The economic and health crises of 2020 have caused energy market participants to refocus their attention on protecting the global ecosystem and regeneration — and now, the global wax industry is doing its part to move toward cleaner, sustainable, and circular products.

As the volume of petroleum wax continues to diminish, crude oil-derived petroleum waxes and non-petroleum synthetic and natural waxes are stepping up to fill supply gaps in the wax industry. But how well will these waxes align with the drive toward global sustainability? Are there more sustainable substitutes? And are consumer preferences changing in favor of end-products with low carbon footprints and recyclable?

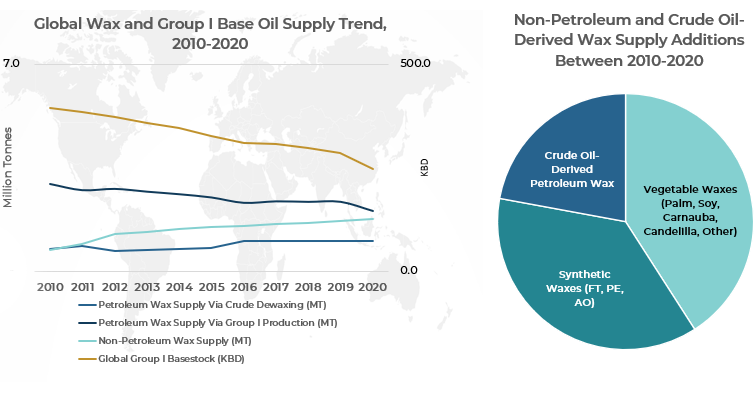

Petroleum wax, which is the workhorse for the wax industry, is produced as a byproduct of Group I base oil production as well as via solvent dewaxing of heavy waxy crude. The supply of Group I base oil-derived wax, which is associated with Group I base oil production, is declining due to declining demand for Group I base oils. The demand for Group I base oils is declining as the automotive and industrial lubricant applications transition toward more efficient lubricants formulated from higher-quality base oils. It is estimated that in the next 10-year period, base oil supply by wax-producing Group I plants will reduce to half of its current volume and, in the long-term — by perhaps 2050 — the supply will further reduce to nearly one-third of the current volume. This will have drastic implications on the supply of petroleum waxes, leaving the world short of nearly 1.5-2.0 million tonnes of gross Group I base oil-associated slack wax production.

Crude oil-derived petroleum waxes, produced by massive petrochemical refineries in Northeast China, have historically helped in softening the blow of Group I base oil-derived petroleum waxes capacity closures. These refineries will continue to supply petroleum waxes in the mid- to long-term future to partially fill the gap created by the loss of base oil-derived waxes.

But which waxes are most sustainable? According to Kline’s research, those produced via synthetic and natural processes may have an edge in the long-term future. Synthetic waxes that are derived from natural gas, such as those produced via Fischer-Tropsch (FT) process and polymerization of ethylene, have relatively lower carbon footprints compared to crude oil or coal-derived waxes. These waxes are also free from toxic impurities such as polycyclic aromatic hydrocarbons, sulfur, and heavy metals, which may be found in petroleum waxes.

Polyethylene (PE) waxes currently upstage other synthetic waxes when it comes to offering innovative sustainable products. Byproduct PE waxes that are produced via thermal cracking of waste plastics replace the “end-of-life” concept with “regeneration” in the plastics industry — one of the most vexed industries for waste generation. Although thermal cracking of waste plastics into oils and waxes has existed for years, the technology is regaining focus as a viable solution for tackling global waste plastics issues. New players are entering this market, with GreenMantra and Clariter being the most recently established.

The wax market is also currently seeing the introduction of revolutionary bio-based PE waxes. This type of wax, produced from plant-sourced ethanol, a 100% renewable source, can assist end users in reduce their carbon footprints when used in applications such as adhesives, cosmetics, coatings, and PCV compounding. In June 2021, Braskem, a Brazilian petrochemical company, introduced a sugarcane ethanol-based bio-PE wax product to its I’m green™ branded product portfolio. Demand for such products in the future will be driven by PVC manufacturers who are introducing bio-based PVC products to their portfolios and are looking for bio-based solutions for PVC lubrication. Bio-based PVC technology has recently surfaced, with eminent PVC manufacturer INEOS’ INOVYN business at the forefront with its BIOVYN branded bio-PVC products.

