By David Tsui and Sushmita Dutta, Project Managers, Energy

This article originally appeared in the October 2022 edition of Lube magazine.

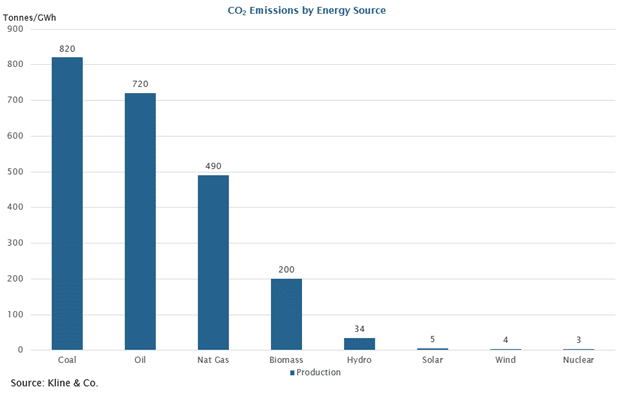

Natural gas engines — or perhaps we should call them Swiss Army Engines — are the multitool for power generation that can work alongside wind and solar to provide a reliable power grid for our future. Unlike other fossil fuels, natural gas has a lower carbon footprint than traditional coal or oil fossil fuels, and the natural gas engine allows for rapid stop/starts, which helps it complement renewable energy such as wind and solar.

Natural gas engines were designed to burn traditional natural gas fossil fuels; however, these engines can be readily adapted to burn renewable and other sources of fuel as well, such as:

- Green hydrogen: Green hydrogen is produced via the electrolysis of water; the electricity used for electrolysis must be derived from renewable sources for it to be “green.”

- Biogases: These include digester gas, landfill gas, sewage gas, and other similar gases which are produced from the anaerobic decomposition of organic matter such as livestock manure and food processing waste. Such alternative gases are composed mostly of methane and carbon dioxide, along with other gases such as nitrogen, oxygen, and hydrogen sulfide.

- Coal gas: Coal gas is formed by destructive distillation of coal and consists mainly of hydrogen, methane, and carbon monoxide.

- Producer gas: The burning of coke in limited air results in producer gas, which is a mixture of carbon monoxide, nitrogen, carbon dioxide, and hydrogen.

- Water gas: The red-hot coke, when treated with steam, yields carbon monoxide and hydrogen, a mixture known as water gas.

Due to environmental concerns, governments across the globe are encouraging the use of cleaner-burning fuels, such as natural gas and manufactured gases, instead of other fossil fuels such as coal. For example, in the United States, according to the U.S. Energy Information Administration (EIA), 257 billion cubic feet of landfill gas were collected at 336 landfills in the country in 2019. This landfill gas was used to generate 10.5 billion kilowatt-hours (kWh) of electricity in the same year. Furthermore, according to EIA, 25 large dairies and livestock operations in the country produced 224 million kWh (or 0.2 billion kWh) of electricity from biogas in 2019.

China, on the other hand — with rich coal reserves – is investing in coal-bed gas. The country is the world’s largest coal producer as well as consumer. The coal-bed gas power generation has witnessed significant growth, with government support for its use as an approach for air pollution elimination and energy conservation.

Green hydrogen or renewable hydrogen is the new buzzword in the energy sector. In 2020, the European Union announced its aim to become climate-neutral by 2050, which means an economy with net-zero carbon emissions. This ambitious plan is likely to be facilitated by the creation of a hydrogen economy. Thus, green hydrogen is more than just a buzzword; in fact, it is a real concept that is currently being put to implementation and can potentially transform the energy sector. After Russia’s recent invasion of Ukraine, the European Commission unveiled REPowerEU, which has doubled the EU hydrogen targets for 2030. It now sits at 10 million tons of renewable hydrogen to be produced annually, along with an additional 10 million tons to be imported.

The usage of green hydrogen is currently in a nascent stage, but it is being viewed as the gas engine fuel of the future. Hydrogen is used in two ways in natural gas engines: as a dual fuel combination of hydrogen and natural gas (blend of natural gas and hydrogen) or pure hydrogen. INNIO and HanseWerk AG have started field testing a 1-MW gas engine that can operate either with 100% natural gas or with variable hydrogen-natural gas mixtures up to 100% hydrogen. Other gas engine manufacturers are also developing engines for 100% hydrogen. INNIO’s current 2022 Jenbacher line of natural gas engines is capable of operating on up to 25% green hydrogen and can be fully converted to 100% hydrogen.

This ability to utilize multiple fuel sources will enable nations to utilize renewable gaseous fuel, helping combat climate change by controlling greenhouse gas emissions. In addition, the flexible fuel sourcing will also allow nations to change sources of fuel quickly should there be supply chain disruptions like the ones we’ve observed recently.

Natural gas and liquified natural gas (LNG) supplies have witnessed global disruptions as the Russian/Ukraine war forces Europe to turn to alternate sources of natural gas and LNG, which will drive shortages in other regions as Europe bids up prices. This could drive changes in the type of natural gas engine oil (NGEO) consumed as the natural gas supply chain is altered and engines start to see more variable sources of fuel.

