In January 2014, Kline & Company, a worldwide consulting and research firm serving the needs of organizations in the lubricants and base stocks industry, introduced its monthly Base Stock Margin Index, a characterization of recent cash margin contributions in the U.S. base oil market over the past 24 months.

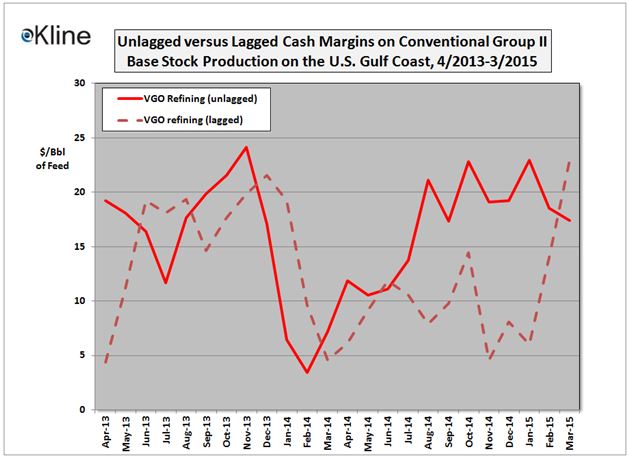

The Index estimates cash margin contributions associated with U.S. Group II base stock production. It simulates EBITDA before the deduction of corporate SG&A expenses for typical VGO-based virgin base stock plants and RFO-based re-refineries.

“It appears that, after nine months of market turbulence, crude oil markets have begun to find a temporary ‘new norm’ at around 50% of pre-collapse levels,” noted Ian Moncrieff, Vice President of Kline’s Energy Practice. “To some extent this collapse has benefitted base oil producers who, despite the adverse supply/demand fundamentals of continuing overcapacity and weak demand, have managed to improve profitability by delaying price adjustments in the face of falling feedstock values. If markets are now truly adjusted to this new, lower level of price fundamentals it will be very interesting to see if base oil producers can hang on to current production margins in the face of intense competition.”

For more information on the Kline Index, or to inquire about our pricing and margin analysis services to the base stocks industry, please contact Ian Moncrieff, Vice President (Ian.Moncrieff@klinegroup3dev.wpenginepowered.com) at (973) 615-3680 in Kline’s Energy Practice.