In the rapidly evolving industrial landscape of Latin America (LATAM), the demand for high-performance and environmentally friendly lubricants is on the rise. This shift is largely driven by stringent environmental regulations and the industrial sector’s pursuit of efficiency and sustainability. A recent discussion among industry experts shed light on the current trends and opportunities in the LATAM lubricant market, emphasizing the need for innovation in response to these challenges.

Market Dynamics in LATAM

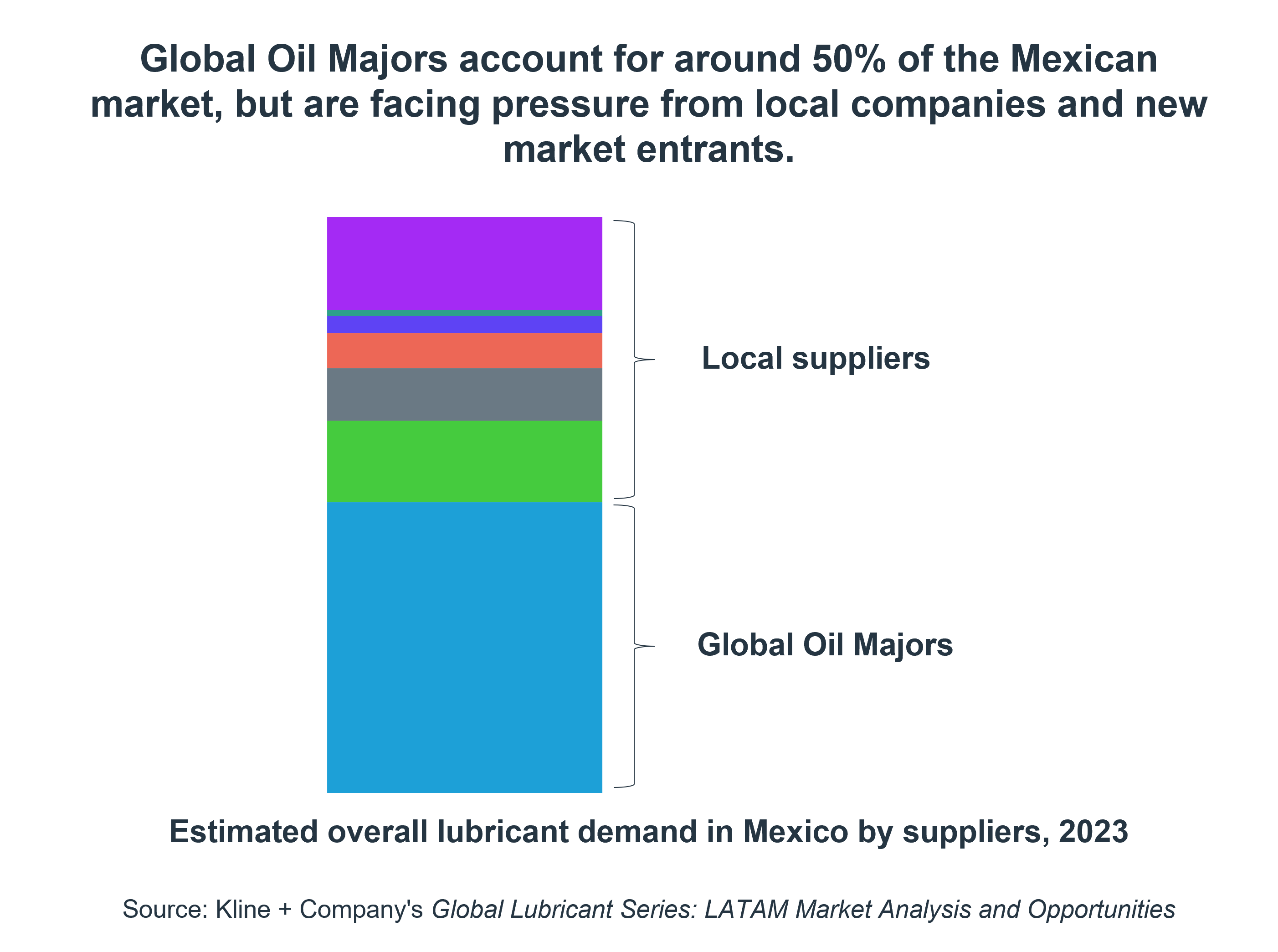

The LATAM lubricant market is characterized by its consolidation with multinational corporations such as ExxonMobil, Shell, TotalEnergies, and Chevron, dominating 40-50% of the market. bp, though present, has a lesser footprint. These companies have positioned themselves through a mix of direct presence or by engaging in strategic partnerships with local companies, Mexico stands out as the most attractive market, where new market entrants are making significant inroads.

Electric Vehicle Adoption and its Implications

Compared to regions like Europe, North America, and parts of Asia, LATAM is lagging in electric vehicle (EV) adoption. However, air pollution derived from car tailpipe emissions remains an acute problem in large cities in LATAM. Countries in the region will tackle this issue by switching from more lenient to more stringent emission regulations and assessing ways to stimulate vehicle renovation. This presents a unique opportunity for lubricant marketers to focus on the development and distribution of premium lubricants. These products can significantly improve energy efficiency and help the region align with global emission standards.

The Role of Regional Players and Market Entry Strategies

Regional companies such as Mexicana de Lubricantes, Petrobras, YPF, and Terpel, among others, play a significant role in the LATAM market. New entrants, particularly from Asia and Europe, are adopting strategies like toll blending and leveraging nearshoring manufacturing trends, especially in Mexico. This approach is facilitated by the U.S. Inflation Reduction Act, which encourages manufacturing near the U.S., thereby benefiting Mexico’s automotive industry and the industrial lubricant market.

Political Landscape and its Impact

The political environment in LATAM, marked by frequent shifts in government policies, significantly influences the market. Recent trends towards leftist governments could impact regulations, especially in sectors like mining and renewable energy, affecting the demand for lubricants.

Opportunities in High-Performance and Bio-Lubricants

There is a growing interest in high-performance industrial lubricants, bio-lubricants, and the re-refining of base oils. Countries like Chile, leading in environmental regulations, are driving the demand for longer-lasting synthetic lubricants in industries such as mining. Additionally, the ageing vehicle fleet in LATAM presents an opportunity for new car sales, potentially incentivized by government policies. However, the high share of used car sales, including unregistered imports from the U.S., complicates this trend.

The LATAM lubricant market is at a crossroads, with environmental regulations and industrial trends pushing for innovation in lubricant technology. The region’s unique market dynamics, coupled with the global shift towards sustainability, present both challenges and opportunities for industry players. As LATAM continues to evolve, the demand for high-performance and environmentally friendly lubricants is expected to grow, shaping the future of the industry in the region.

Why is the Global Lubricants Market exhibiting strong Value Growth despite Flat Volumes?

Join Kline in conversation on the current state, trends, and growth of the global lubricants market, and explore why market value continues to grow despite flat volumes.

With the recent publication of Kline’s Global Lubricant Series, our experts will discuss what are the big questions that lubricant industry players need to focus on, including the most important – how do you find new areas of value growth in a mature market? Where are the value opportunities and hotspots by region?

After the conversation, we will run a Q&A session; these can be submitted on the day, or pre-submitted through a link you’ll find in the webinar confirmation email.