Anuj Kumar Singh

Senior Project Manager, Energy

Anuj Kumar, Senior Project Manager at Kline, explores how re–refined lubricants, while a currently a small segment of the finished lubricant market, has immense potential.

A Hidden Sustainability Challenge

Behind the sleek efficiency of cars, trucks, and machines lies a quiet environmental challenge: used oil. Every litre of lubricant poured into an engine or machine will one day reach the end of its service life. Once degraded, contaminated, or burnt off, this oil becomes a potential pollutant if not responsibly managed. What happens next, whether it is discarded, burnt as low-grade fuel, or transformed through re-refining into valuable base oils, defines the sustainability story of the global lubricants industry.

Today, as the world intensifies its focus on circular economy models and carbon reduction, the way industries handle used oil is gaining unprecedented importance. For a deeper look at how sustainability trends are reshaping used‑oil management globally, see Kline’s Sustainability, Used Oil and Re‑Refined Basestocks study.

Why Recycling Matters

Improper disposal of used oil poses serious environmental risks. Just one litre can contaminate millions of litres of water, harm aquatic life, and degrade soil fertility. Beyond protecting the environment, recycling and re-refining used oil delivers strong economic and resource benefits, reducing reliance on crude, conserving energy, and turning waste into value.

These combined advantages have transformed how the industry views used oil, making re-refining a vital part of the circular economy. With advances in technology and growing regulatory support, this once-overlooked segment has emerged as a dynamic and sustainable business opportunity.

- Circular economy: Viewing used oil as a resource rather than waste closes the loop, reducing dependency on virgin crude oil.

- Environmental benefits: The more used oil is recycled, the less damage is caused to the environment.

- Energy efficiency: Re-refining consumes less energy compared to refining base oils from crude.

- Local economic growth: Collection and re-refining industries create jobs, reduce reliance on imported oil, and strengthen energy security.

The Used Oil Value Chain

The journey of used oil involves three crucial stages: generation (upstream), collection (midstream), and disposal (downstream). At each stage, sustainability is either enabled or compromised. The success of any used oil re-refining industry is contingent upon each of these stages and how well they are integrated with each other.

- Generation of used oil is directly correlated with finished lubricant consumption. The higher the quality of lubricants used, the better the quality of the resulting used oil, which enhances the efficiency and yield of re-refining processes, enabling the production of higher-quality base oils.

- Collection remains the single biggest bottleneck in the used-oil value chain. Effective collection and storage practices are essential to preserving used-oil quality, which directly influences the production of high-quality re-refined base oils. Markets with a more developed re-refining landscape typically feature a strong midstream segment, supported by robust infrastructure that ensures quality assurance, traceability, and proper segregation of feedstock. In contrast, less-evolved markets often struggle with fragmented collection systems, leading to contamination and adulteration, which ultimately result in lower-quality re-refined base oils (RRBOs).

- Disposal pathways for used oil vary widely, from burning as heavy fuel to processing in refinery crackers or re-refining into base oils. These choices are often shaped by regulatory frameworks, or lack thereof, that either mandate specific disposal methods or offer incentives promoting environmentally preferred options such as recycling and re-refining.

Re-refining technologies such as filtration, thin-film evaporation, solvent extraction, and hydrotreating determine the quality of the final output. Advances in solvent extraction and hydrotreating have enabled production of RRBOs that now rival, and sometimes exceed, virgin base oils in quality. In mature markets, Group II RRBOs are the norm, with some plants producing Group III grades, while less-developed markets still rely on basic processes yielding VGO or low-end Group I base stocks.

Global Landscape: A Patchwork of Progress

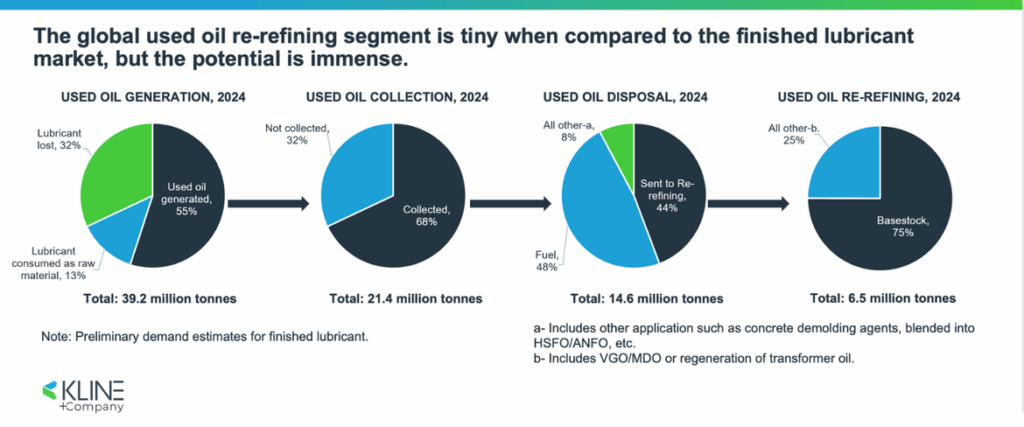

Despite its potential, the re-refining industry remains a fraction of the global lubricants market. In 2024, an estimated 39.2 million tonnes of finished lubricant were consumed resulting in used oil generation of around 21.5 million tonnes, but only 6.5 million tonnes ended up re-refined into base oils

The progress of re-refining varies widely across the world and depends on a combination of regulatory, economic, and market-driven factors. Kline’s proprietary RRBO Scorecard evaluates markets across multiple dimensions, including regulatory strength and enforcement, used-oil quality, collection efficiency, RRBO acceptance, market gap, and re-refining capacity and potential supply. This benchmarking framework provides a comprehensive view of each market’s current maturity and future growth potential.

