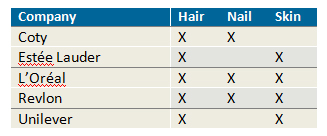

Acquisition activity has greatly altered the landscape of the global professional beauty industry in the past few years. L’Oréal is now the clear leader and only major player to have a leadership role in all three sectors of professional beauty: hair care, skin care, and nail care. The company has long held the #1 spot in the hair sector. With its acquisitions of SkinCeuticals (2005) and Essie (2010), L’Oréal landed a slot among the top 10 in skin care and nail care, respectively. Adding Decléor and Carita to its portfolio in 2014 propelled L’Oréal to the #1 ranking in skin care. The #1 spot is now firmly taken, but rankings beyond that are very much up for grabs.

Coty has also been busy acquiring its way into a leadership role. Adding OPI to its portfolio in 2010 gave Coty the top slot in professional nail care. Once the deal with Procter & Gamble is finalized that will give it ownership of the Wella business, the company will catapult to the #2 position in salon hair care. However, Coty has yet to make a serious foray into the professional skin care sector, which revolves around beauty institutes, spas, and medical care providers (think dermatologists and plastic surgeons).

Unilever has also been eyeing the space. A rapid succession of acquisitions earlier this year gave the company ownership of Dermalogica and Murad, both key players in professional skin care. Until now, things had been relatively quiet for Unilever on the professional beauty front since acquiring the TIGI salon hair care business in 2009. So far, Unilever has not made a move in professional nail care.

Revlon is also a serious contender here. Acquiring Colomer in 2013 brought the company back among the top 10 leaders in professional hair care, and its vibrant CND business is a leader in professional nail care. However, like Coty, Revlon has not fully tapped the skin care sector yet, though it does have a small presence in Europe with its Gatineau brand.

Estée Lauder is another multinational with a solid position in more than one professional beauty sector. With Aveda as its most prominent professional brand, the firm now ranks sixth in hair care and is at the bottom of the top 10 in skin care. Like Unilever, Estée Lauder does not yet play in the professional nail care arena.

Multinationals That Play in More than One Sector of Professional Beauty

Solid revenue growth, healthy profit margins, and considerable upside potential in developing countries like Brazil and China make the professional beauty sector quite attractive. Significant opportunities remain, particularly in the skin care and nail care arenas, where, apart from those firms mentioned here, there are very few large multinationals playing in these spaces. There are numerous independent brands with revenues in the $25-$50 million range, which could potentially be attractive acquisition candidates for those interested in participating in this market. Those who want to win in professional beauty should pay attention to opportunities in all three sectors: hair, skin, and nail.

Kline will continue to thoroughly examine all facets of these markets, including coverage of the smaller, independent brands, in the upcoming editions of the Salon Hair Care Global Series: Market Analysis and Opportunities, Professional Skin Care Multi-regional Series, and Professional Nail Care: Global Market Brief report series, slated for publication in early 2016.