Natural waxes that are produced from renewable plant-based sources and carry a green label on them, such as palm and soy, are doing exceptionally well in candle applications. These waxes are also gaining steam in cosmetics, food-based packaging, and coatings applications, driven by their suitability for food contact. Natural waxes have historically advanced only in application areas that consume softer waxes due to their lower melting points. However, the growing desire of wax consumers to use sustainable ingredients in other applications that have been traditionally served by harder, high melt-point waxes will drive their demand in the long term. Clariant’s Licocare rice bran wax, which is targeted at high-melt applications such as engineering thermoplastics and masterbatches, is an example of this trend.

How will the wax industry acclimate to the new sustainable and circular environment? What roadblocks could slow down the adoption of waxes with low-carbon footprints?

The wax market has historically exhibited versatility and adeptness in absorbing non-petroleum waxes in the absence of a sufficient supply of petroleum wax. In the future, it is estimated that wax customers in traditional candles or board sizing applications — who are sensitive to changes in supply or price of wax — will experience a more significant impact. These applications will find it tougher to transition toward more expensive alternatives to petroleum wax, such as FT waxes. These applications are driven by end-consumer preference, have low barriers to entry, and are vulnerable to substitution in the long run. In contrast, rheological and surface applications such as PVC, hot-melt adhesives, masterbatches, inks, paints, and coating are higher-value applications that offer higher barriers to entry. Rheological and surface applications also have the ability to pay higher prices for waxes. In the long run, these applications will exhibit higher flexibility to absorb cleaner or sustainable products, such as synthetic waxes or even chemically modified plant-sourced waxes, which are typically more expensive.

Another foreseeable challenge in transitioning toward clean and sustainable waxes could arise due to the raw material limitations for these waxes. Both synthetic and plant-sourced natural waxes could see supply limitations in the long-term future for several reasons. For one, in FT waxes, nearly half of the global supply is met by Chinese coal-to-liquids (CTL) plants, which convert coal to syn gas for producing waxes and other products. These plants are not likely to see any capacity additions beyond 2030 as China tightens its carbon emission limits to meet its carbon neutrality targets by 2060. Other synthetic wax suppliers, such as thermal degradation PE producers, may see lower volumetric growth due to raw material issues. The raw materials (plastic waste) that these plants consume are non-uniform in nature, resulting in lower quality of finished products. While these waxes may be able to meet the circular economy objective, they may not achieve the required quality standards for several applications.

Vegetable oil-derived waxes may seem to be checking all the boxes, as they are plant-sourced. However, they will also have their own limitations in the future. Growth in palm plantations, from which palm wax is derived, has been termed as “the other oil spill,” as it has resulted in large-scale deforestation of tropical forest land in Asia. Negative consumer sentiments associated with palm plantations are likely to hamper the growth in palm waxes in the future. Meanwhile, soy waxes —produced from soy oil — are seeing growing demand from other competing markets such as fuels and food, and this could restrict the availability of soy oil for producing wax.

Sustainability trends will provide a new spin to the wax market

The ever-complex wax market will face new challenges as consumers increasingly demand materials produced from greener sources. As a result of such demand, suppliers will strive to exhibit their commitment to protecting the global ecosystem by including new, innovative products based on renewable and recycled sources. With a reinforced global wave toward sustainability and a circular economy in 2020 and 2021, the wax industry is at the cusp of a new — and sustainable — normal.

Kline & Company, an industry leader in providing market research reports and expertise on the wax industry, will soon be publishing a detailed report titled, Global Wax Industry: Market Analysis and Opportunities.

RELATED STUDIES

Global White Oils: Market Analysis and Opportunities

The global demand for white oils has been increasing slowly over the past few years. Despite the slow growth, the market remains dynamic due to the increasing use of Group II baseoils, intensifying competition from small suppliers, substitution by other products, and increasing regulatory control.

This continuous publication since 2003, provides a comprehensive, in-depth analysis of automotive and industrial finished lubricant products, end-use industries, trade classes, major suppliers, and market trends in leading country markets and regions.

The customized report covers your choice of 10 country market and/or supplier profiles and offers a comprehensive Year in Review summarizing the overall global lubricants industry.