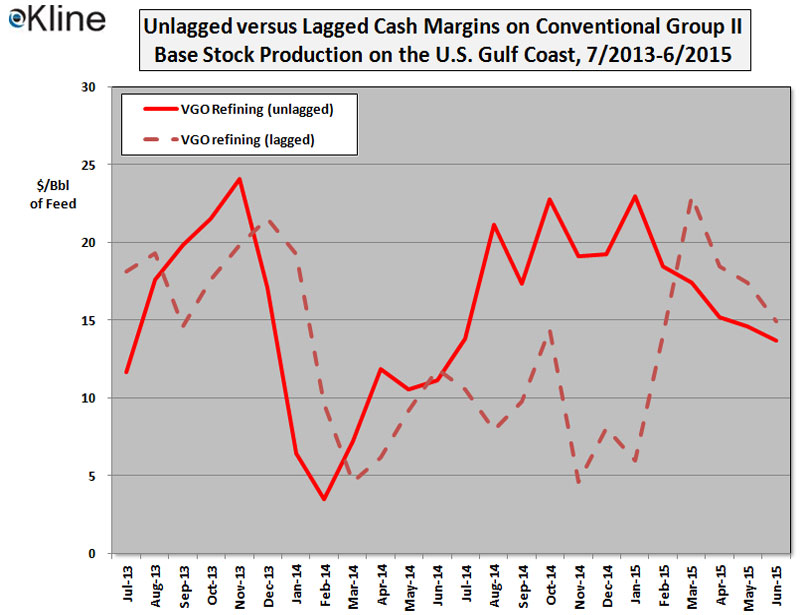

In January 2014, Kline, a worldwide consulting and research firm serving needs of organizations in the lubricants and base stocks industry, introduced its monthly Base Stock Margin Index, a characterization of recent cash margin contributions in the U.S. base oil market over the past 24 months.

The Index estimates cash margin contributions associated with U.S. Group II base stock production. It simulates EBITDA before the deduction of corporate SG&A expenses for typical VGO-based virgin base stock plants and RFO-based re-refineries.

“While feedstock prices for conventional refiners and re-refiners were unchanged or increased modestly during June, the month began with a 10 cents/gallon drop in Motiva’s low viscosity (100/110N) Group II posting. These two effects combined to produce a slight decrease in cash margins from May” noted Ian Moncrieff, Vice President of Kline’s Energy Practice. “Concurrent with the price reduction in the 100N grade, the 600N posting was raised by 18 cents/gallon, but it was not enough to lift overall margins for Group II producers. Overall, as Brent remained in the $60-65 per barrel range from late April through end-June, postings were expected to remain relatively stable. Looking to July, however, the drop of some $5/Bbl in crude oil prices from earlier this month is likely to make it more difficult for base oil producers to hold the line on pricing.”

“While all base oil refiners besides Motiva held the light grades steady, supply-demand pressures allowed those refiners with high-viscosity production to increase postings. The USGC Group I vs. Group II dynamic continues to be anomalous, as low viscosity Group II postings are now 5% lower than light Group I grades, while heavy grade Group II postings command only a nominal premium over similar Group I viscosity grades.”

For more information on the Kline Index, or to inquire about our pricing and margin analysis services to the base stocks industry, please contact Ian Moncrieff, Vice President (Ian.Moncrieff@klinegroup.com) at (973)-615-3680 in Kline’s Energy Practice.