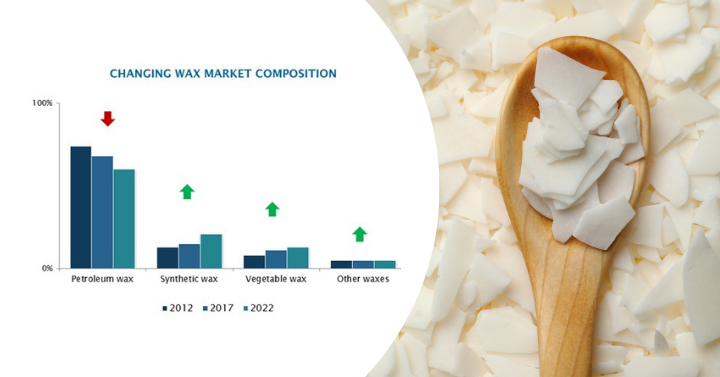

The global wax industry has experienced significant volatility recently, marked by abrupt shifts in supply and demand. The years 2020 to 2022 witnessed dramatic changes in wax supply, with petroleum wax suppliers exiting the market and synthetic wax suppliers expanding. This volatility has been further compounded by uneven demand in various applications due to uncertain global macroeconomic conditions. In this blog, we delve into the driving factors behind this turbulence, drawing insights from our recently published Global Industry Wax report.

Challenges Faced by Group I Refineries

Group I basestock refineries, particularly in Europe, have grappled with financial difficulties, uneven demand, and geopolitical uncertainties. The obsolescence of Group I base oils, along with the industry shift toward Group II and Group III base oils, forced the closure of several refineries even before the COVID-19 crisis. The economic impact of the 2022 crisis exacerbated these struggles, leading to the cessation of wax production by major refiners like TotalEnergies, Galp, Gazpromneft, and Orlen Oils.

The Rise of Synthetic Waxes

In contrast, the supply of synthetic waxes experienced substantial capacity additions during the same period. Chinese Fischer-Tropsch (FT) wax suppliers, including Inner Mongolia Yitai CTO Co. Ltd., Shanxi Lu’an Coal-To-Liquid Co. Ltd., and Shenhua Group Co. Ltd., expanded their production capacities to fill the void left by the global petroleum wax deficit. New players like Shaanxi Future Energy Chemical Co. Ltd. have also entered the market and are rapidly expanding. Many of these suppliers have plans to continue increasing FT wax supply over the next five years.

Growth in Alphaolefin (AO) Wax Supply

Alphaolefin (AO) wax supply is also on the rise. Industry leaders like Chevron Philips Chemicals and Shell Chemicals remain robust players, with ExxonMobil entering the market in September 2023, introducing a new range of AO waxes. Additionally, Shell Chemicals is expected to expand its supply in the coming years.

Challenges for Vegetable Waxes

Vegetable oil-derived waxes are facing challenges, as concerns about sustainable production practices and tightening regulations, particularly in Europe, are impacting the demand for palm and soy waxes. The European Union (EU) has implemented measures to distinguish between bio-products or oils with high indirect land-use change (iLUC) risks and those with low or no iLUC risks. Bio-products classified as high iLUC risks may be subjected to caps based on 2019 levels and will gradually be phased out starting in 2023. As a result, the anticipated impact of these regulations is a deceleration in the future growth of vegetable waxes.

Wax Demand is Witnessing Uneven Growth

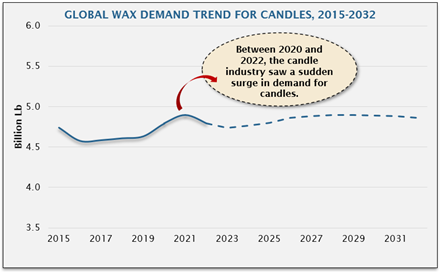

The COVID-19 crisis had a varied impact on different wax applications. Candle sales experienced a significant surge in demand from 2021 to 2022, driven by the growing work-from-home trend and heightened consumer interest in home and mental wellness products. Geopolitical tensions arising from the Russo-Ukrainian war further bolstered candle sales in Europe, as the fear of reduced natural gas supply prompted panic-buying. However, candle demand gradually softened in late 2022 and continued to decline throughout the first half of 2023.

In contrast, the demand for waxes in polyvinyl chloride (PVC) applications, which had previously been thriving, faced a slowdown. Weak demand in North America, influenced by factors such as rising interest rates, high inflation, and increased housing prices, led to a decline in PVC demand. Similarly, the European PVC market encountered obstacles like oversupply, high manufacturing costs, and low demand, prompting PVC producers to reduce their operating rates in late 2022 and the first half of 2023.

The hot-melt adhesives (HMA) market, another significant sector for wax demand, is currently experiencing a downturn. Factors such as semiconductor shortages and COVID-19 lockdowns impacting the automotive industry, coupled with a slowdown in the packaging sector and rising raw material prices, have contributed to the decline in HMA demand. Moreover, high inflation rates and housing prices have also hindered growth in construction activity.

Overall, the demand for waxes in most other applications remained weak to moderate throughout the last quarter of 2022 and the first half of 2023. Concerns about a potential recession, combined with the impact of high inflation rates, have restrained consumers from seeking large quantities of waxes for their operations.

Wax Prices are Skyrocketing

Wax prices are directly influenced by the cost of their raw materials, with crude oil prices impacting petroleum wax prices, ethylene prices impacting polyethylene wax prices, and soy oil prices impacting soy wax prices.

The year 2021 saw a surge in wax prices as lockdown measures were eased and economies began to recover, driven by pent-up demand. Particularly, petroleum waxes experienced sharp price increases due to rising crude oil prices, reaching a peak average price of USD 0.85/lb in October 2021.

This upward trend continued into 2022, with average low-melt FRP wax prices remaining more than 50% higher compared to 2019 levels. However, as the year progressed, demand began to ease, and high logistic costs and supply chain disruptions started to stabilize. Contributing factors, such as high inflation rates and inventory levels, also played a role in softening wax prices. In 2023, slow economic growth prevented wax prices from returning to their peak levels in 2022, although the average low-melt FRP price remains about 20-25% higher compared to pre-COVID-19 levels.

Future of the Wax Industry

The global basestock industry is undergoing a major shift due to refinery rationalization, resulting in a petroleum wax shortage and higher prices in the next 5 to 10 years. To counter this, non-petroleum waxes, particularly alphaolefin (AO) and Fischer-Tropsch (FT) waxes, are introduced. Sustainability is a key focus, with natural gas-derived FT waxes gaining ground. As a result, success in the wax market may depend on offering tailored solutions and maintaining a reliable supply chain. Adaptability and foresight are essential for long-term prosperity in this evolving industry.

To better seize opportunities in the wax market, please refer to our Global Wax Industry report focusing on market size and growth, key challenges, and business opportunities in six key regions. This eighth edition also includes a Wax Market Model, enabling easy analysis of the supply and demand for petroleum, synthetic, and vegetable- and plant-based waxes for 2022, 2027, and 2030.