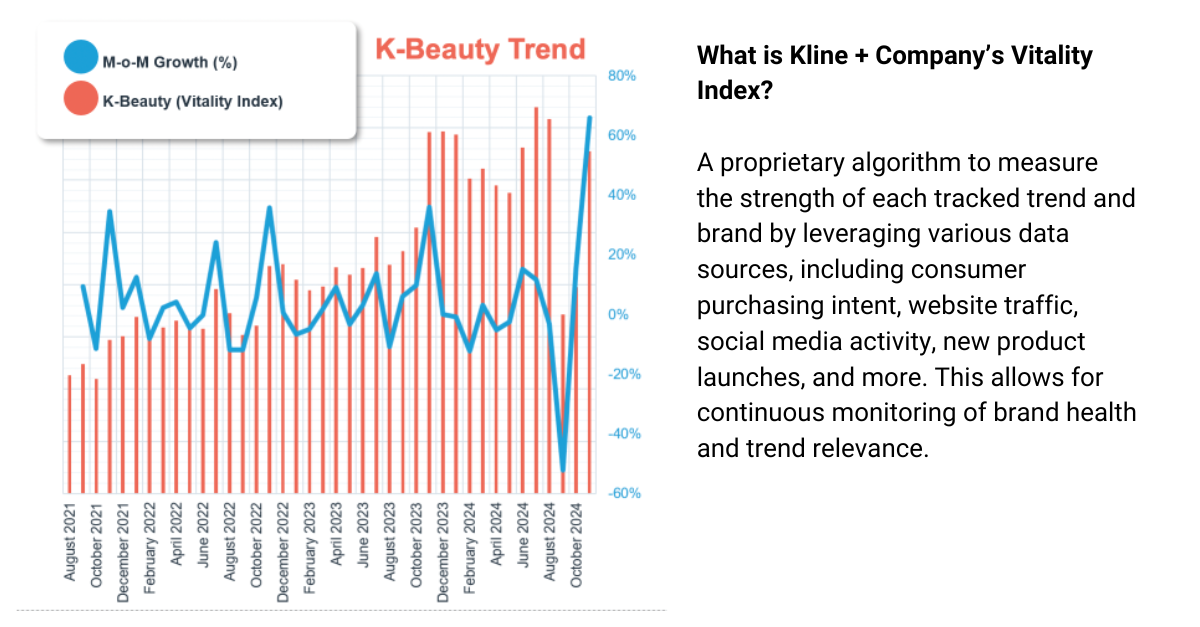

K-Beauty is experiencing a notable resurgence in the United States, with Kline + Company’s Trend Vitality Index showing a month-over-month growth of 6%. After a temporary decline in the early 2020s, driven by shifting consumer priorities toward wellness and DIY beauty care, the last three years have shown a steady increase in search trends for K-beauty.

A major turning point occurred a year ago with the rise of overnight masks and the glass skin trend, led by products such as Sungboom’s Deep Collagen Anti-Wrinkle Lifting Mask. TikTok has since taken the lead as the primary platform for K-Beauty exploration, surpassing traditional search engines, such as Google, and fueling renewed consumer interest. So, which product formats and brands are now taking the spotlight?

Graphic Source: Kline + Company’s Trend Analytics

Product Formats Leading the Charge

TikTok’s ability to propel less-known ingredients and formats into the mainstream has been instrumental in reviving K-Beauty. For instance, snail mucin, which was once a niche ingredient, became popular after influencers and skin care enthusiasts raved about the radiant glow achieved with products such as COSRX’s Advanced Snail 96 Mucin Power Essence.

Similarly, sunscreens have also surged in popularity, with tinted formulas and sun sticks capturing consumer interest like never before, especially favorites like Beauty of Joseon. Furthermore, sensitive skin care solutions are also rising in popularity and have become a focal point of many influencers’ content. Face masks, long a staple in K-Beauty routines in sheet format, are seeing renewed interest, especially collagen and jelly masks from brands such as Medicube.

Other formats gaining momentum include lip tints and glosses, with brands such as Fwee and Nooni quickly becoming user favorites. This marks a shift from the previous focus on cushion foundations and BB creams, reflecting evolving beauty priorities in the K-beauty landscape.

Brands Driving the Comeback

TikTok’s viral influence has opened up new opportunities for both established and emerging K-Beauty brands. Iconic names such as not only have built loyal followings but also are expanding their reach by tapping into TikTok Shop, alongside their successful direct-to-consumer strategies and presence in major retailers, such as Sephora and Ulta.

In the second quarter of 2024, Amorepacific reported strong performance of its brand in the United States, with Amazon driving growth in facial care and sunscreen products from Cosrx and Innisfree. Moreover, the limited-edition watermelon lip products from Laneige show that watermelon is still a crowd favorite.

Meanwhile, a wave of newer brands is making K-Beauty accessible in the U.S. market more than ever before. Mixsoon, Medicube, and Beauty of Joseon, among other brands, are gaining traction in our digital trend trackers. Medicube’s Glass Glow device and collagen-infused masks are among the most-watched K-Beauty items on TikTok, blending innovation with skin care. Beauty of Joseon’s viral sunscreen has quickly won over TikTok users with its lightweight formula and skin-nourishing ingredients, solidifying its position as a must-have product.

The Expanding K-Beauty Market: What’s Next?

In our recent trend analytics webinar, K-Beauty’s U.S. Revival: Predicted Fad or Long-Term Trend, we not only analyze TikTok’s impact but also dive into K-Beauty’s growing presence on platforms such as Pinterest and YouTube. Additionally, we explore emerging retail concepts and future drivers that could sustain its strength. We also calculated K-Beauty’s future vitality index to help you gauge its potential over time, including key periods of demand.

Replay the webinar recording here to access the full insights into K-Beauty’s resurgence and what lies ahead for this dynamic category.

Want beauty and wellbeing industry updates, expert analysis, insider tips, and webinar invites in your inbox? Click here to sign up for the Kline newsletter.