Global energy needs increase continually. Primary energy demand grew by 6% in 2021. However, this steep growth was due to the drop in energy demand in 2020. Besides overall demand growth, one key development is the push for clean energy or decarbonization. Several governments in developed and developing countries have expressed their intention to reduce their reliance on fossil fuels, including coal-fired power plants, and increase the use of renewable energy sources. Numerous countries have set net zero or carbon neutrality targets for 2050 and 2060, with a few setting mid-term targets for 2030 and 2040. To achieve these targets, countries will have to reduce their reliance on thermal power and increase the use of renewable sources like solar and wind. Hydropower was the leading source of renewable energy. However, the most commercially viable hydropower potential has already been unleashed. In contrast, there is enormous potential for wind and solar power yet to be exploited.

In the short-to-medium term, countries are also investing in natural-gas-based power generation, which is less polluting than coal-based thermal power. However, this will not result in net zero or carbon neutrality in the long run, making it a short-term or bridge solution. Additionally, new technologies are likely to emerge and gain commercial importance, such as the generation of electricity from tidal sources, geothermal, or biomass. However, these sources are far away from commercialization.

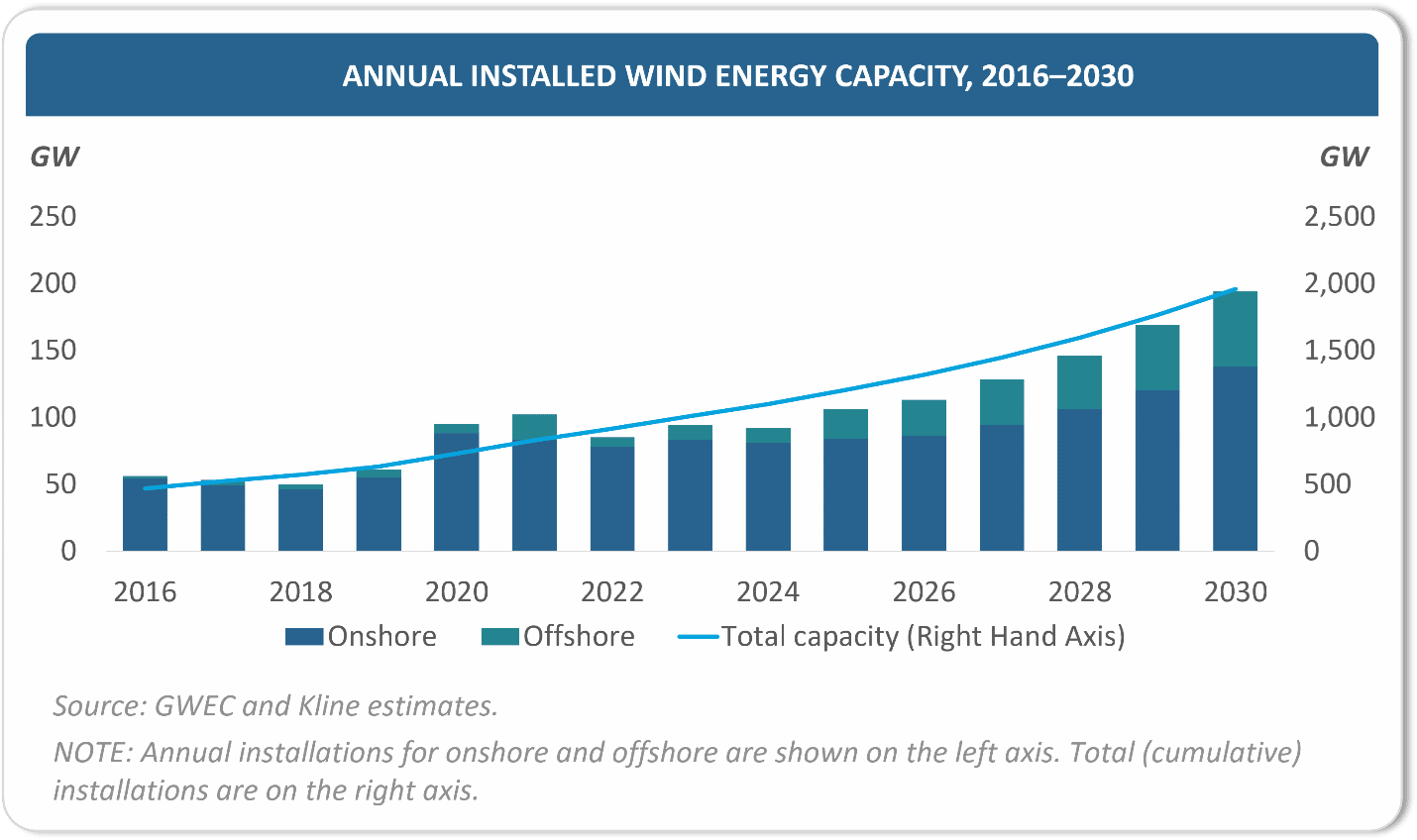

Wind energy is one of the fastest-growing renewable energy power sources, with rapid advancements in the underlying technologies. While there are a host of factors driving wind turbine installations, there are various challenges faced by this sector.

