The difficulty in predicting just how fast or how far things will move towards full vehicle electrification in the next 20 years makes understanding the implications for the wider industry a significant challenge. George Morvey, Energy Industry Manager at Kline & Company, gives a sneak preview of his session at next week’s ICIS World Base Oils and Lubricants Conference in London that explores the opportunities for lubricant suppliers and the actions they need to take now.

Media headlines point to an all-electric future for vehicle powertrains—and apparently soon! Yes, it is certainly one of the key industry disruptors that analysts are closely monitoring. However, views on the future penetration of full electric vehicles are generally shaped by where an organization sits in the market. Battery and electric vehicle (EV) suppliers, for example, naturally paint a picture of strong growth, which makes for exciting headlines. On the other hand, conventional internal combustion engine (ICE) vehicle manufacturers, refiners, fuel suppliers, and lubricant and additive companies suggest a more conservative view. Kline & Company is in the privileged position of being able to take a neutral view of the shifting market landscape and its wider implications.

Electrification to 2025 – a niche market

Looking at the near term, out to 2025, electric mobility is expected to remain a relatively niche market. The degree of powertrain electrification will vary by region and country, mainly reflecting the push from government regulations combined with the geographic conditions, ready availability of sufficient power and investment in charging infrastructure. In this timeframe, most of the so-called “electric vehicles” will be hybrids that will still contain an ICE that will drive the wheels at least some of the time.

Electrification will exert only a limited influence on the demand for passenger car and other finished lubricants to 2025.

In some of the fast-growing markets in Asia Pacific and emerging economies in the Middle East, Africa, and Latin America, robust car sales will continue to drive growth in the passenger car motor oil (PCMO) market. This will even be the case in China, where targets for new energy vehicle sales mean EV penetration is expected to be higher. Here, PCMO market growth will simply reflect the huge rise in car sales, many of which will still contain some form of ICE. Conversely, in the United States and Europe, PCMO demand will be more susceptible to downward pressure, even under a low EV penetration scenario. This is mainly down to technology advances and the desire for longer lubricant drain intervals.

In this timeframe, fuel economy requirements will push lubricant viscosity grades down to SAE 0W-8 and below. In an environment of new materials, additional complexity, and increased electrification, more advanced lubricants will be needed to ensure sufficient hardware protection is maintained. There is certainly room for significant product innovation and differentiation here.

Mass-scale adoption

Market participants suggest that 2025 may be a turning point for the mass-scale adoption of full battery electric vehicles (BEVs). This is likely to be the case if, at this point, the cost of BEVs reaches a par with conventional vehicles or if legislation has been imposed that bans the sale of ICE-powered vehicles.

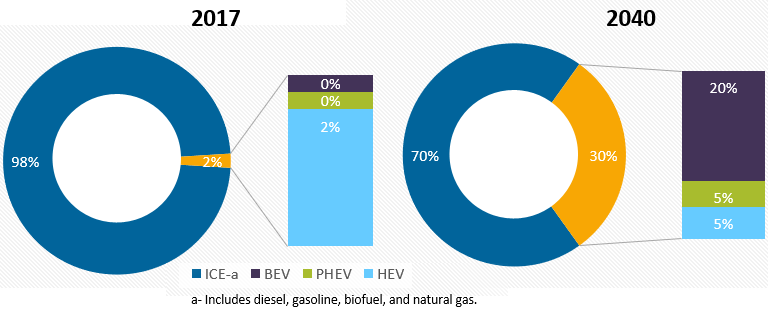

According to Kline analysis, the 2040 landscape for EVs will be very different from that of 2017.

EV Population of the World’s Leading 15 Country Markets, 2017 and 2040

By 2040, hybrids will have fulfilled their purpose, as the bridge to full electrification. Looking at the world’s 15 leading markets, the market share for BEVs will grow to around 16% of the total EV population, with about half of the world’s EVs being on Chinese roads. However, ICEs will continue to account for more than three-fourths of the vehicle population.

Clearly, this growth in BEVs has the potential to reduce lubricant consumption, since the lack of an ICE eliminates the need for PCMOs, which are the largest lubricant product category. However, BEVs will also create requirements that will drive the development of new products, such as coolants, specialised greases, and gear and transmission fluids.

Lubricant suppliers have the opportunity to introduce high-value, EV-specific products to compensate for any volume losses that may occur.

To be successful in the coming years, as EV adoption continues shaping the market, lubricant suppliers need to closely monitor developments in this fast-changing space. This is particularly the case as EVs exert a greater influence on the finished lubricants market, mainly as a by-product of technological improvements, new production processes, new materials, and the inevitable convergence with other technologies, such as autonomous transportation.

With such a high level of uncertainty ahead, it is important for market players to look beyond the basic market numbers, such as volume growth or decline. By paying attention to the broader shifts within the value chain and by thinking creatively lubricant suppliers will be able to ensure their products are selected by both EV end users and the service providers who are charged with vehicle maintenance.

Kline & Company at ICIS London

George Morvey’s presentation at the ICIS World Base Oils and Lubricants Conference in London will take a unique view of the EV market from the perspective of lubricant suppliers. It will explore three key themes covering the impact EVs are likely to have on lubricants:

- How the market may change moving forward, for lubricants, sales, and distribution.

- Insights into the commercial impact of EVs on PCMO sales and distribution, and the opportunities for suppliers and distributors as a result.

- The ways EV penetration is driving demand for synthetics, lower viscosity grades, and is opening the market to new suppliers, new routes to market, and new product offerings.

Following his presentation, Morvey will participate in a panel discussion that will further explore where the opportunities lie for the lubricants and base oils businesses in the future charging infrastructure and EV industries.

The PCMO Market in 2040: A Long-term Outlook Report

This report explores the influences of emerging technologies on the global PCMO market. Electric vehicles, ride sharing, and autonomous vehicles are just some of the factors that the report examines in terms of their impact on future lubricant consumption. Profiles of the 15 leading country markets are provided, which enable the customer base and potential emergence of new customer groups to be assessed. The report also provides information on demand by viscosity grade, quality level, and the penetration of synthetics to help customers identify emerging opportunities.

The PCMO 2040 report enables readers to assess future overall PCMO demand based on a variety of parameters, which enables the development of multiple market scenarios that can help to evaluate the opportunities and challenges ahead.

Read more about the PCMO market in 2040 report or purchase a copy.