The analysis covers key regions such as the United States, Canada, the United Kingdom, France, Germany, Italy, Iberia, China, Japan, and India, revealing distinct contrasts as well as underlying similarities among them. Based on the findings, markets can be broadly grouped into three categories, reflecting different stages of re-refining evolution and opportunity. Based on this the markets can be classified into three key buckets:

- Leaders: Germany and Italy showcase some of the highest re-refining rates. In fact, Germany even imports used oil to feed its re-refining capacity while the United States leads in the production and supply of high-quality RRBOs.

- Laggards: India, despite possessing a substantial pool of used oil and a broad refining base, continues to face challenges related to collection quality and technological sophistication. Japan, although generating high-quality used oil, has an almost non-existent re-refining sector.

- Middle ground: China possesses substantial re-refining capacity; however, only a limited number of facilities utilize advanced technologies capable of producing high-quality RRBOs. France, meanwhile, benefits from a strong pool of high-quality feedstock but has relatively limited capacity dedicated to manufacturing premium-grade base oils.

While there is no universal blueprint for a successful re-refining ecosystem, certain common success factors emerge from leading markets. Efficient used-oil collection and the consistent availability or security of high-quality feedstock are defining hallmarks of markets positioned at the upper end of the re-refining spectrum. In contrast, markets that lag behind, such as India, continue to face challenges related to used-oil quality and collection efficiency, although recent regulatory initiatives are beginning to address these gaps.

Extended Producer Responsibility (EPR): A Policy Turning Point

Across the world, Extended Producer Responsibility (EPR) policies are transforming used-oil management. The core principle is straightforward: lubricant producers and marketers remain responsible for their products even after use. Unlike traditional policy tools that address a single stage of the chain, EPR integrates environmental accountability across the entire product life cycle.

Governments, producers, marketers, consumers, and independent collectors all share responsibility for ensuring proper collection and recycling. While governments set the framework, producers typically implement EPR schemes, and collectors play a vital role in channelling used oil to re-refiners, closing the loop of the lubricant economy.

Producers and marketers carry the greatest responsibility to develop efficient, sustainable systems for used-oil recovery. Although progress varies globally, EPR compliance is fast emerging as both a strategic and environmental imperative.

Formal EPR schemes come with administrative costs and typically redistribute funds from lubricant marketers, and ultimately consumers, to collectors and processors. Fees are usually applied to lubricants with regeneration potential, excluding those fully consumed during use or difficult to recover, such as greases.

EPR models differ by design. Some charge per-litre fees, others impose RRBO content quotas, but their shared goal remains clear: to promote collection and regeneration while discouraging disposal and energy recovery. For a clear breakdown of how different EPR schemes incentivize collection and regeneration, read Kline’s article on EPR in the used‑oil chain.

Quality Matters: Building Trust in RRBO

One of the biggest challenges for re-refined lubricants has long been the perception of quality. However, RRBOs have made remarkable progress, moving steadily into the mainstream lubricant market. Advances in re-refining technologies have significantly improved product quality, narrowing both the performance and price gap with virgin base oils.

This transition is increasingly visible. With digitized collection systems, rigorous testing protocols, and state-of-the-art refining processes, re-refined oils are now approaching parity with virgin oils. Leading lubricant companies are incorporating RRBOs into their blends, lending strong validation to the segment. Many are also becoming active participants in the used-oil value chain, through partnerships, acquisitions, or long-term offtake agreements with re-refiners. These collaborations are mutually reinforcing. Lubricant marketers enhance their sustainability credentials, while RRBO producers gain market legitimacy and commercial scale.

Barriers and Challenges Ahead

Despite the promise, the re-refining sector faces persistent challenges:

- Collection bottlenecks: unstructured systems in developing markets.

- Technology access: capital-intensive advanced re-refining methods remain out of reach for smaller players.

- Scale: most re-refineries are small and scattered; scaling up increases logistics costs.

- Awareness and perception: end-users often remain sceptical of RRBO quality.

Addressing these requires collaboration, between governments setting policy, companies investing in technology, collectors ensuring quality segregation, and consumers demanding sustainable lubricants.

Anuj Kumar Singh

Closing the Loop

The story of used oil and re-refined lubricants is one of transformation—from waste to worth, from pollutant to product. By embracing sustainability principles and circular economy thinking, the industry can turn a looming liability into an asset.

The path forward requires overcoming challenges of collection, quality, and perception. But the rewards, such as reduced emissions, conserved resources, and stronger energy security, make the effort worthwhile.

In an era where sustainability defines competitiveness, re-refined lubricants may well emerge as the backbone of a greener, more circular lubricants industry.

To understand where opportunities and bottlenecks are shifting next, watch Kline’s Year‑in‑Review session that looks ahead to 2026 and beyond.