All signs in our professional skin care research point to a reset in the demand for aesthetic services and skin care products in 2023 and moving into 2024. While there continues to be a high level of enthusiasm for medical-dispensing skin care and services amongst physicians and consumers alike, this will be the second year in a row of a slowdown in growth.

While doctors are optimistic about revenues generated by their skin care brands, collectively, there is a shift to product sales accounting for under 10% of total revenues in 2023, down from the year before. Physicians are cautious about their spending and are taking in less inventory. Our survey findings show that the most coveted assets that doctors want from their skin care partners are better prices and value-added services. This can include greater flexibility with contract terms, as well as more promotional and social media support in light of the current economic situation.

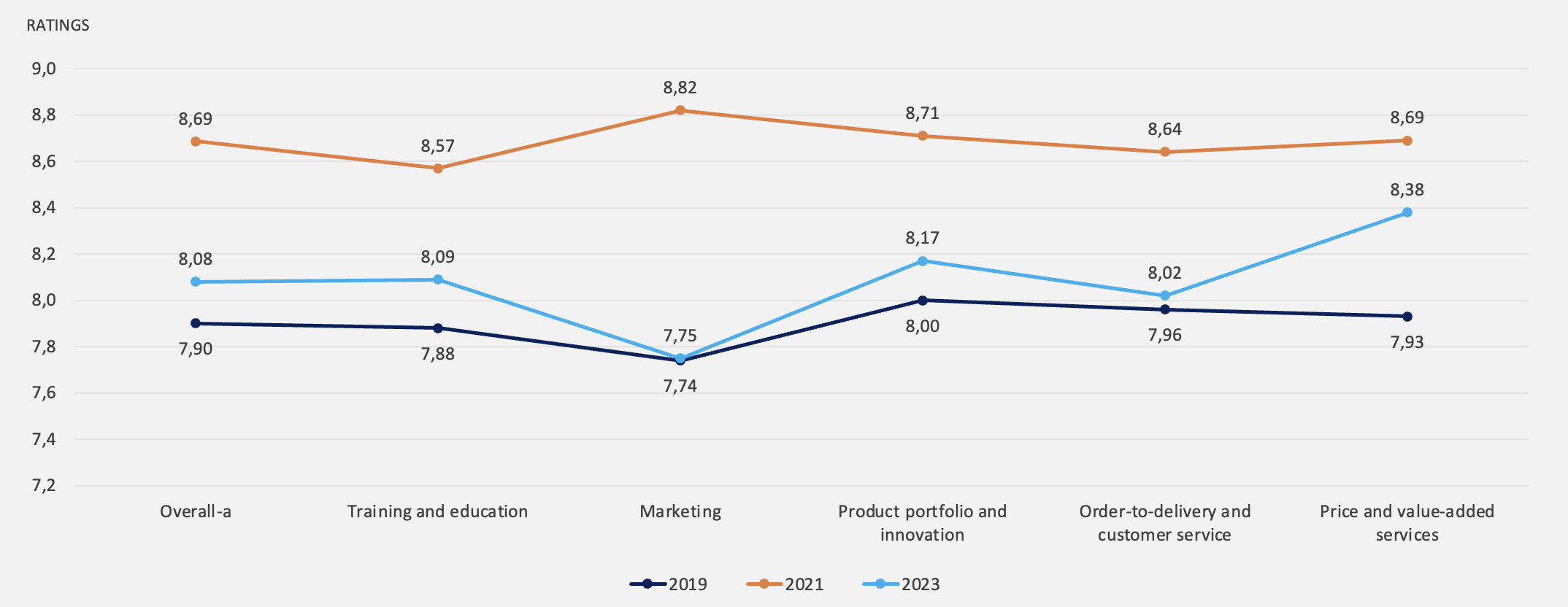

The overall importance and performance scores of all brands indicate a return to pre-COVID levels, showing a gradual return to normalcy.

Importance Ratings for #1 Revenue-Generating Brand by Attribute, 2019–2023

Source: Kline’s Physician-Dispensed Skin Care: Perception and Satisfaction Survey

Source: Kline’s Physician-Dispensed Skin Care: Perception and Satisfaction Survey

Spending habits have also taken a hit due to rising inflation, causing consumers to approach their spending on services with more caution. This shift is clearly reflected in the highly anticipated release of our Aesthetic Skin Care Consumer Insights report. In the premium segment of non-invasive aesthetic services, where spending exceeds $4,000 annually, we have witnessed a significant decrease from 44% to 28% this year. Moreover, the number of consumers who identify as minimalist skin care users, favoring a simplified routine with fewer products, has doubled in 2023 compared to the previous year. This indicates that consumers are now opting for a more streamlined approach to their at-home skin care routines.

While some consumers have cut back on their spending on skin care products this year, citing increased prices and reduced disposable income as the main reasons, there is a glimmer of hope. Approximately 40% of aesthetic consumers have expressed their intentions to ramp up their spending on products and services in 2024. Despite the challenges, it seems that many individuals are eager to invest in their skin care regimens and treatment routines.

For further insights into how physicians and consumers are navigating the professional skin care landscape in 2023 and beyond, refer to our released Physician-Dispensed Skin Care: Perception and Satisfaction Survey and Aesthetic Skin Care Consumer Insights surveys. These valuable resources shed light on what matters and why, to help you better prioritize your future initiatives.

Discover how brands such as Alastin, Avène, EltaMD, Glytone, Obagi, PCA Skin, Revision Skincare, SkinMedica, SkinBetter Science, SkinCeuticals, and ZO Skin Health score on key attributes, such as product portfolio and innovation, price and value-added services, as well as training and education. Additionally, gain insights into how different age groups, including Gen-Z and Millennials, approach skin care alongside their preferred product types and the factors influencing their purchasing decisions. To get a sample of these surveys, please contact us.