OTC Indies: U.S. Analysis of Independent OTC Companies

Base Year: 2018

Published May 2019

Regional Coverage: United States

With the recent low growth of traditional OTCs, many large market players will seek growth via acquisition of complementary companies and/or brands. This study offers in-depth profiles of approximately 70 independent OTC companies, many of which have recently recorded double-digit sales growth. These companies often outpace market growth by offering unique brands, unique and often natural ingredients, focused distribution, and a strong online presence, frequently combined with compelling digital marketing that resonates with today's OTC consumers. This report identifies these market disruptors and assess the factors that make them resonate with consumers and retailers.

This report helps subscribers to:

- Identify companies or brands that could be acquisition opportunities

- Understand which independent OTC brand innovations have been successful and why

- Assess marketing strategies used by these OTC brands to differentiate themselves

- Cast a wide net analysis to uncover potential licensing or acquisition opportunities

- Gain a source of valuable competitive information and insights

- Learn which product categories these brands are dominant in and where the opportunities lie

- Analyze compelling digital marketing successfully used by smaller companies and brands

Report Contents

Introduction

Executive Summary

- Key market trends and drivers

- Indie companies ranked by sales

- Indie companies ranked by sales growth

- Companies and brands to watch

- Outlook

Company Profiles

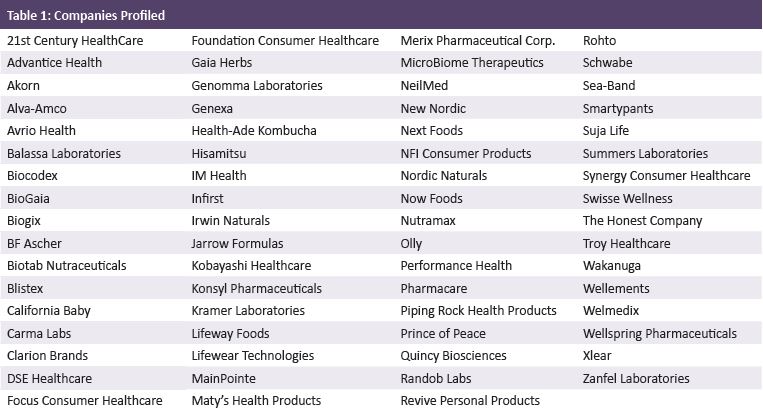

Profiles of approximately 70 OTC companies (see Table 1), with each including the following:

- Company overview

- Corporate sales and profits (or sales estimates if privately held)

- OTC brand portfolio

- Recent new product launches

- Recent developments including acquisitions/divestitures/licensing agreements

- Marketing activity with a focus on digital strategy

- Retail distribution including online, and expansion strategies

- Brand sales for 2017 and 2018 with 2019 estimates

Scope & Benefits

OTC Indies: U.S. Analysis of Independent OTC Companies is an appraisal of about 70 independent OTC companies that have disrupted categories and grown at rates greater than the industry average.

- Geographic scope of the research is the United States

- Includes coverage of major OTC and nutritional supplements categories as shown in Table 2

- Both OTC monograph and natural OTC products are included

- Channel scope includes all consumer outlets where OTCs are sold, including mass merchandisers, drug stores, food and grocery stores, online, warehouse clubs, convenience stores, natural and specialty stores, health food stores, vitamin and supplement stores, discount and dollar stores, and other outlets

This report provides insights and information on the most compelling independent OTC companies and brands that are helping to shape the OTC market. While some of these brands and companies are small in terms of sales volume now, they have resonated with consumers and are poised for growth. This report provides:

- A wide net analysis of independent OTC brands and companies to uncover acquisition opportunities

- Highlights on the brands and concepts that are resonating with today's OTC consumer

- A focus on the role of digital marketing and how it is driving sales growth for indie brands

- Valuable competitive insights and information

- Analysis of the role that retail channels play in reaching OTC consumers

Price Anchor

OTHER NONPRESCRIPTION DRUGS REPORTS