A flat finished lubricant market, significant basestock capacity additions, and a pause in capacity shutdowns are the key factors that have been driving down margins for basestock suppliers. In such an overcrowded market, Kline Group’s Anuj Kumar looks at one industry event that might offer some respite.

A flat finished lubricant market, significant basestock capacity additions, and a pause in capacity shutdowns are the key factors that have been driving down margins for basestock suppliers. In such an overcrowded market, Kline Group’s Anuj Kumar looks at one industry event that might offer some respite.

The shipping, refining, and other related industries have been assessing the challenges, opportunities, and cost implications associated with the upcoming International Maritime Organization’s cut in sulphur emissions (IMO 2020). But could the knock-on effects of this regulation be a plus for basestock suppliers, who are operating in a very tough marketplace?

Certainly, the basestock industry has been under pressure, as production capacities have continued to increase at a time when demand growth from its largest customer–the finished lubricants market–has slowed. By far, the largest share of global demand in the lubricant market comes from the automotive sector. However, in 2018, for the first time in a decade, global automotive production saw a slight decline. This trend is expected to continue, given the uncertain macro-economic environment and as growing social pressure to reduce carbon emissions spurs ridesharing and the uptake of electric vehicles.

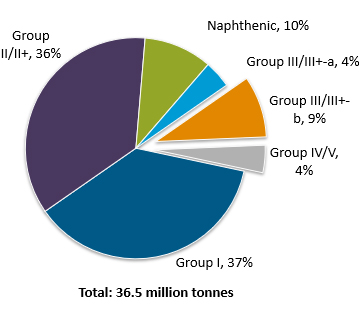

With these market drivers in mind, it is expected that lubricant demand will continue to be essentially flat, projected to grow at just 0.4% CAGR on a global basis for the period 2018-2028. This significant reduction in the growth forecast will impact the outlook for all API basestock categories. In 2018, global finished lubricant demand reached 40.5 million tonnes, and the consequent demand for basestocks was 36.5 million tonnes.1

Global Lubricant Basestock Demand for all Lubricants, 2018 |

| a- Group III / III+ used in other applications. b- Group III / III+ used to blend synthetic and semi-synthetic lubricants. NOTE: Group III basestocks with VI of 130 and higher classified as Group III+. 1 Excluding demand arising from non-lubricant applications such as drilling fluids, solvents, fuel blending, among others. |

Unbalanced market

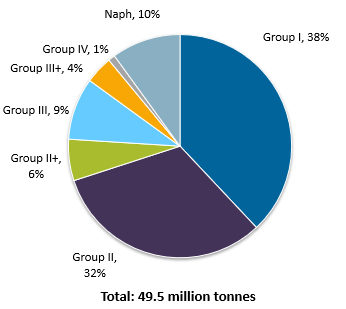

However, with a global effective basestock capacity sitting at more than 49 million tonnes, the market has remained in surplus capacity. And, in the past year, there have been significant capacity additions along with a slowdown in the removal of capacity via Group I shutdowns. This has resulted in lower average operating rates, which makes it hard to recover costs. While basestock prices in 2018 were generally higher than those in 2017, margins remained under pressure throughout the year.

| Global Lubricant Basestock Effective Capacity by API Groups, 2018  |

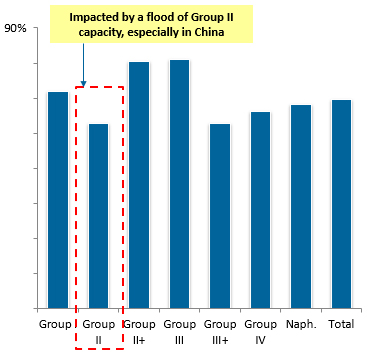

Global Average Operating Rates-a by API Groups, 2018 |

| NOTE: Excludes Group V. Group III basestocks with VI of 130 and higher classified as Group III+. |

a-Operating rate calculated as total production in a calendar year as a fraction of the effective capacity. |

| 2 Effective capacity: total amount of basestocks a plant can produce in a year when it is available for production. It excludes the portion of the year when a plant is down either for planned (e.g. maintenance turnarounds) or unforeseen circumstances. | |

At a global level, the supply of Group I, II, and II+ all exceed demand, while Group III, III+, and naphthenic are generally in balance.

Looking ahead 10 years, while not much increase in demand is expected, there is a strong pipeline of new plants and additional basestock capacity on the way. Currently available public announcements suggest that 5 to 5.5 million tonnes of incremental capacity, mostly Group II /II+, will be added. This does not bode well for a market where demand is forecast to grow at a paltry 0.4% CAGR. This mismatch between the rate of growth for capacity and demand casts an unfavorable scenario for basestock producers. In a scenario where the basestock market is plagued with a flat demand outlook in the wake of consistent capacity additions, the only way margins could be restored is by commensurate capacity retirals. Forecasting how much, when, and where these capacity retirements would happen is an extremely difficult task. However, it is anticipated that IMO 2020 will bring some relief.

Improved margins ahead?

The IMO 2020 regulation, which comes into force on January 1, 2020, cuts global sulphur limits for fuels used onboard seagoing ships from 3.5% to 0.5% (weight/weight). This has wide-reaching investment implications for vessel operators and the world’s marine fuel producers. While IMO 2020 may have several direct and indirect implications on the basestocks market, one such fallout could actually prove to be a blessing in disguise, as it may help to improve basestock margins.

It is highly likely that most shippers will choose to comply with IMO 2020 by burning low sulphur fuels rather than installing exhaust gas scrubbers. As a result, demand for high sulphur fuels is expected to decline. This scenario means refineries with heavy equity in high sulphur fuel oil (HSFO) production may struggle to find an alternate market for their products. Those that cannot invest in the upgrades required to produce low sulphur fuel oil may be under threat. And, if the refinery also produces basestocks, capacity shut down here could also be expected. Currently, it is difficult to forecast just how much capacity would be rationalized, and from where. However, in our view, Group I producers in Europe appear to be the most vulnerable.

In addition, as demand patterns change, the price difference between low sulphur distillates and gasoil vs. HFSO will widen. It is likely that those refineries with surplus hydrocracking capacity will choose to divert vacuum gas oil from basestock to distillate production. This action would again help to ease basestock overcapacity.

There is still much uncertainty ahead for Group I, II and II+ producers. However, the changes arising from IMO 2020 could help them to partially move toward equilibrium in the mid- to long-term. That said, the market could be expected to face considerable inter-API Group competition as blenders explore options to optimize their costs and explore new market positioning strategies.

The global basestocks market will continue to face challenges, but perhaps there is a glimmer of hope in 2020 as the impacts of the IMO regulations on all the industry stakeholders become clear.

New report on global basestocks

Kline has been publishing the Global Basestocks Market: Analysis and Opportunities study for over a decade, and the latest report includes a market appraisal to 2028. The report provides a comprehensive supply and demand analysis for different API Groups at a global level and by key regions, manufacturing cost estimates, and market profiles of nine countries including the United States, Russia, and China are also included.

In addition, readers will gain an analysis of current pricing levels and price forecasts, based on a robust model, for Group I, II/II+ and III in Northwest Europe, U.S. Gulf Coast, and Northeast Asia.

Read more about the study, or to reserve your copy, please visit our website.