The away-from-home cleaning wipes market registered healthy gains driven by the unprecedented sales of hard surface disinfectant and sanitizing wipes in 2021. While almost half of the professional cleaners we surveyed stated that the impact of COVID-19 on businesses was rather neutral, more than 75% of them noted dynamic changes in cleaning procedures. Here are four of the most important ones:

1. Increased usage and spending on wipes will continue

Of the 600 professional cleaning decision makers we surveyed, 61% say that they are now using more disposable wipes than pre-pandemic. Furthermore, over 70% of our sample indicated an increase in spending on disposable wipes in 2021, and about half of the respondents say that they will continue to spend the same on wipes in 2022, which is expected to result in relatively flat market performance in 2022.

2. Surface disinfection remains a priority for end users

Disinfecting and sanitizing wipes will continue to be widely used to keep surfaces clean and germ-free, especially high-touch surfaces such as handrails, door handles, elevator buttons, shopping carts, and payment kiosks. Also, digital screens used in many I&I settings—such as tablets in schools and preschools, payment kiosk screens in retail stores, and screens to place orders in fast-food restaurants—are the new growing areas that need specialized wipes to clean. Dry electronics wipers are expected to gain sales over the next few years as a result of more digital screens being shared in more settings.

3. Sustainable wipes are in high demand

Hospitality, healthcare, education, and foodservice facilities have a strong interest in sustainable and environment-friendly wipes. Wipes made with active ingredients that are plant-based or botanical—such as citric acid, lavender, and thymol—are in high demand, with nearly 30% of the end users surveyed noting that they already use them. Furthermore, 14% say that they have switched from chemical-based wipes to more environment-friendly/green/plant-based products since the pandemic began.

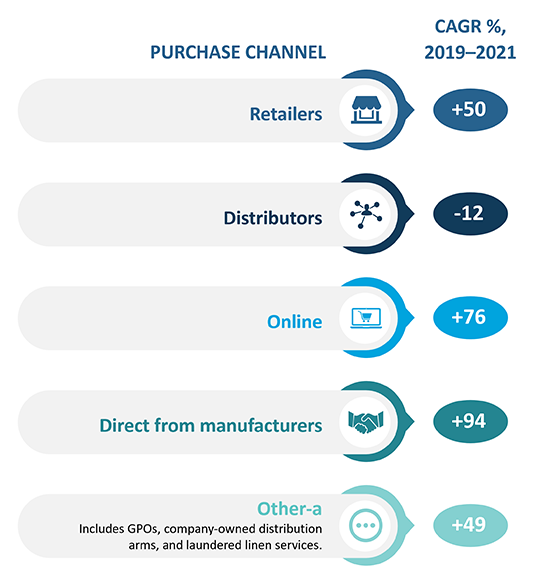

4. Direct and online sales grew the fastest

Due to out-of-stock situations and supply chain shortages, there was volatility in purchase channels for wipes. Between 2019 and 2021, sales of wipes to commercial end users through retailers, independent online sources such as Amazon, retailer, general supply, and distributor websites, direct sales from manufacturers, and other purchase channels (such as group purchasing organizations, company-owned distribution arms/commissaries, and laundered linen services) surged strongly. However, sales through distributors declined due to supply chain issues.

For a deep dive into the U.S. professional cleaning wipes market, please refer to our Professional Cleaning Wipes: U.S. Market Analysis and Opportunities report, for which we surveyed 600 commercial end users to understand the changes in wipes usage, spending, purchasing channels, and more. Also, don’t miss our presentation on Key Trends Impacting the Professional Cleaning Wipes Market at INDA’s World of Wipes conference. Join Laura Mahecha, Director of our Professional Cleaning practice, on June 29 at 10 AM EST as she shares key highlights from our survey.