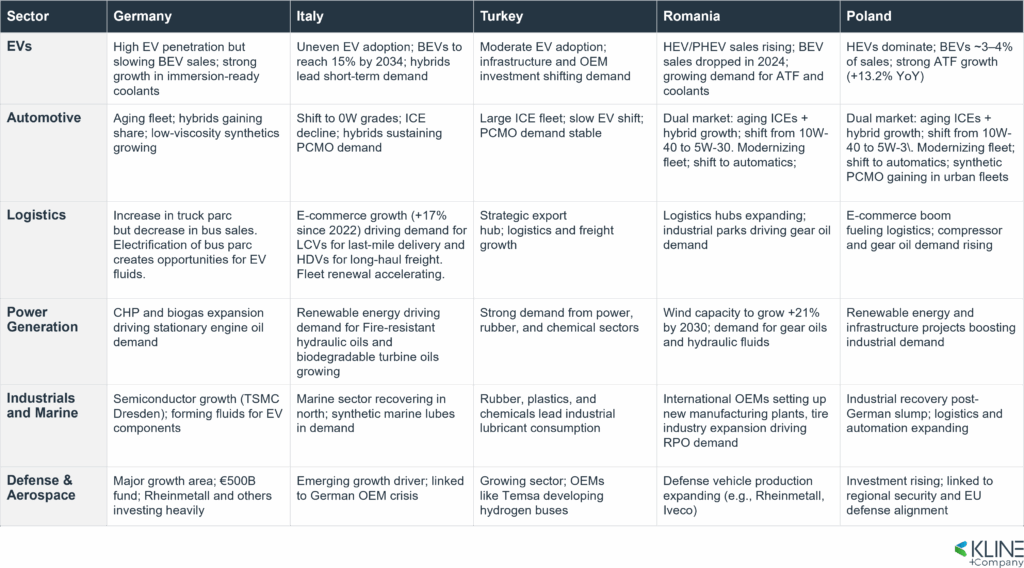

Country Market Differences Present Unique Opportunities and Challenges

It is a market of markets, consisting of individual country markets moving in broadly the same direction but at different speeds, and often tugged sideways by competing forces.

While total lubricant demand in Turkey is poised to power ahead by 5% by 2034, with uniform growth across all segments, Germany is flatlining, with a decline in the industrial and consumer segments. Turkey also shows the highest EV growth rates, while EV sales in Italy and Germany are falling.

The outlook for industrial lubricants, particularly rubber process oils (RPOs), is significantly stronger in Poland and Romania than in Western European countries like Germany and Italy.

Marketers need to understand how to navigate these asymmetries in order to thrive on the European finished lubricant market. Kline’s Global Lubricant Series 2025 has probed deep into several country markets, from the largest (Germany, Turkey, and Italy) to the emerging (Poland and Romania). Together, they paint a complex and comprehensive picture of the European lubricant market situation today.

The Impact of Electrification

Europe as a whole remains at the forefront of the electric transition. However, electrification has changed gears since the 2020-2021 boom in EV sales, with sales of battery electric vehicles (BEVs) slowing down to a statelier rhythm.

Consumers are shifting to hybrids, seen as a more affordable and reliable choice, with its familiar backup engine screening it from the vagaries of range anxiety. While passenger car motor oil (PCMO) consumption volumes are the primary casualty of the electric revolution, the resulting volumetric decrease is now taking the form of a gentle decline rather than a steep clifftop plunge.

The increasing popularity of hybrid cars is fueling demand for specialized lubricants that are compatible with hybrid powertrains. Forecast consumption of specialty fluids and greases for battery thermal management and transmission systems is expected to soar, making up for some of the lost ground. In value terms, the picture is rosier, as lithium greases and the 0W PCMO viscosity grades that new hybrid models require are made from fully synthetic basestocks which command high price premiums, and synthetic penetration is only set to grow.

Alternative Fuels make Inroads

Beyond electrification, other alternative fuels are increasingly playing their part in powering the continent. Hydrogen power solutions are in early-stage deployment, with Turkey developing its first hydrogen-fueled intercity bus and Germany investing in hydrogen mobility infrastructure. Biodiesel is widely used in Italy and Germany, especially in agricultural and municipal fleets, supporting demand for compatible HDMO and gear oils.

Propane and LPG occupy a more obscure niche in the European energy ecosystem, but they make an appearance, above all in urban fleets and public transport in Italy and Poland, often as part of dual-fuel systems.

Sustainability Creates Niche Markets for Specialty Fluids

Sustainability is still the watchword of the day, despite the blowback on the other side of the Atlantic. Across the continent, industry interest in sustainability remains strong. Bio-lubricants, including both bio-based and biodegradable lubricants, are gaining traction throughout Europe, especially in sectors like power generation, industrial manufacturing, marine, food processing, forestry, and rail, driven by EU regulations and export requirements.

Re-refined base oils and regenerated lubricants are emerging as viable options, supporting EU-mandated circular economy goals. Wind, hydro, and solar energy expansion is driving demand for synthetic gear oils and biodegradable turbine lubricants, in both the continent’s core (Germany) and its periphery (Poland, Turkey).

Strict Emission Norms Strengthen Synthetics Demand

Ever more stringent emission norms, implemented across the continent through the Euro standards, are pushing original equipment manufacturers (OEMs) towards ever lower viscosity grades which enable greater fuel economy and extend oil drain intervals.

The upcoming Euro 7 standards, already applicable on passenger cars since July 2025 and to be implemented for heavy-duty vehicles from July 2027, impose stricter limits on NOx, particulates, and real-world emissions. These are nudging the industry further towards synthetic formulations for premium low-viscosity engine oils such as SAE 0W-20 and 0W-16, used for factory fill and recommended for service fill.

