The industrial vegetation management market, as Kline defines it, is broken down into six market segments: rangeland and pastureland, forestry, roadways, railroads, aquatic areas, and electric utilities and pipelines. In each of these segments, herbicides are used to control unwanted vegetation for different purposes. Out of all six market segments, rangeland and pasture is the largest in terms of overall acres and the amount spent on herbicides. Kline conducted a structured interview survey with 300 range and pasture managers in the United States to identify market trends; it included an analysis of pasture weed control as well as invasive weed control in rangelands.

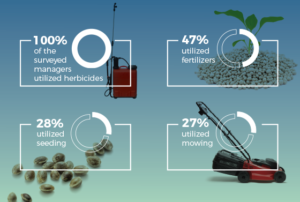

The median pasture acreage of the managers surveyed was 1,280 acres, with 100 acres at the low end and 180,000 acres at the high end. Overall, 100% of the managers utilized herbicides, 47% utilized fertilizers, 28% utilized seeding, and 27% utilized mowing.

The significant amount of information delivered by this survey also includes the most common and important weeds being treated and the difficulties met in doing so.

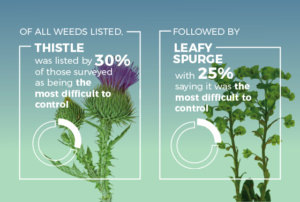

The most important weeds treated by range and pasture managers are thistles. Among the species of thistles treated, the most important are musk thistle, Canada thistle, and star thistle. Other weeds managers reported treating are knapweed, leafy spurge, and cheatgrass. Of all weeds listed, thistle was noted by 30% of those surveyed as being the most difficult to control, followed by leafy spurge, with 25% saying it was the most difficult to control. It is important to note that most of the weeds mentioned as being important or difficult to control are classified by the USDA as invasive/noxious weeds.

In the rangeland and pastureland report, Kline breaks out invasive/noxious weed treatments, showing that they account for more than $50 million in herbicides consumption.

Survey respondents were also asked about the problems and needs in weed control. The potential/perceived issue of glyphosate causing cancer was mentioned by almost one-third of respondents. In addition, some 20% range and pasture managers noted their need for herbicides that provide longer residual weed control, as managers believe they are making additional costly and time–consuming treatments that products with a longer residual would eliminate. The survey also included questions about the need for more selective herbicides, specifically ones that would not kill clover (mentioned by 17% of respondents), were more weather–resistant (17% of respondents), and had reduced wait time for grazing after application (17% of respondents).

Another survey finding showed that pasture and rangeland managers do most of their herbicide application themselves (69%), while a minority (29%) contracted an applicator, and 2% utilized an applicator for some applications while doing some on their own. In general, pasture and range managers made their own decisions on what herbicides to use and when (83%), while 8% relied on the applicator to make the decision, and 9% made joint decisions with the applicator.

Additionally, to determine whether range and pasture acres treated with herbicides were made through ground applications or by air, treatment methods were discussed in the survey. Pasture managers stated that only 6% of their acres were treated by air, while 89% were by ground. In addition, 1% of acres were treated with both methods, and 5% said they only made spot treatments. Range managers said they treat about 25% of their acres by air and 61% by ground. About 10% use both methods, and 4% of their acres are treated by spot treatments.

To determine an outlook, managers were asked whether they expected their herbicide use to increase, decrease, or stay the same over the next two to three years. Some 52% expect their usage to remain consistent, whereas 32% said that they plan to increase their usage; 16% said their usage will decrease. While these results are not unexpected, it is important for herbicide manufacturers and suppliers to understand some of the issues that face the users of range and pasture herbicides.

This study is part of a larger market study covering range and pasture, railroad, aquatic, industrial, and mesquite applications throughout the United States. To gain further and in-depth insights into the Industrial Vegetation Management subscribe to our RECENTLY PUBLISHED Industrial Vegetation Management Market for Pesticides: Country Analysis and Opportunities report.