There is a great deal of wind power capacity addition planned globally; however, it is unclear how this capacity will be attained. There are a limited number of original equipment manufacturers (OEMs) manufacturing wind turbines and limited manufacturing capacity. Moreover, due to extremely competitive bidding, the financial health of wind farm operators and wind turbine OEMs is weak. Wind turbine OEMs have faced significant losses recently due to rising costs and fierce competition.

Furthermore, the industry witnessed tougher competition amongst OEMs and a steep decline in per-unit revenue as several governments shifted from fixed, subsidized tariffs for power to an auction-based system that favors the lowest bidder. This is influencing the wind turbine industry’s overall revenue model. Operators are agreeing to lower prices due to the auction-based system, but this lowers their profitability. Operators might simultaneously seek CAPEX reduction on wind turbine purchases from OEMs. In addition, spikes in raw material prices cannot be absorbed as wind turbine OEMs operate on narrow margins. The auction-based system has an impact on all components of the supply chain, including operators, OEMs, and producers of ancillary equipment.

Various governments have set wind power installation targets for 2030 that will be difficult to meet. For instance, per the REPowerEU action plan, the European Union’s wind power capacity is targeted to increase from 190 GW in 2021 to 510 GW in 2030. In 2022, new wind installations in Europe are expected to be approximately 18 GW. To meet these targets, the European Union needs to install 38 GW of wind capacity per year, beginning in 2025, to reach the target set for 2030. It takes at least 8 to 24 months to manufacture and install wind turbines. As a result, to meet the target by 2030, the last set of orders should be placed two years in advance.

To meet such targets, which are over double the current annual installations, wind turbine OEMs must double their manufacturing capacity while addressing challenges around sourcing raw materials. Also, ancillary component manufacturers for gearbox, bearing, and hydraulics need to multiply their capacity to cater to the demand from wind turbine OEMs.

Prices of steel, the key raw material used in building a wind turbine, soared in 2022, with the benchmark price rising 86% in the United States and 53% in Europe. This means that the cost of new wind farm projects has skyrocketed. Direct-drive turbines require rare earth elements to make permanent magnets. China is the primary source of rare earth metals, producing approximately 60% of all rare earth, but much of it may be consumed in the country. China has ambitious targets for installing wind turbines. It also has aggressive targets for the electrification of vehicles, rechargeable batteries, radar systems, and laser crystals, all of which need rare earth materials. These uncertainties around raw material costs have subsequently pushed down the share prices of several renewable energy companies.

Besides manufacturing, there are two other challenges, one of which is manpower shortage. To meet the goal, three times the current number of skilled labor is needed to manufacture, install, and maintain wind turbines. Another issue is the transportation of wind turbines. Due to technological advancements, hub heights and rotor diameters have increased, resulting in increased electricity generation with less capital expenditure. However, transporting these turbines is logistically difficult.

There is a strong emphasis not only on onshore but also on offshore wind capacities. Specialized equipment is required to install offshore wind turbines, and criticalities such as safety considerations and installation time are also present. However, one advantage in this segment is the presence of barges that are used in oil/gas offshore activities. These barges can be well-utilized in installing and maintaining wind turbines.

China will add a significant amount of wind capacity by 2030, accounting for over 50% of total installed capacity globally. The recent price hikes by major western wind turbine makers have reignited concerns about increased competition from China, where domestic manufacturers sell turbines at consistently lower prices but are yet to replicate their domestic success overseas. Margins of Chinese OEMs have held better than their Western peers, though their ability to replicate these margins in markets outside China remains unknown.

Maintenance is a key factor in ensuring maximum uptime of wind turbines. Maintenance has moved away from time-bound servicing to need-based servicing, including oil changes. Hence, preventive as well as predictive maintenance has been crucial in modern wind turbines. Lubricants are a key factor in not only ensuring the long life of wind turbines but also in widening maintenance intervals. Better lubricants are used now as compared to 5 or 10 years ago.