Country Spotlight

But Europe does not tell a uniform story, and its cast of constituent countries follow different arcs. Country markets move at diverse speeds, and different countries display different dynamics, with their own challenges and opportunities.

Germany faces a structural makeover as auto woes deepen, EV growth cools, and industrial investment is reoriented towards defense.

Germany has long been the main engine for the European economy and its chief trendsetter, in finished lubricants as much as any other sector, but the engine came to a sputtering halt in 2023, when its automotive industry entered a prolonged crisis prompted by high energy costs and plummeting business and consumer confidence.

EV adoption in the country remains high, but momentum has slowed due to the withdrawal of government subsidies in December 2024, in a climate of high inflation. BEV sales dropped by a quarter between 2024 and 2023, while hybrids (HEVs and PHEVs) gained share. Coolant demand for BEVs is expected to grow by double digits, and suppliers like bp, FUCHS, and Liqui Moly are launching non-conductive, immersion-ready coolants for EVs.

Investment into defense and aerospace is growing across the continents, and Germany is poised to take a leadership role in the re-armament of Europe thanks to its industrial manufacturing base, still strong despite the weakness in the automotive sector.

Companies such as Rheinmetall are undertaking significant investment in this sector, underscored by government support, and some automotive supply chain manufacturers are pivoting to the sector. The Federal government has established a special fund of EUR 500 billion for the development of defense capabilities, which includes correlated provisions for transport and civic infrastructure, power grid modernization, and a housing program, all of which should boost demand for commercial and industrial lubricants.

Germany’s industrial diversification, from semiconductors and power generation to defense, continues to shape lubricant demand, offsetting declines in metalworking fluids with growth in stationary engine oils and forming fluids.

Italy’s lubricants market navigates uneven EV uptake and sectoral shifts amid industrial and energy pressures

EV adoption in the country is uneven, with stronger growth in northern urban centers thanks to the establishment of low-emission zones, and slower uptake in the south. BEVs are expected to reach 15% of the passenger vehicle parc by 2034, with hybrids leading the transition in the short term.

The impact of the German automotive manufacturing crisis, which snowballed across tier 1 and 2 parts suppliers based in Northern Italy, and high energy costs are dampening lubricant demand in traditional sectors, but defense, aerospace, and renewable energy are emerging as growth drivers.

The Industrial and marine sectors have partly recovered, especially in northern regions. Industrial lubricants are projected to grow in value due to rising synthetic penetration, particularly in areas such as fire-resistant synthetic hydraulic oils for industrial manufacturing and biodegradable turbine oils, even as volume stagnates.

Turkey emerges as a strategic growth hub for lubricants with expanding industry and EV parc

Turkey’s strategic position, coupled with a large vehicle parc and expanding industrial base, positions it as a crucial market for lubricant suppliers targeting Europe, the Middle East, and Central Asia.

The power generation, rubber, plastics, and chemicals sectors lead in industrial lubricant consumption, serving as the primary demand drivers and key competitive areas for suppliers seeking growth.

Although EV adoption is moderate, infrastructure expansion and OEM investments are gradually shifting lubricant demand patterns across passenger cars and two-wheelers, influencing volume demand and product mix in the long-term scope.

Romania’s lubricants market balances aging vehicle parc with hybrid growth and manufacturing resurgence

The country’s vehicle parc growth continues to grow at a steady rate, but over a third of cars are over 20 years old. EU infrastructure funds play a significant role in accelerating parc modernization, with increasing sales of HEVs and PHEVs. These contrasting dynamics create a dual market, with aging ICE vehicles and rising hybrid adoption. Many motorists are upgrading from 10W-40 viscosity oils to mid-tier synthetic PCMO such as SAE 5W-30.

Industrial lubricant demand is rising due to the construction of new manufacturing plants, and an expansion in the tire industry which is powering rubber process oil demand. Romania is investing in renewable energy infrastructure, including wind turbines, which is driving demand in turn for synthetic industrial gear oils as well as hydraulic fluids. The country targets a 21% wind capacity increase by 2030.

Poland’s lubricants market accelerates with transmission fluid growth, logistics demand, and industrial recovery

The vehicle parc is modernizing here as well, with motorists shifting to cars equipped with automatic transmission, fueling a boom in automatic transmission fluid. Thriving logistics and freight transportation (and particularly the ongoing boom in e-Commerce) are creating a boost in consumption of commercial lubricants.

The industrial lubricant sector is recovering after being affected by the German automotive slump, and investment in defense and aerospace is rising. Synthetic penetration is growing across all segments, with urban fleets and OEM mandates accelerating the shift.

Europe’s lubricant market is stagnant in volume but fractured into a patchwork of national stories, where the real growth lies not in bulk sales but in high-value synthetics, specialty fluids, and the niches carved out by uneven policies, industries, and electrification rates.

Regulatory policy and sustainability are key drivers. EVs reshaping demand as BEV growth steadies, and hybrids gain ground, but not at the same rate in every country. Oil drains are lengthening, and demand is tilting toward lower-viscosity oils, EV specialty fluids, and synthetic industrial lubricants.

While some industrial end-uses fade away, others rise in their place. Marketers need to navigate this uneven terrain with confidence.

Ready to master complexity and lead through disruption?

Watch our on-demand webinar, “Think Global, Act Local: Lubricant Marketing in a Post-Certainty World,” and discover how the Global Lubricant Series can help you build locally attuned, globally impactful strategies.