Brazil’s personal care ingredients industry is being transformed by the growing number of conscious consumers who expect brands to offer natural products.

“The market is heavily focusing on natural ingredients in all categories,” says Sabrina Hadek, Project Lead in our Chemicals sector. “Several suppliers are investing in mostly vegetable-based ingredients, thus meeting the demand for the sustainability wanted by most companies and consumers.”

As a result, Hadek says, demand for biodegradable polymers has increased, even though most of them are synthetic in nature. In addition, preferred ingredients are those that can replace more than one ingredient in a formulation with greater stability and can be used in cold processes to reduce energy consumption.

What other personal care ingredients are being affected by the natural trend? Read on:

SURFACTANTS

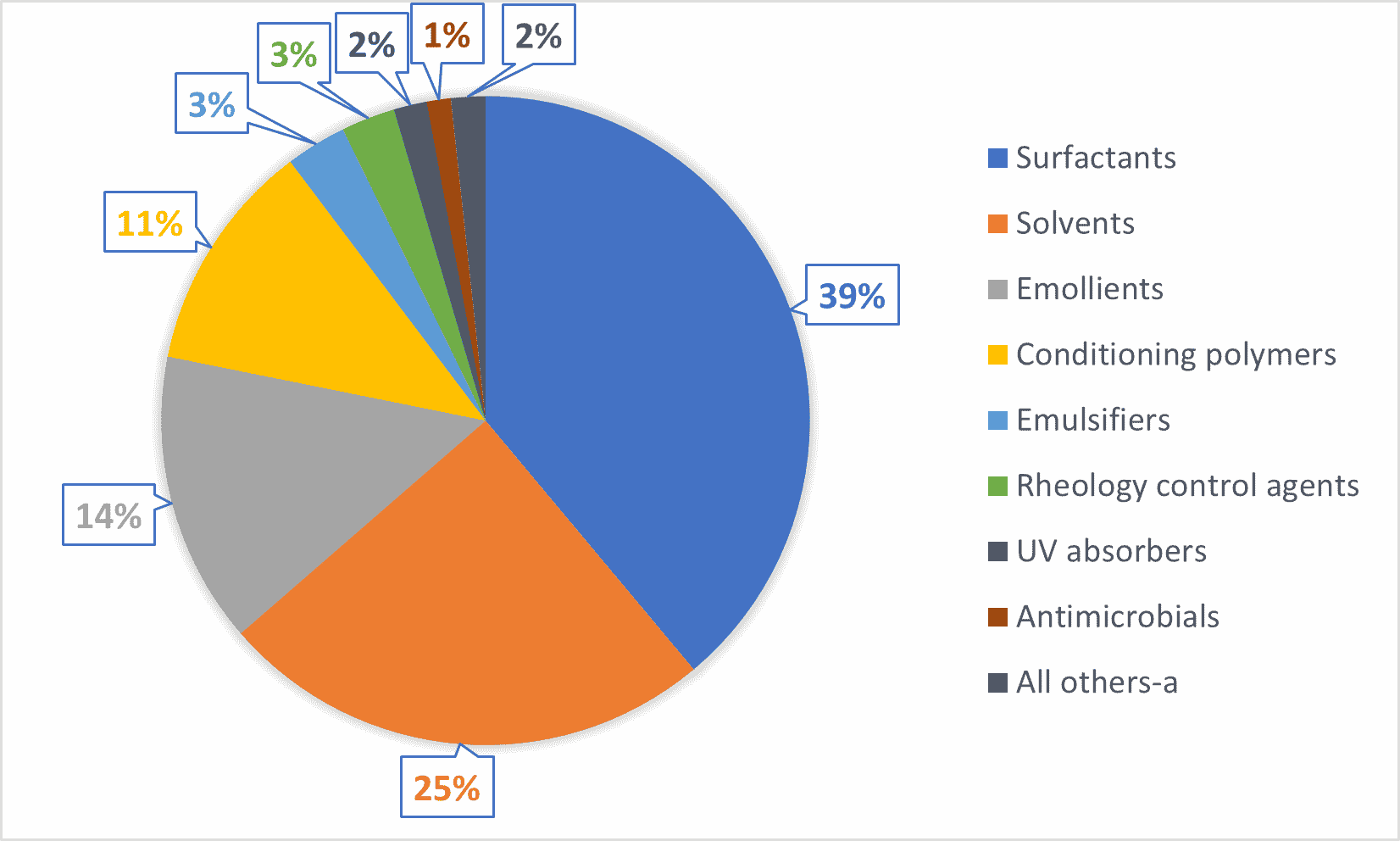

The category of surfactants remains Brazil’s biggest market, accounting for 39% of sales volume; its main driver is the hair care industry.

“The surfactant market is a competitive one, driving manufacturers and distributors to develop new applications for their products,” Hadek says. “Today, the standout technologies have multifunctionality and high efficiency – meaning, performance improvement with lower dosage.”

The industry is seeking to differentiate itself with low environmental impact formulations, thus adding value to the market and potential for growth. Increased preferences for milder and specialty surfactants will further boost the demand for betaines.

The sulfate-free movement, meanwhile, has gained importance in recent years, and formulators are paying increased attention to this demand, with more brands offering sulfate-free products.

EMOLLIENTS

The skin care category leads the market for emollients in Brazil, with natural-derived ingredients dominating the segment in terms of volume. Natural ingredients, meanwhile, lead in value, as such ingredients are priced higher. Emollient esters accounted for the largest share of emollient demand in 2021.

“Natural oils not only have a lower price than minerals, but they offer a similar performance,” says Hadek. “Natural oils are also slowly substituting silicone in skin care products.”

SILICONES

According to Hadek, silicone specialties are replacing commodities to comply with regulations in different regions

EMULSIFIERS

Emulsions are no longer just carriers of active ingredients – instead, they’re being used to bring pleasure to the skin. Vanishing, transforming, sensory, and liquid crystal textures – plus nano-emulsions, and micro-emulsions — are just of the few innovations being used to drive the market.

Meanwhile, Hadek says, “Consumers are seeking multifunctional ingredients that follow the minimalist trend, along with ingredients that have natural certification or are allowed in products claiming natural or organic certification.”

And, she notes, because green formulations require high stability in formulation, the demand for high-performance emulsifiers is expected to grow.

Source: Kline’s Personal Care Ingredients: Global Market Analysis

RHEOLOGY MODIFIERS

Millennials are driving demand for new textures when it comes to skin care products in Brazil, and that’s driving the market for rheology modifiers. The reason: Rheology modifiers are the additives that make skin care creams softer, more liquid-like, or creamier. Says Hadek: “Natural ingredients that have stability and texture are expected to drive the rheology control agent market for the next five years.”

ANTIMICROBIALS

Demand for safer and milder antimicrobials is increasing demand for phenoxyethanol, a relatively milder antimicrobial, and causing a slight shift away from traditional preservatives such as parabens. Despite this trend, still traditional antimicrobials account for the biggest share of the market, especially because natural alternatives are expensive and perceived as a niche market.

And while parabens continue to have a negative image due to the belief that they can cause health issues, they are still often used in Brazil, as regulatory bodies have not banned them from usage in personal care products. In addition, parabens offer an attractive price point and high efficiency.

Meanwhile, demand for organic acids such as benzoic acids/benzoates is expected to increase further, as they are gaining popularity over traditional antimicrobials.

For more information on this subject, check out our Personal Care Ingredients: Global Market Analysis, which analyzes the consumption, supply, and pricing of ingredients used in personal care formulations. It also evaluates drivers and restraints affecting the market and builds a five-year forecast model, giving a clear view of market opportunities in the post-COVID world. In addition to Brazil, the study covers Africa, China, Europe, India, Japan, Southeast Asia, the United States, and Rest of World.