Wind turbine lubricants play a critical role in wind turbine operation, maintenance, and reliability. In a wind turbine, there are several lubrication points, including gear box, open gear, pitch gear, pitch bearing, rotor shaft, yaw bearing, yaw gear, hydraulic systems, and generator bearings, that require various lubricants.

Factors Driving Growth

The most significant lubricant demand driver is growth in wind power capacity. Although the growth rate was lower in 2017 than in previous years, according to Global Wind Energy Council, it is still much faster than global industrial lubricant demand growth or lubricant demand growth in other end-use industries. Several regions, including Europe, India, and the offshore sector, are having record years in terms of new installments. Factors that could hinder capacity growth include grid connectivity issues, the availability of land for onshore installations, and the withdrawal of government support. However, according to Global Wind Energy Council (GWEC), wind energy is now operating in more and more markets on a purely commercial basis, moving away from the support schemes of the old.

A properly formulated gear oil increases the reliability of the gear box unit and prevents failure. Therefore, usage of gear oils made from high quality synthetic baseoils is well established in the wind power sector. Gear oil, which accounts for 70% of lubricant consumption, is the most important lubricant category. Synthetic lubricants that are being used in the wind power industry are full synthetics, typically polyalphaolefin-based products. Synthetic lubricants are estimated to account for more than 80% of total lubricant consumption by the industry.

Wind turbine lubricant demand volume is a function of a variety of factors like new installations, operating capacity, oil change frequency, and penetration of direct drives. There are also limitations, such as extension of oil drain intervals will result in lower lubricant usage. Moreover, the penetration of direct drives dampens lubricant demand as direct drive installations do not need gear oils.

Factors Restraining Growth

As gear box failure can result in huge downtime costs for wind farm operators, gearless technology, also known as direct drive, has been developed. The technology eliminates gear boxes and problems associated with its failure. However, in the near term, the potential for increasing the share of direct drive is quite small because not all OEMs offer this technology. This technology is more expensive as it requires usage of exotic materials to make permanent magnets, which increases the cost of installations. For higher MW capacity turbines, the use of direct drive technology is not preferred because of high capital costs. In addition, gear box manufacturers have improved equipment reliability and the number of failures has reduced significantly.

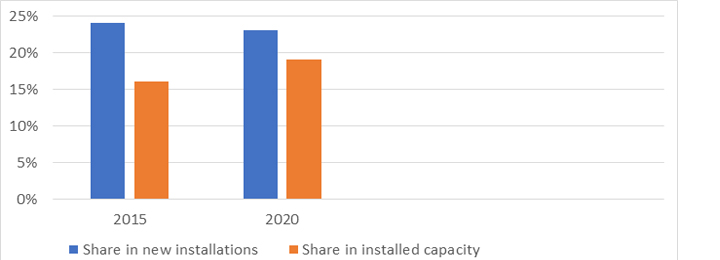

Penetration of Direct Drive, 2015 to 2020

While a shift towards deploying direct drive wind turbines is expected, gear boxes remain the dominant technology. Direct drive offers lower maintenance and is easier to install, contributing to their increased usage in off-shore wind farms. Direct drive is estimated to reach only 25-30% of the total market volume by 2022.

Conclusion and Opportunities

In conclusion, wind power is a high growth industry, and its lubrication needs are expected to trend in a similar fashion. The industry will drive demand for high performance lubricants, and suppliers willing to offer product customization and aftersales services will have higher growth prospects. This fast growth, risk-averse industry will remain attractive for suppliers of synthetic lubricants as wind turbine lubricants have a high penetration of synthetics as compared to other industries.