The U.S. finished lubricants market rebounded from COVID-19 and experienced a strong recovery in 2021, with volumetric demand reaching 97% of the 2019 level.

According to Pooja Sharma, Project Manager in our Energy sector, demand for industrial oils and fluids experienced the strongest recovery (99% compared to 2019 levels), with nearly all sectors growing back to 2019 levels and the U.S. GDP outgrowing its 2019 level. Commercial vehicle lubricants demand recovered at 97% compared to 2019, which coincides with a strong rebound in ultra-low sulfur diesel consumption and vehicle miles driven. Demand for consumer automotive lubricants experienced a recovery of approximately 93% in 2021 compared to 2019, driven by a recovery in vehicle miles driven as well as significant developments such as regulatory updates, the lubricants supply situation and pricing, and changing consumer preferences.

Consumer automotive lubricants are the focus this year’s publication of Opportunities in Lubricants: North America, Vol. II, a Kline study which covers detailed analysis of one of the three lubricant segments each year: consumer automotive lubricants, commercial automotive lubricants, and industrial oils and fluids. The study lays down the changes that the consumer automotive lubricants market has seen in the last couple of years and the key trends that are impacting the demand for lubricants.

What helped growth – and what hindered it

“The recovery in demand for consumer automotive lubricants in 2021, which was relatively slower than commercial vehicle and industrial segment, was a consequence of some positive and negative factors impacting the demand for lubricants,” says Sharma. “On the positive side, the U.S. automotive market experienced a strong recovery in vehicle miles driven in 2021, which positively impacted the demand for lubricants. At the same time, the consumer automotive market experienced a slowdown in the registration of new cars, and a part of the population still continued to work from home during the year. This impacted the lubricant demand negatively.

Meanwhile, supply chain constraints in the lubricants industry resulted in significant upward price revisions in 2021. Demand for lubricants rose sharply toward the end of 2020 and in 2021 as the U.S. economy began regaining normalcy, but lubricants manufacturers faced severe challenges in sourcing raw materials, such as base oils and additives, in 2021. This caused six to seven record price increases for finished lubricants, thus keeping finished lubricant sales in check during the year. These issues continue to loom in the lubricants market in the first half of the 2022 as well.

