As the commercial vehicle market works to meet efficiency and emissions requirements, Sharbel Luzuriaga, Project Manager at Kline Energy, looks at the different factors influencing the future outlook for heavy-duty motor oils in the world’s two largest markets.

Combined, the demand from China and the United States for heavy-duty motor oil (HDMO) represents 35% of the global market. While these two heavyweight markets are being driven by some of the same technology and economic disruptors, there are also a number of key differences shaping their futures. Although declining volumes are forecast in both regions, HDMO suppliers who are aware of the disparate challenges will be well placed to take advantage of the emerging opportunities.

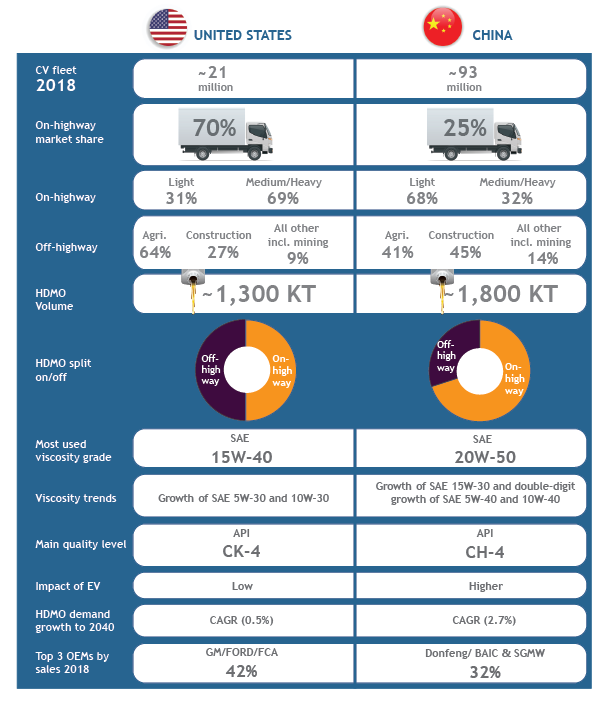

Snapshot of the world’s largest HDMO markets

U.S. HDMO market trending to lower viscosity grades

In the United States, across the classes, from the lightest to heavy-duty and off-highway, there are estimated to be more than 21 million commercial vehicles in operation. While some 70% of these are on-highway, the more than 1,300 kilotonnes (KT) demand for HDMO is split almost 50/50 between on and off-highway applications.

Commercial vehicle sales between 2013 and 2018 have grown at a compound annual growth rate (CAGR) of 8%. This is a trend that is expected to continue as we look forward over the next five years. However, lubricant demand is forecast to fall, albeit only modestly in the coming years.

When looking at the factors affecting lubricant demand, electrification is anticipated to play only a relatively small part. Light commercial vehicles (LCV), used for example in last-mile urban deliveries, are more easily electrified than the heavier classes. However, in the next 20 years, only one-third of LCV in the United States are expected to be electrified, while in the medium and heavy-duty sectors, electrification will still be in the single figures in this time period. As the medium and heavy-duty markets look for cleaner technologies, what is far more likely to occur is the use of natural gas and hydrogen as an alternative to diesel fuel. However, currently, the main barriers to their broad uptake are similar to electrification: the lack of infrastructure, high initial vehicle purchase cost, and poor return on investment.

In the transition to new fuels and technologies end users will look for lubricants to help them simplify inventory, minimize misapplication, and reduce costs.

Lubricant suppliers who can ensure enough protection across mixed fuel fleets will have an advantage in this market.

Emissions reduction and fuel economy measures will have the most impact on the U.S. HDMO market. Currently, SAE 15W-40 is still the most consumed HDMO grade and the uptake of lower viscosity API FA-4 SAE 10W-30 oils has been slow. With the implementation of the next round of greenhouse gas emissions cuts and as large fleet owners appreciate the benefits they can deliver, the penetration of lower viscosity grades SAE 5W-30 and SAE 10W-30 is expected to gradually increase. As fleets replace vehicles, they will look for suppliers with lower viscosity lubricant offerings that can deliver proven hardware protection over longer oil drain intervals (ODI).

Q-up expected in China

The market in China is very different to that in the United States. Of the more than 93 million commercial vehicles in operation, some 70% are in off-highway use, mainly in agricultural and construction applications. However, these vehicles account for only 25% of the 1,800 KT HDMO market, which means demand from the on-highway segment in China is twice the size of that in the United States.

However, the Chinese on-highway market makeup is very different to that of the United States, with almost 70% of the vehicles being in the light-duty vehicle segment. As mentioned already, lighter vehicles are more easily electrified, which means there could be a larger uptake of new energy vehicles (NEV) in China. The total share of NEV, including battery electric, plug in hybrids, and hybrids, in the on-highway segment is forecast to be just short of 20% by 2040, up from 2% in 2018. Despite the uncertainties surrounding the penetration of NEV into this segment, their long-term penetration will contribute to the volume decline in the region’s HDMO market. In the most likely scenario for NEV penetration, total demand for on-highway HDMO is predicted to halve by 2040.

Another contributing factor to the negative HDMO volume growth is the expected decline in sales of on-highway trucks and buses at a CAGR of 3.7% out to 2040. This is based on a number of factors, for example, increased competition from other transportation sectors, such as rail, and the slowdown in economic growth over the longer term.

However, what can be seen as a positive trend in China is the anticipated lubricant quality upgrade (Q-up). Although API CF-4 still accounts for one-third of HDMO demand today, tightening emissions legislation, with National VI phasing in from 2020, means continued Q-up is likely here.

By 2027, our projections suggest that 80% of trucks will use quality grades at or above API CI-4.

Another trend will be the move to lower viscosity grades as OEMs change oil recommendations to help meet emissions regulations, achieve longer ODI, improve fuel economy and to ensure better protection for their engines. While SAE 20W-50 still holds 50% of the market today, OEMs are increasingly recommending lower viscosity multigrade HDMO instead of monogrades. SAE 15W-40 will post only modest growth, while SAE 5W-40 and 10W-40, currently holding only minor market shares, may witness double-digit growth in the future.

Capturing value

Marketers looking for growth in the global HDMO market need to carefully assess the trends in each geographic region to ensure they have the right products to meet the opportunities and challenges that are arising. As volumes decline, suppliers who can quickly identify potential opportunities to meet evolving market needs for improved fuel economy, emissions reduction, reduced vehicle downtime, and cost savings will be able to create and capture value.

HDMO Market in 2040: A Long-term Outlook report explores the influences of emerging technologies on the global HDMO market. Electric vehicles, telematics, and digitization are just some of the factors that the report examines in terms of their impact on future lubricant trends. Profiles of six leading country markets are provided, which enables readers to identify the possible regional scenarios and their impact on long-term HDMO demand. The report also provides information on demand by viscosity grade, factory fill vs. service fill, quality levels, distribution channels, and end-use industries. This gives actionable insights to assist lubricant marketers to identify opportunities and challenges within the evolving HDMO industry.

The HDMO 2040 report provides a comprehensive appraisal of the evolving market in context with the emergence of transformative forces.