M&A/Due Diligence

Our Practice

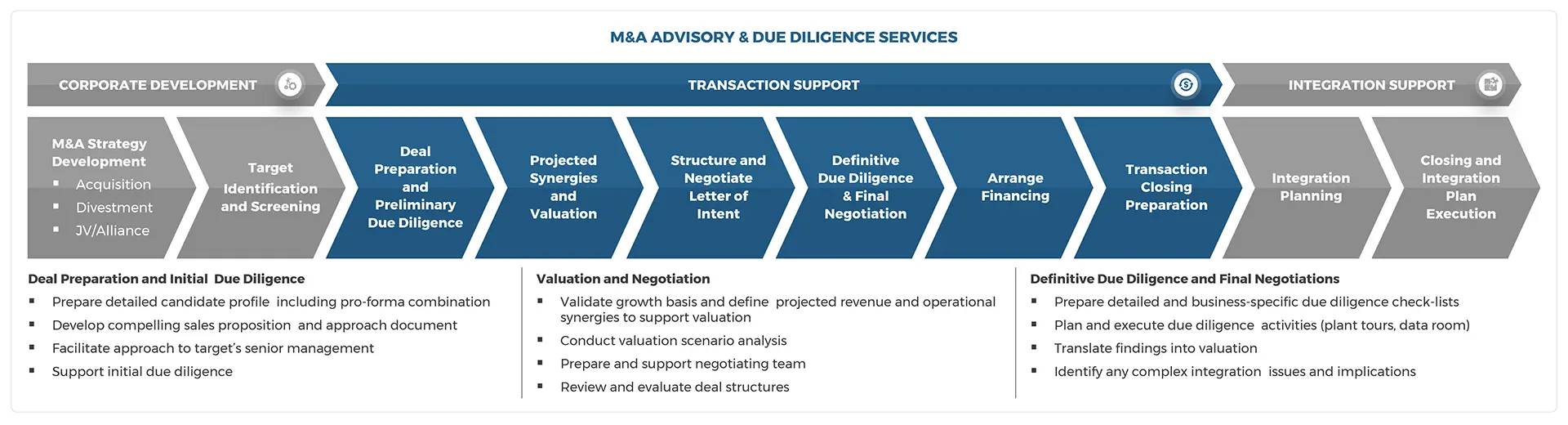

Kline offers a comprehensive range of M&A services from candidate screening to due diligence. In our core industry sectors of specialty chemicals, lubricants and petroleum specialties, and professional beauty, Kline is the preferred advisor and due diligence partner due to this foundational expertise and supporting databases. Much of our advisory support work entails pipeline building and candidate vetting projects. We can efficiently build and screen target lists – working from our competitive databases. For commercial due diligence, Kline provides the deep industry expertise necessary to deliver objective and fact-based assessment of business health and financial forecasts. Our process includes:

- Investment thesis assessment: vet/ challenge client’s approach and supporting rationale for value creation

- Industry and competitive analysis: evaluate industry/ category growth dynamics, attractiveness, and competitive situation

- Target company evaluation: understand and evaluate details regarding the organizations, sales performance, and customers

- Business plan assessment: review the business plan to assess credibility and feasibility and develop revenue forecasts based on alternate growth scenarios

- Strategic recommendation: provide overall recommendation and suggest other opportunities to add value and realize cost savings

Our Experience

Examples of our M&A consulting assignments are provided below organized by industry. Please contact us to learn more about our project work and capabilities.

Chemicals

- Specialty chemicals and lubricant additives: due diligence on a leading independent manufacturer of specialty chemicals and lubricant additives (for private equity client)

- Personal care ingredients: commercial due diligence (private equity)

- Specialty chemicals: green technology acquisition program (for leading chemical company)

- Specialty compounder: due diligence program on target, a specialty compounder of material for medical, wire, and cable markets (for global thermoplastics supplier)

- Antimicrobial products: commercial due diligence (for private equity client)

- Ethylene oxide sterilization: assess health of end-use markets as part of M&A and strategic planning support (for medical technology company)

- EPDM: commercial due diligence on leading supplier of EPDM elastomers (for private equity client)

- Methacrylates: commercial due diligence including assessment of target’s cost competitiveness, margin sustainability (for leading global chemical company)

- Catalysts: due diligence to support potential investment in two alternative companies (for private equity client)

- PVC compounding: commercial due diligence (for private equity client)

Energy

- Metalworking fluids: candidate screening (China, India); for leading European lubricant company

- Lubricants: fulfilled the market information requirements for IPO preparation (for independently owned provider of lubricant and oil related products based in SE Asia)

- Marine diesel fuel: commercial due diligence (for industry client)

- Industrial greases: M&A scouting in Western Europe (for industry client)

- Specialty petroleum products: commercial due diligence on target including base oils, other products (for private equity client)

- Base oils: assessment of used oil sourcing options for a target’s planned base oil re-refinery (for private equity client)

- Lubricants: retainer, global lubricants, due diligence (industry client)

- Lubricants: screen and vet acquisition targets lubricants and metalworking fluids formulators chain (industry client)

- Lubricants: M&A screen, vet, and contact – independent lubricant manufacturers in U.S. market (industry client)

- Lubricants: US and Mexico lubricants distributor screening (industry client)

Consumer

- Salon hair care brands: commercial due diligence (for private equity acquirer)

- Professional hair company: commercial due diligence (for leading CPG company)

- Professional makeup business: commercial due diligence for private equity acquirer (including VOC research)

- Beauty brands: profile and vet indie brand targets (leading global beauty company)

- Consumer health & wellness: identify, vet, and qualify BD opportunities in vitamins, minerals, and supplements (for mid-sized health and wellness company)

- Skin health/dermatology: BD opportunity screening in dermatology (for leading pharma/ consumer health care company)

- Professional skin care: commercial due diligence (for leading CPG company)

- Prestige skin care: commercial due diligence (for leading CPG company)

- Consumer health & wellness: identify and vet “seedling” opportunities in China (for leading CPG company)

- Nutraceuticals: identify, vet, and qualify (i.e., availability) BD opportunities in anti-aging supplements in Asia (for leading health & wellness company)