Germany is one of the world’s most technologically advanced producers of transportation equipment, steel, iron, cement, chemicals, machinery, and machine tools. It is also the fifth-largest metalworking fluids market globally.

Over the past five years, German industrial output has risen considerably, driving demand for metalworking fluids to 130 kilotonnes in 2018. The transportation industry was the leading consumer of metalworking fluids that year, accounting for an estimated 46% of the total.

The German metalworking fluids market is highly consolidated, with the top three metalworking suppliers accounting for more than 50% of the total market. The top three metalworking fluid suppliers are Quaker Houghton, BP, and FUCHS. Some of the largest metalworking fluids consumers are VW Group, Daimler, BMW, Bosch, Continental, DMG Mori, and thyssenkrupp, consuming more than 200 tonnes of metalworking fluids per year.

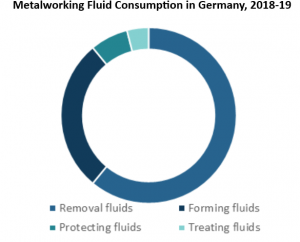

The market size and demand for metalworking fluid consumption in Germany is led by removal fluids, with over 60% share of total consumption, followed by forming fluids. Protecting and treating fluids are at third and fourth place, respectively.

However, uncertainty over global trade had German industrial production drop by 4.2% compared to July 2018. Most of this decrease can be attributed to the Brexit uncertainty and the United States’ trade war with China and the European Union. Also, due to a decrease in demand for German goods in emerging markets, metalworking fluids demand in Germany dropped in 2019 compared to 2018. Overall, except in Russia and Poland, all country markets in Europe saw a reduction in consumption in 2019.

The global move toward sustainability has strongly affected the metalworking fluids business and consumption and, at the same time, increased demand for green products. This is also reflected in the growth of electric passenger vehicles, which poses a threat to the metalworking industry. However, new fields such as robotics and bioengineering offer fresh prospects for the metalworking fluids industry. Moreover, German machinery OEMs plan to use Industry 4.0 in the next few years. Companies will increasingly connect their machinery to warehouse systems to better control material deployment and delivery chains.

That said, the automotive industry is still the largest industry sector in Germany, representing around 20% of total German industry revenue. This is reflected by the fact that the major metalworking fluids-consuming end-use industry is the transportation equipment manufacturing industry. It accounts for around 46% of total volume, followed by the machinery and fabricated metal products manufacturing industries. The transportation equipment manufacturing industry includes the fabrication of motor vehicles, which consumes roughly 41% of total metalworking fluids consumption.

The metalworking fluids industry is currently facing several growth disruptions from regulations and standards such as REACH and CLP, the manufacturing recession and trade war, the automotive transition which includes e-mobility, and technological advancement which includes the use of Industry 4.0 and fluid management services.

Despite a manufacturing slowdown, the new CLP guidelines, coupled with REACH registrations, have increased the volume in 2018 due to changes in formulations, biocide abolishment, and additive scarcity. The scarcity of additives led to the production of less stable fluids that do not last for long, leading to an increase in volume. The lifespan of a fluid decreases if biocides are not used. However, volumes stabilized in 2019, and metalworking fluids should resume their long-term correlation with industrial production.

Going forward, the demand for metalworking fluids is expected to decline at a CAGR of 1.6% through 2023. However, an annual decline rate of 1.6% for metalworking fluids could be quite conservative in the event of a complete global recession and prolonged trade tensions.

Germany’s GDP grew 0.6% in 2019, slightly better compared to 0.5% in 2018; however, it was still affected, partly due to the recession in its manufacturing sector. Trade tensions have dampened export-driven industries, such as automotive and machinery and equipment. However, e-mobility is set to be a game changer over the next 20 years. While German OEMs are preparing to invest more in e-mobility, it is unlikely that this shift will affect metalworking fluids demand over the forecast period.

Kline’s soon-to-be published report on Metalworking Fluids: Global Market Analysis and Opportunities provides detailed and invaluable information and analysis of the market, its trends, key players, and the performance of overall metalworking fluid market. Please send us your feedback on which country you would like us to profile next.