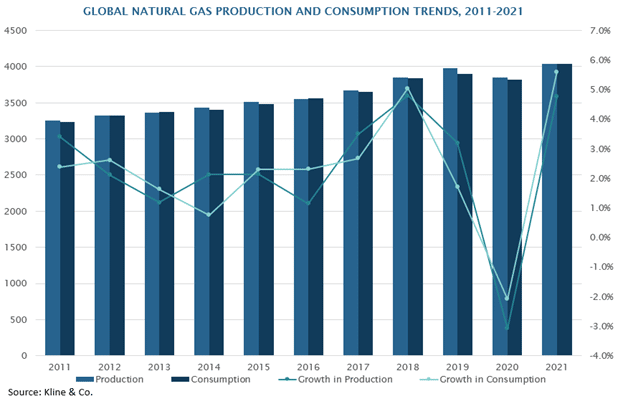

Despite the disruptions, natural gas will continue to be utilized as a transitional fuel source to help the world shift toward fully renewable energy. Europe has confirmed this continued usage of natural gas, with the European Union voting in favor of calling natural gas a “green” or “sustainable” source of energy despite some pushback. The caveat is that by 2035, a further transition toward biogas or green hydrogen will be required. This will phase out traditional natural gas use in parts of Europe. It’s a good sign that natural gas power generation units will have a solid future, as power generation plants can continue to operate — though they may require an OEM conversion kit should they seek to utilize green hydrogen. Kline expects global gas consumption to remain strong as global economies recover from 2020 declines caused by pandemic-related shutdowns.

According to bp’s Statistical Review of World Energy 2021, natural gas witnessed robust growth with a jump of more than 60% in production and consumption between 2000 and 2019. As global economies recover from pandemic lockdowns, growth is expected to continue. However, the supply chain and sourcing for natural gas have seen dramatic shifts that began when Russia invaded Ukraine and the UN began to impose sanctions on Russian natural gas. The EU has also implemented changes in its sourcing for natural gas and halted Russia’s Nord Stream 2 gas pipeline. In response, Russia’s Gazprom is limiting natural gas through the Nord Stream 1 pipeline to 20% — just as European energy consumption hit record levels, with natural gas being burned to meet electricity demand from a historic heatwave which caused temperature spikes of more than 104°F (40°C) in some countries in July 2022. This is hindering Europe’s plans to maximize its gas stores before winter should Russia completely cut Europe off from natural gas.

The rapid strategy shift away from Russian-sourced natural gas, which had supplied 40% of Europe’s demand with more planned as Nord Stream 2 was to come online, has caused Europe to tap into other sources, including LNG imports. In 2021, 45% of European LNG imports were sourced from the U.S., and another 20% was sourced from Qatar. This shift helped drive up prices and will likely cause supply shortages for poorer nations. (For more information on the EU’s emerging power generation scenario, check out Kline’s blog here: https://klinegroup.com/the-eu-s-emerging-power-generation-scenario/).

According to Kline’s recently published Natural Gas Engine Oils: Global Market Analysis and Opportunities study, the change in gas sourcing will help drive growth in new pipelines and liquefication and gasification facilities, as well as expedited investment in renewable gases such as green hydrogen and bio or landfill gas. This, in turn, is likely to drive demand for NGEO more suited to handle various fuel sources that could include a mix of hydrogen and gas or sour gases from landfills.

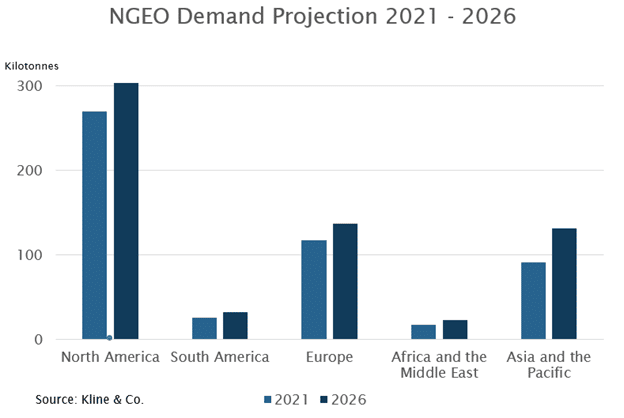

North America remains the strongest market for NGEO utilized in both power generation and in mechanical drive to operate massive pipeline networks. Europe and Asia follow, with more growth seen in the Asia and the Pacific region, as these developing nations rapidly consume more energy.

In the short/medium term, Kline projects growth in low ash and medium ash traditional NGEO demand. In the longer term, Kline projects more use of medium ash NGEO or new formulations designed for green fuels. These new products will likely be formulated to better handle a more variable Wobbe Index (WI) and greater levels of contaminants such as water. NGEO demand, globally, is expected to exceed 500 kilotonnes by 2026 and grow at almost a 4% CAGR, with some regions outpacing others depending on gas availability and government infrastructure plans. Germany, for instance, is looking to retain three of its nuclear power generation plants, given the issues with Nord Stream gas from Russia — so its transition to natural gas will be slowed. However, other nations such as China are expected to see over 10% growth in NGEO demand. With continued heat waves and harsher weather, the demand for more power will only increase.

For more information, check out Kline’s Natural Gas Engine Oils: Global Market Analysis and Opportunities report. A comprehensive analysis of the global NGEO lubricants market in the wake of record natural gas prices and global turmoil, it focuses on key trends, developments, changes, challenges, and business opportunities.