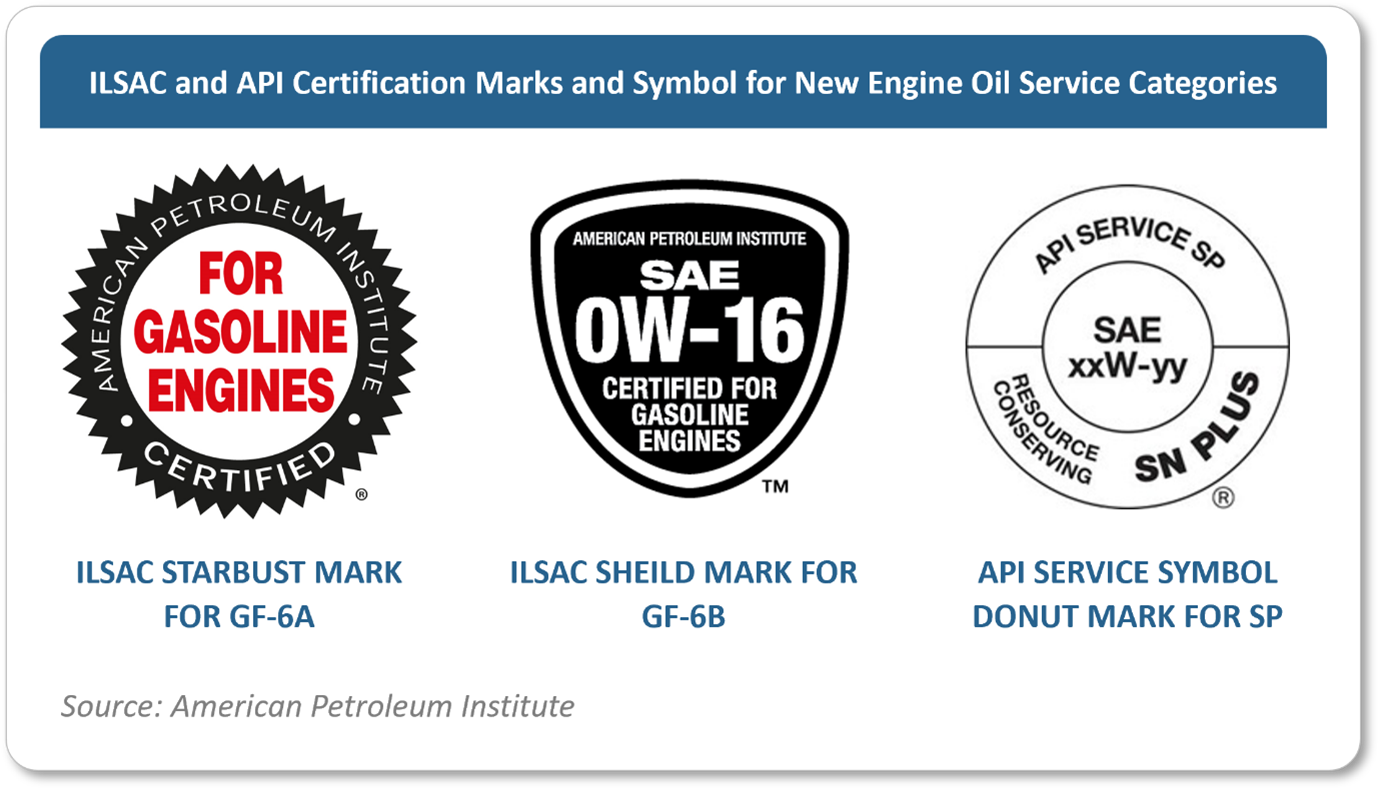

Growing penetration of synthetic fluids in consumer automotive lubricants is another factor that continues to impede the volumetric growth in the market. This trend strengthened further in 2020 and 2021, following the introduction of new specifications for passenger car engine oils in 2020. ILSAC GF-6A and GF-6B specifications for engine oils, which are targeted at providing better fuel economy, came into force in May 2020. During the same year, API introduced the new service category SP for gasoline engine oils that are required to provide better engine protection and offer resource-conserving properties.

After the launch of GF-6 and API SP categories, there has been a strong shift toward 0W viscosity grade engine oils. Near the fourth quarter of 2020, the U.S. market started to see increased availability of oils meeting API SP/ILSAC GF-6A standards. Many leading lubricant suppliers, such as bp, ExxonMobil, Shell, and Valvoline, as well as private-label brands such as Super Tech, offered these engine oils. The shift to 0W grades is forecast to continue strengthening as the need for fuel efficiency grows. Most Asian manufacturers, such as Toyota and Nissan, are leaning toward 0W-16. With the growing penetration of newer cars in the U.S. market, demand for lower viscosity grades will continue to grow.

