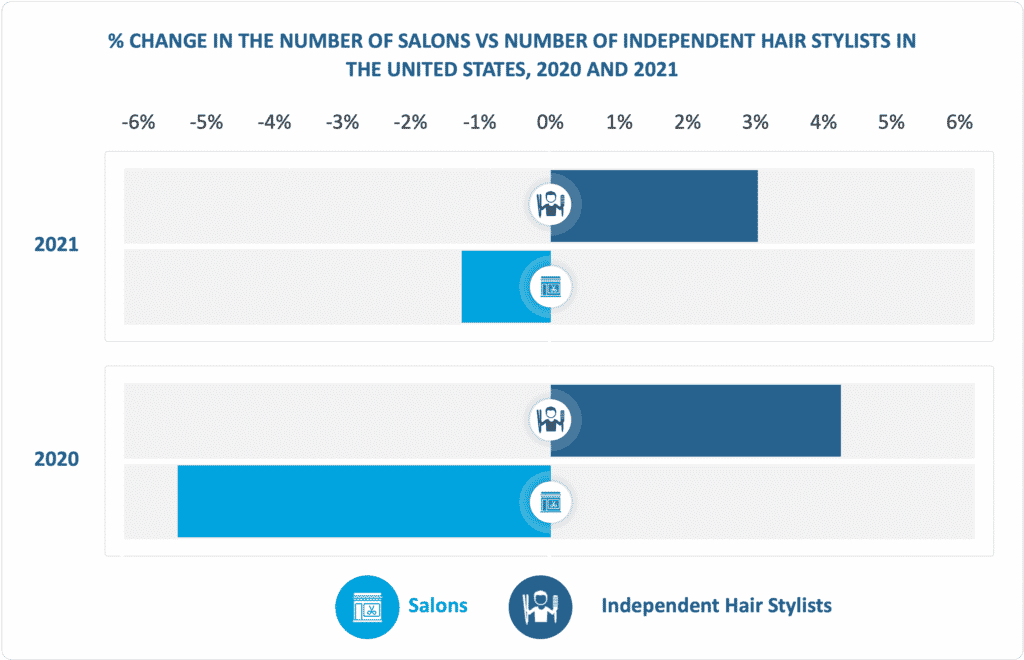

The emergence of independent stylists as a growth channel has opened the door for untapped revenue potential for salon hair care brands. Globally, the number of hair salons has declined almost 5% from the 2019 levels. While the door count decreased, many of the previously salon-employed stylists decided to venture into opening independent hair-related services—driving their need to build their own inventory of products for service provision and consumer resale.

In the United States, the number of independent hair stylists is well above half a million and is gradually increasing every year. Their collective spend on professional hair care products is over USD 2 billion, making them an attractive target for professional hair care brands.

The characteristics and behavior of independent stylists are quite different from those of full-service salons. Here are three key differences:

Challenges linked to mobility

While a salon is a fixed location, U.S. stylists that operate independently work on average in 2–3 different places, which makes it difficult to physically carry all products along with them. Additionally, they often face challenges linked to procedures that can be easily done in the salon such as washing their clients’ hair.

Different clientele, adapted services

A quarter of stylists provide services in care & retirement homes, translating into a particular age group—women over 51 years old. Interestingly, the vast majority of independent stylists surveyed in our soon-to-be-published Independent Stylists: Global Market Brief provide services that many salons dropped or that represent a fraction of their revenues. An example of such services is perming and straightening, representing an important share in the overall independent stylists’ revenues.

Retailing products: An emerging area of improvement

Of all independent stylists surveyed in our study, only 15% sell products regularly. With the rise in the popularity of online platforms that allow product retailing without worrying about logistics, such as Salon Interactive, stylists’ behavior, in all likelihood, may change. However, there are still many barriers to overcome as many of the independent stylists we surveyed stated that they do not like selling products or feel comfortable doing it, or it is not a part of their offering.

For a deep dive into how to best target this growing segment, please refer to our upcoming Independent Stylists: Global Market Brief, where we surveyed independent hairdressers in key countries such as France, the United Kingdom, Russia, Germany, Italy, Spain, Brazil, Canada, and the United States, to understand where they buy products, which brands they prefer and why, and what motivates them to select brands and sell products.