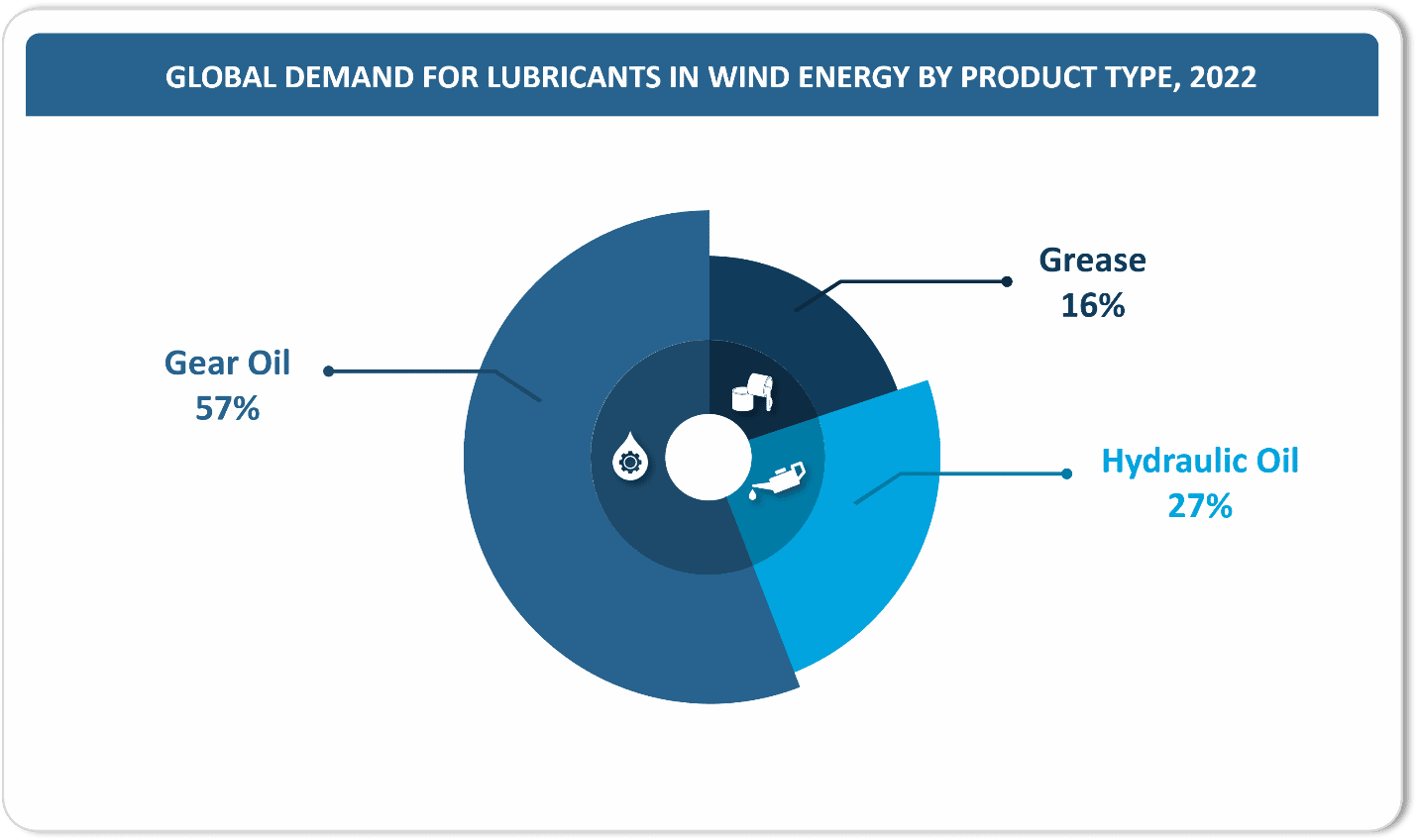

Gear oil, hydraulic oil, and grease are key lubricants used in wind turbines. Gear oil and hydraulic oils have drain intervals as high as 7 to 10 years. However, annual top-ups are necessary for grease. In 2022, around a quarter of wind turbine lubricants demand was from the initial fill. This segment’s share is poised to grow to around 40% over the next 10 to 15 years. More than half of the aftermarket is catered to by OEMs. This emphasizes the importance of wind turbine OEMs to lubricant suppliers in capturing market share and the importance of having tie-ups with OEMs. The demand for lubricants used in this sector is growing and could reach 100 kilotonnes per annum in the next 10 years.

For more information on the subject, check out our recently published Lubricants for Wind Turbines: Global Market Analysis and Opportunities. The study, which focuses on key trends, developments, and technology changes, provides a comprehensive analysis examining the market for lubricants used in wind energy generation and identifies challenges and opportunities for lubricant marketers.

By Hareesh Nalam and Karishma Kamble

This article first appeared in the March edition of STLE magazine