How consumer preferences are shifting

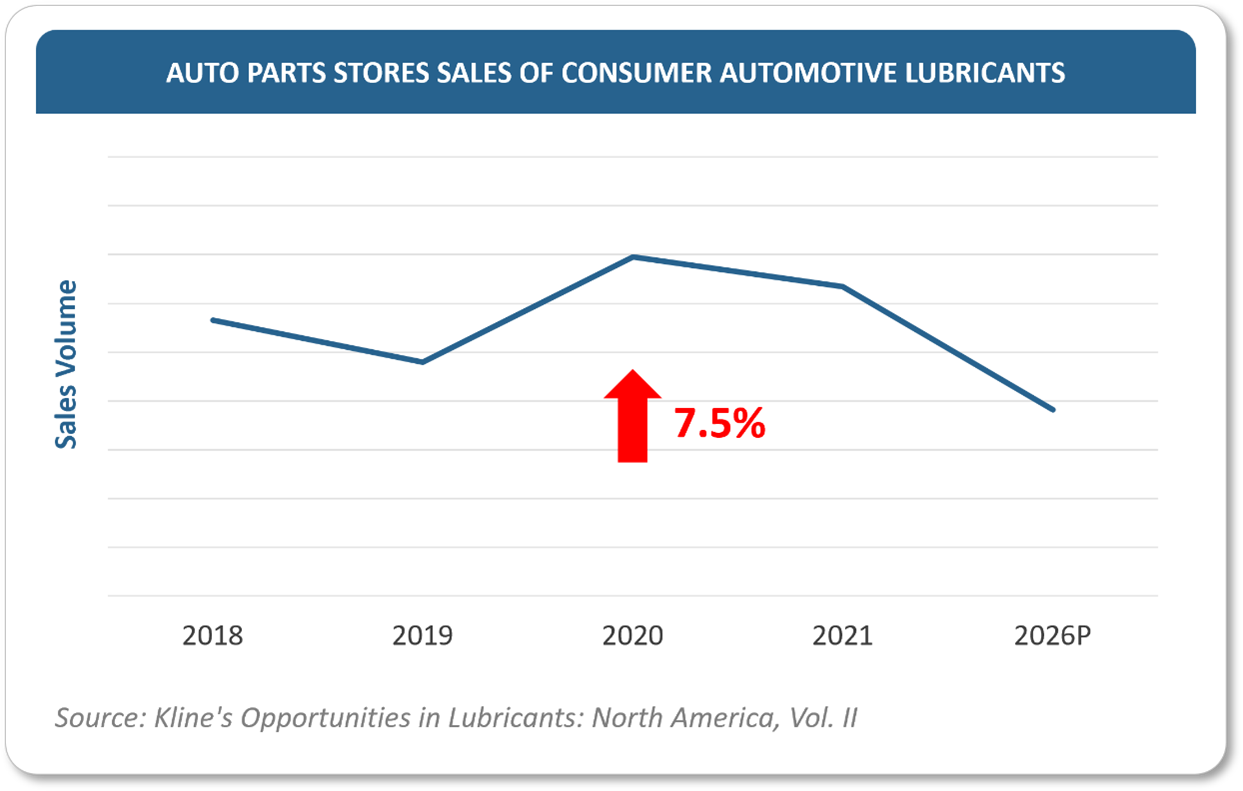

Consumer preferences in the U.S. consumer automotive lubricant industry are changing. The market continues to drift toward the “do-it-for-me” (DIFM) mode of maintenance from “do-it-yourself” (DIY) practices. The year 2020 saw some upheaval in this trend, as retail sales of aftermarket lubricants spiked since many vehicle owners preferred performing maintenance on their own rather than stepping out for services. Specifically, auto parts stores and convenience stores in the United States saw a sudden spike in sales of lubricants in 2020, as nearly one in five consumers delayed taking their vehicle for services during the COVID-19 pandemic.

The year 2021, however, saw a reversal in this trend, and the market began to regain its pre-pandemic momentum toward DIFM practices at installed channels. Franchised workshops and quick lubes experienced a strong recovery. Franchised workshops, in particular, fared well in increasing their guest footfall as a result of the introduction of OEM customer retention programs and better marketing of services and products. Additionally, franchised workshops were better placed in sourcing automotive parts in 2021, when most installers faced supply issues in sourcing parts as a result of supply chain constraints caused by the pandemic.

What’s the future of personal mobility?

Regarding personal mobility preferences, a growing focus on sustainability has encouraged car owners to increasingly adapt to electric vehicles (EV), which produce low or zero emissions. Efforts on the part of the U.S. government to bring down the prices of EVs include tax credits ranging from USD 2,500 to USD 7,500 for the purchase of new EVs for the first 200,000 units produced by OEMs; meanwhile, the pace of installing charging infrastructure is being hastened to increase the appeal of EVs among private car buyers. The penetration of EVs, especially in the U.S. light-duty vehicle segment, is expected to continue to grow; it, in turn, will further drive future demand for synthetic oils.

Overall, the consumer automotive segment saw a recovery in personal vehicle mobility in 2021 from the dip in 2020, resulting in a substantial recovery in lubricants demand by this segment. However, challenges in the lubricants supply chain still loom and continue to impact the volumetric demand growth for consumer automotive lubricants. The introduction of stricter fuel regulations and engine oil specifications, as well as the growing penetration of modern vehicles and electric vehicles, will only strengthen the shift to longer-life synthetic oils. Together, these factors will drive the U.S. consumer automotive market toward high-quality synthetic lubricants; at the same time, growing use of synthetic fluids will cut back on the volumetric demand for these products, thus keeping demand for consumer automotive lubricants well under 2019 level during the next five years.

Kline’s Opportunities in Lubricants: North America, Vol. II includes 2021 data for four product categories that find use in seven major trade classes. In addition, each product chapter analyzes applications, consumption, major customers, major suppliers, market developments, and a forecast of consumption through 2026.

As a new addition to the report this year, Kline is providing an analysis of the consumer automotive lubricants throughput via various Petroleum Administration for Defense Districts (PADDs). This analysis is built on state-wide lubricant sales estimations for 50 U.S. states covering all seven consumer automotive trade classes. It will act as a tool for understanding the distribution pattern for consumer automotive lubricants among 50 U.S. States by each trade class.