Besides Asia, Africa and the Middle East were the only regions which did not stop growing during the recession. Although their economic growth rates did slow down by 2009, they have since started to pick up again. Despite the fact that AME will not see growth rates commensurate to those of the rapidly expanding markets in Asia, going forward the region is expected to show positive growth. Finished lubricant demand in the region is projected to grow close to 2.5% per year and reach about 80 thousand barrels per day by 2019. Growth rates for the Middle East are estimated slightly higher at 2.7-3.0%, as contrasted with a 1.8-2.0% growth expected in Africa.

The fundamental growth drivers for lubricant demand in the region are a growing population, growing disposable income and an expanding car, bus and truck population. Furthermore, as the existing car park undergoes modernization a shift is encouraged away from spurious and adulterated lubricant products previously used in the older vehicle models, to mainstream products necessary in their modern replacements.

Overall, the region can be expected to see a gradual migration to higher quality lubricants. The use of mono-grades will continue to decline and be replaced by mid-viscosity grades. In the HDMO category, however, monogrades will still be the most frequently consumed viscosity grade. Due to consumer mind sets that favor more frequent lubricant replacement and due to harsh operating conditions and the local climate, the use of 0W and 5W grades will remain a small market niche.

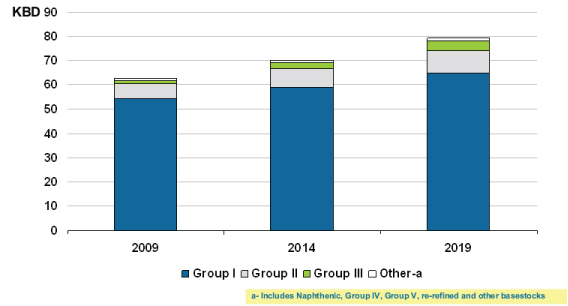

Projected lubricant basestock demand in AME, 2009-2019

Group I basestocks will continue to dominate the market, but their market share will fall from about 87% in 2009 to 82% in 2019. The reason for the relatively small decline is the fact that imports from Europe will likely increase due to Europe’s increasing surplus of Group I basestocks, and the growing export competitiveness of European basestocks due to a depreciating Euro.

Basestock supply in AME is expected to grow at nearly 8% over the next ten years. Almost all of the new supply will be in the form of new Group II and III plants set up in the region, which include the Shell GTL Plant in Qatar. The new capacity addition will change the supply demand balance dramatically. From a 14 KBD deficit in 2009 the region will move to a 20-25 KBD surplus by 2019.

Related articles: