Despite an overall decline in salon retail sales, the latest data from Kline PRO reveals pockets of growth over the past four quarters, ending in Q1 2024. Some of the larger brands are finding growth opportunities through new sub-brands such as Wella with its successful Ultimate Repair range. Meanwhile, smaller brands are also making meaningful sales gains in the salon channel, often through unique value propositions, catering to specific niches and consumer demands, and expanding distribution. Let’s take a closer look at a few:

IGK Hair, founded by celebrity hairstylists, has made significant strides, particularly in the styling products category. These products, which dominate the brand’s portfolio, are primarily stocked in salons with a moderate price-to-value. In Q1 2024, styling products accounted for 72% of IGK’s sales, with the Beach Club Texture Spray generating the highest revenue. IGK has also increased its salon presence from just over 3% in Q1 2022 to approximately 4% in Q1 2024, representing a growth rate of over 20% in locations. Additionally, the brand now averages 7.5 SKUs per salon.

IGK-owned salons—located in Miami, New York City, and Las Vegas—have gained significant popularity through TikTok and Instagram, thanks to their state-of-the-art services ranging from coloring to styling, leveraging their own products to show the effectiveness. This has helped them enhance their product offerings as well as connect with consumers more effectively, aiding their overall growth.

The brand’s strategic partnership with the luxury Fontainebleau Casino in Las Vegas led to the opening of a 1,800-square-foot salon in the fourth quarter of 2023. Additionally, being named “Brand of the Year in Haircare” at the 2024 Ulta Field Leadership Conference underscores IGK’s growing influence and recognition in the industry.

IGK’s Distribution in Independent Salons in the United States

Source: Salon Distribution Benchmarking Dashboard

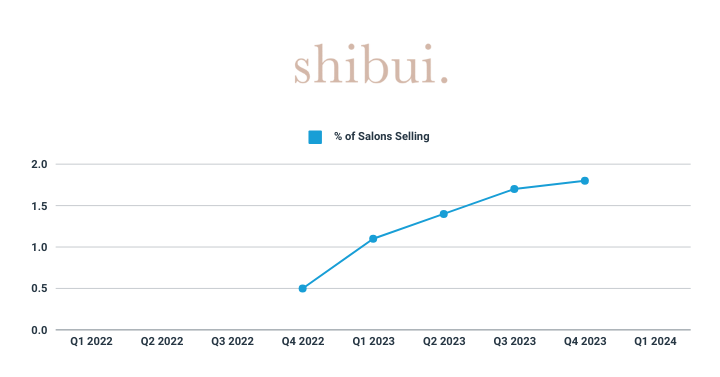

Shibui has rapidly emerged as a noteworthy player, particularly in moderate salons. The brand’s focus on clean color care and sustainability has driven strong sales in shampoos, conditioners, and styling products. Shibui did not have a presence in independent salons across the United States until Q1 2023 but is currently in nearly 2% of all locations. With solid growth in salon distribution during its first year, Shibui has been averaging 9.9 SKUs listed in salons since Q1 2023.

In Q1 2024, the brand’s top five best-selling products, led by the Everydayness and Ultra Hydrating lines, accounted for 60% of its total salon revenue. Its emphasis on sustainable and high-quality products has resonated well with consumers, propelling overall growth. Additionally, Shibui Hair leverages its minimalist and nature-inspired aesthetic to create content that aligns with its philosophy—simple, beautiful, and understated elegance.

Shibui’s Distribution in Independent Salons in the United States

Source: Salon Distribution Benchmarking Dashboard

Goldie Locks, a luxury brand founded by a hair extension expert, was developed to focus on intense hydration and moisture care suitable for both hair extensions and natural hair year-round. The brand also offers hair care supplements for regrowth and well-being. Goldie Locks products are primarily sold through moderately priced and premium salons.

Between 2022 and 2023, sales in premium-priced salons saw a sevenfold increase. Absolute distribution growth has been slow, and Goldie Locks averages 7.1 SKUs in salons where listed since Q2 2022. The Signature Hair Serum, along with the Hydrating Shampoo and Conditioner, has primarily driven this growth, with the serum alone tripling its sales over the last four quarters from Q1 2023 to Q1 2024. Although the overall distribution for Goldie Locks remains low due to its niche premium positioning, the number of salons carrying the brand has nearly quadrupled since Q2 2022.

Goldie Locks’s Distribution in Independent Salons in the United States

Source: Salon Distribution Benchmarking Dashboard

These brands have begun carving out decent market niches through unique value propositions, innovative products, and strategic partnerships. Their ability to cater to specific consumer demands and leverage modern marketing techniques has helped them grow. To learn more about other smaller brands gaining traction in salons or the ways to better position yours, schedule a session with an industry expert. Leverage the industry’s only market measurement platform for independent hair salons in the United States to strengthen your position in the market, using hard-to-track product and service sales data from thousands of salons.

Want beauty and wellbeing industry updates, expert analysis, insider tips, and webinar invites in your inbox? Click here to sign up for the Kline newsletter.